U.S. Construction Spending Gain Moderates in November

by:Tom Moeller

|in:Economy in Brief

Summary

- Monthly increase slows but annual rise is strong.

- Residential surges with jump in single-family construction; nonresidential building growth eases.

- Public sector construction declines.

The value of construction put in place rose 0.4% (11.3% y/y) during November following a 1.2% October jump, revised from 0.6%, and a 0.4% September gain, revised from 0.2%, according to the U.S. Census Bureau. The y/y increase is up from the April 2023 low of 1.3%. A 0.6% November rise had been expected in the Action Economics Forecast Survey.

Private construction rose 0.7% (10.0% y/y) in November after increasing 1.2% in October, revised from 0.7%, and falling 0.2% in September, revised from no change. Residential building strengthened 1.1% (3.7% y/y) after a 2.0% October increase. Single-family construction rose 2.9% (5.5% y/y) after rising 1.1% in October. Multi-family building activity edged 0.1% higher (13.6% y/y) after holding steady in October. The value of home improvements fell 0.8% (-2.0% y/y) after strengthening 4.0% in October.

The value of nonresidential construction improved 0.2% (19.3% y/y) in November, the same as in October. Building activity here has shown modest change in recent months. Office construction was little changed in November (+4.6% y/y) and lodging construction fell 3.0% (+5.4% y/y). Health care building held steady (13.1% y/y). Commercial construction fell 0.5% (+4.2% y/y) while construction of educational facilities inched up 0.1% (16.5% y/y) after falling 0.4% in October. Building of religious structures weakened 2.0% (+31.1% y/y) while amusement & recreation construction declined 0.9% (-0.8% y/y). Transportation construction edged 0.1% higher (4.6% y/y) while communication building fell 0.3% (+0.1% y/y). Power building activity rose 0.8% (12.4% y/y), the same as in October, while factory sector construction improved 0.5% (59.4% y/y) following a 2.7% jump.

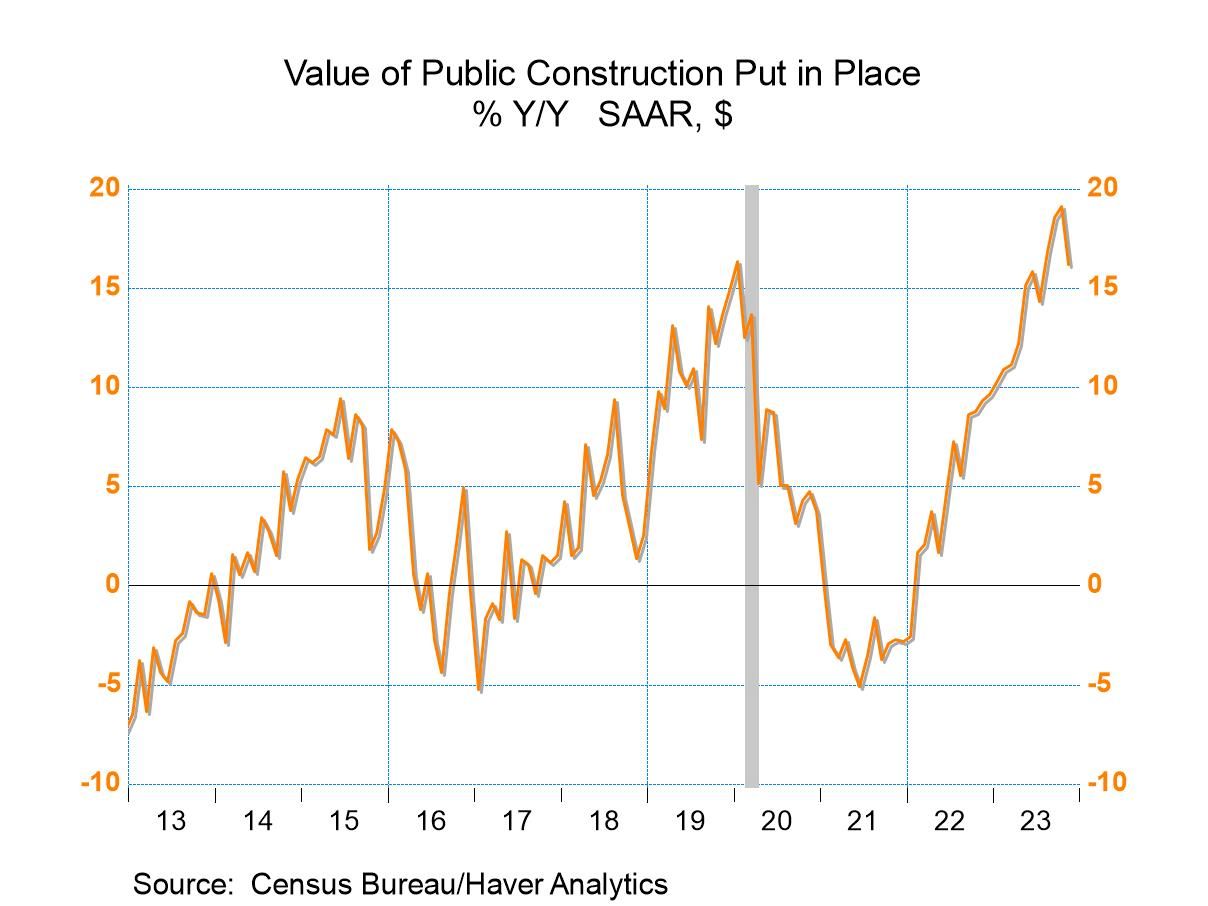

Public sector building activity weakened 0.7% in November (+16.2% y/y) after strong gains in each month of 2023. Residential building fell 2.2% (+10.1% y/y) while nonresidential construction fell 0.6% (+16.3% y/y). Office construction rose 0.2% (12.3% y/y) but commercial construction fell 0.3% (+4.6% y/y). Health care construction held steady (+6.5% y/y) while educational construction fell 0.3% (+16.7% y/y). Public safety building weakened 2.4% (+22.3% y/y) while amusement & recreation construction held steady (+13.5% y/y). Transportation construction declined 1.0% (+8.6% y/y) and power construction fell 1.2% (+56.6% y/y). Highway & street construction edged 0.1% higher (15.2% y/y) while sewage & waste disposal fell 1.6% (+24.6% y/y). Water supply construction declined 1.4% (+18.4% y/y) while conservation & development building weakened 4.4% (-0.0% y/y).

The construction figures can be found in Haver's USECON database. The expectations figure is from the Action Economics Forecast Survey in AS1REPNA.

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.