- Nonrevolving credit up 0.5% y/y in January.

- Revolving credit up 8.5% y/y.

Introducing

Carol Stone, CBE

in:Our Authors

Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

Publications by Carol Stone, CBE

- Initial claims up 13,000; maintain tight range

- Continuing claims also up moderately; 4-week average rises to 26-month high.

- Insured unemployment rate maintains tight 1.2%-1.3% range.

- USA| Feb 28 2024

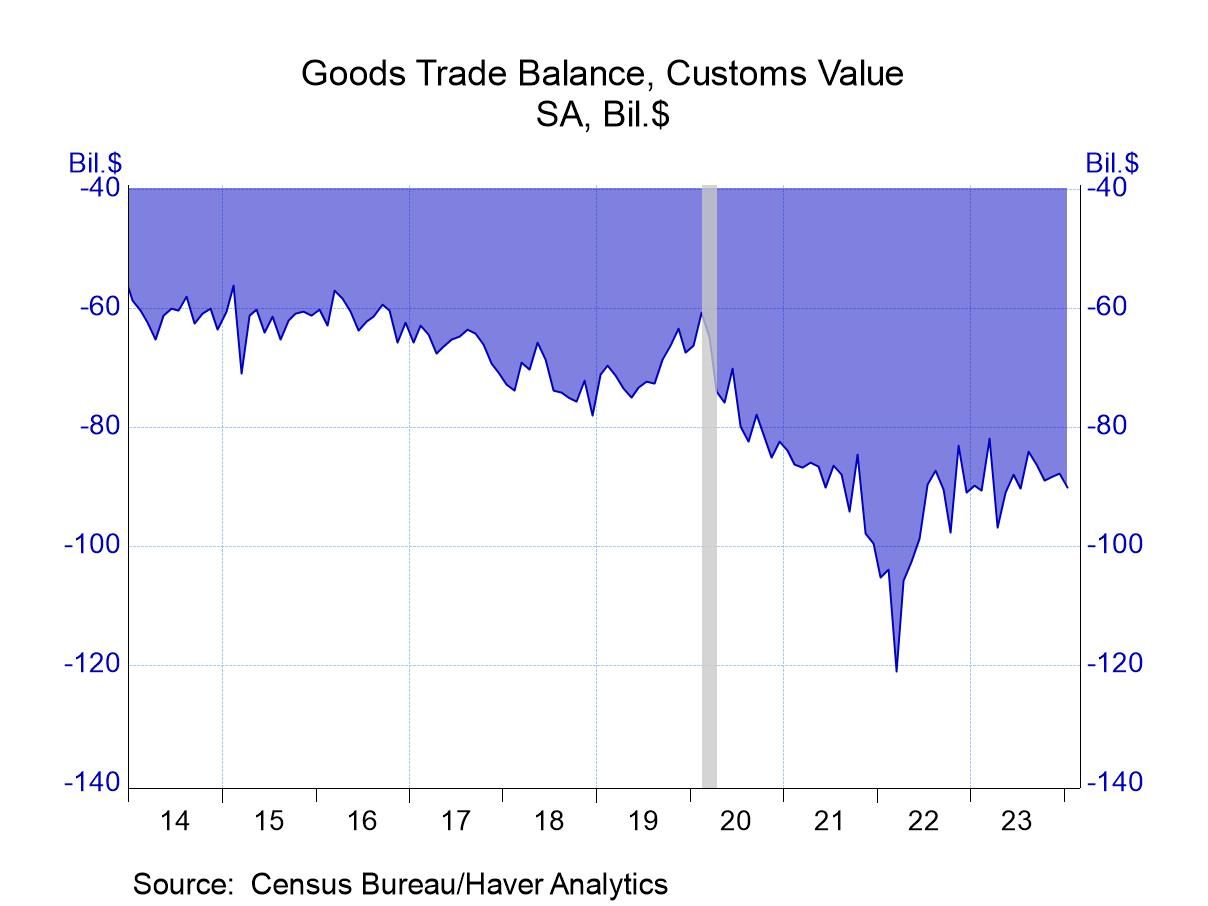

U.S. Foreign Goods Trade Deficit Widens Slightly in January

- $90.2 billion deficit modestly wider than expected.

- Exports rise 0.2%, led by shipments of automotive goods.

- Imports increase 1.1%, with autos and associated goods up 5.1%.

- This month’s overall diffusion index -2.4, after January’s -43.7

- Shipment increased at more firms than had deceases

- New orders & other business components still negative

- Initial claims down for a second week, reach lowest in four weeks

- Continuing claims up in the Feb. 3 week

- Insured unemployment rate ticked back up to 1.3%

- Wholesale inventories have first increase since November 2022.

- December sales were up 0.7%.

- The I/S ratio held steady.

- USA| Feb 01 2024

U.S. Jobless Claims Rise Moderately in January 27 Week

- Initial unemployment insurance claims up 9,000 after prior week’s 26,000 rise.

- Continuing claims increase 70,000 in their latest week, but prior week revised down somewhat.

- Insured unemployment rate ticks up to 1.3%.

- USA| Jan 31 2024

U.S. Employment Costs Index Moderates Noticeably in Q4

- ECI up 0.9% in Q4, least since mid-2021.

- Wages & salaries also up 0.9%, noticeably less than 1.2% in Q3.

- Goods-producing industries compensation up 1.0% in Q4; service-producing industries compensation 0.9%.

- January 13 week’s initial claims down 16,000.

- Continuing claims down 26,000 in January 6 week.

- Insured unemployment rate steady at 1.2%.

- Average gasoline prices down 2 cents in Jan. 15 week.

- Crude oil prices down 47 cents per barrel.

- Natural gas prices near recent highs.

- USA| Dec 28 2023

U.S. Jobless Claims Up 12,000 in December 23 Week

- Latest week’s initial claims higher than forecast.

- December 16 week’s continuing claims up 14,000 from prior week.

- Insured unemployment rate 1.3%, up slightly from prior week’s downwardly revised 1.2%.

- USA| Dec 22 2023

U.S. Durable Goods Orders Jump in November after October Fall

- Nondefense aircraft orders rebound after October drop.

- Defense goods orders fall after October surge.

- Durable goods shipments up; nondurable goods shipments flat.

- of114Go to 6 page