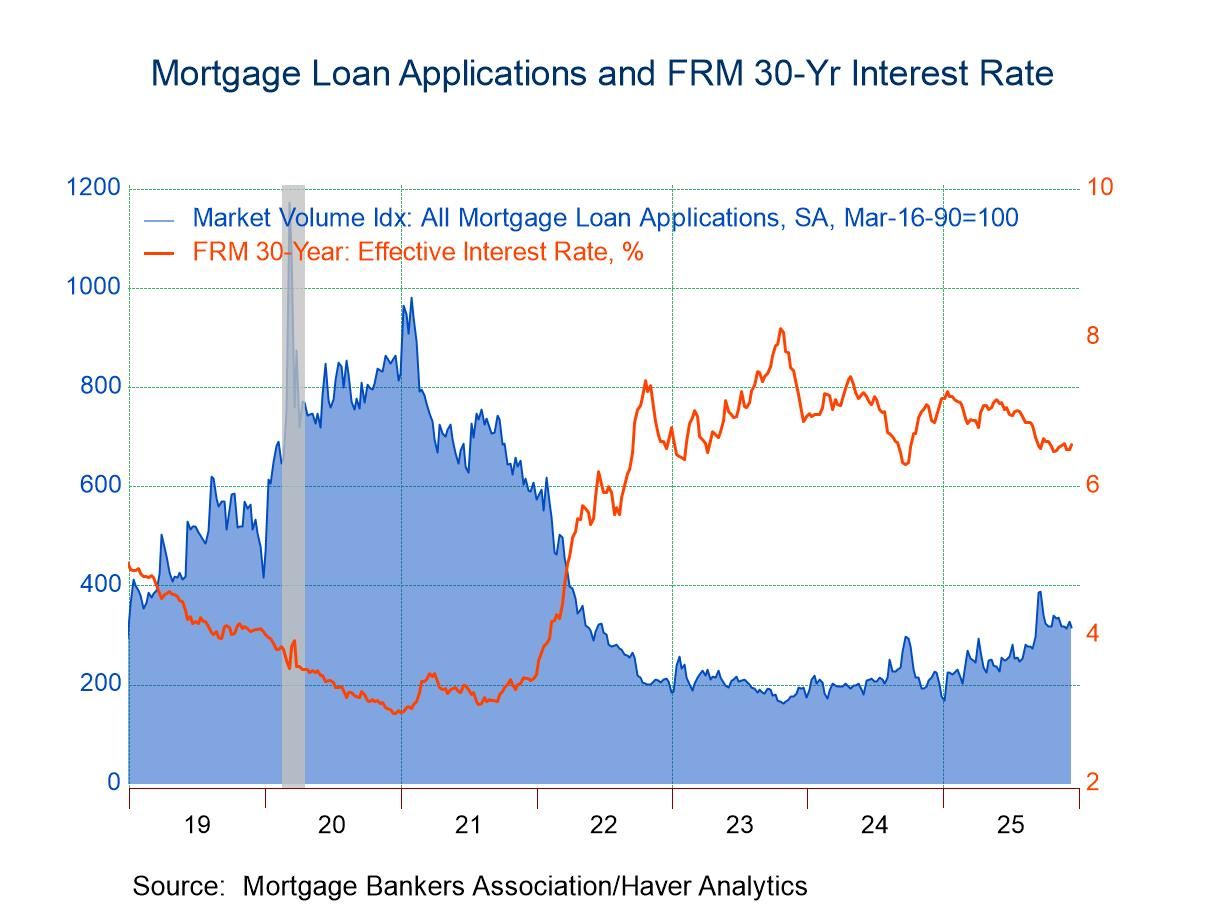

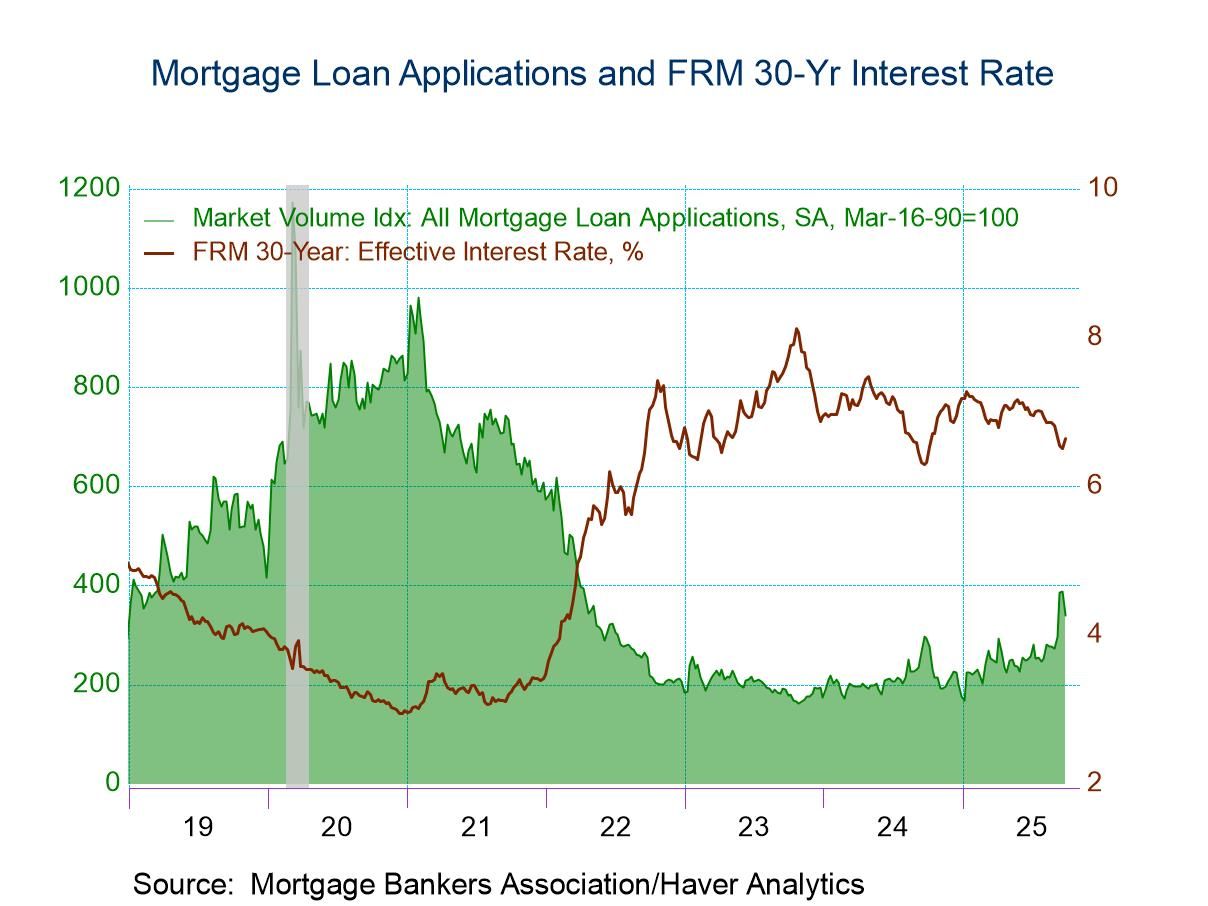

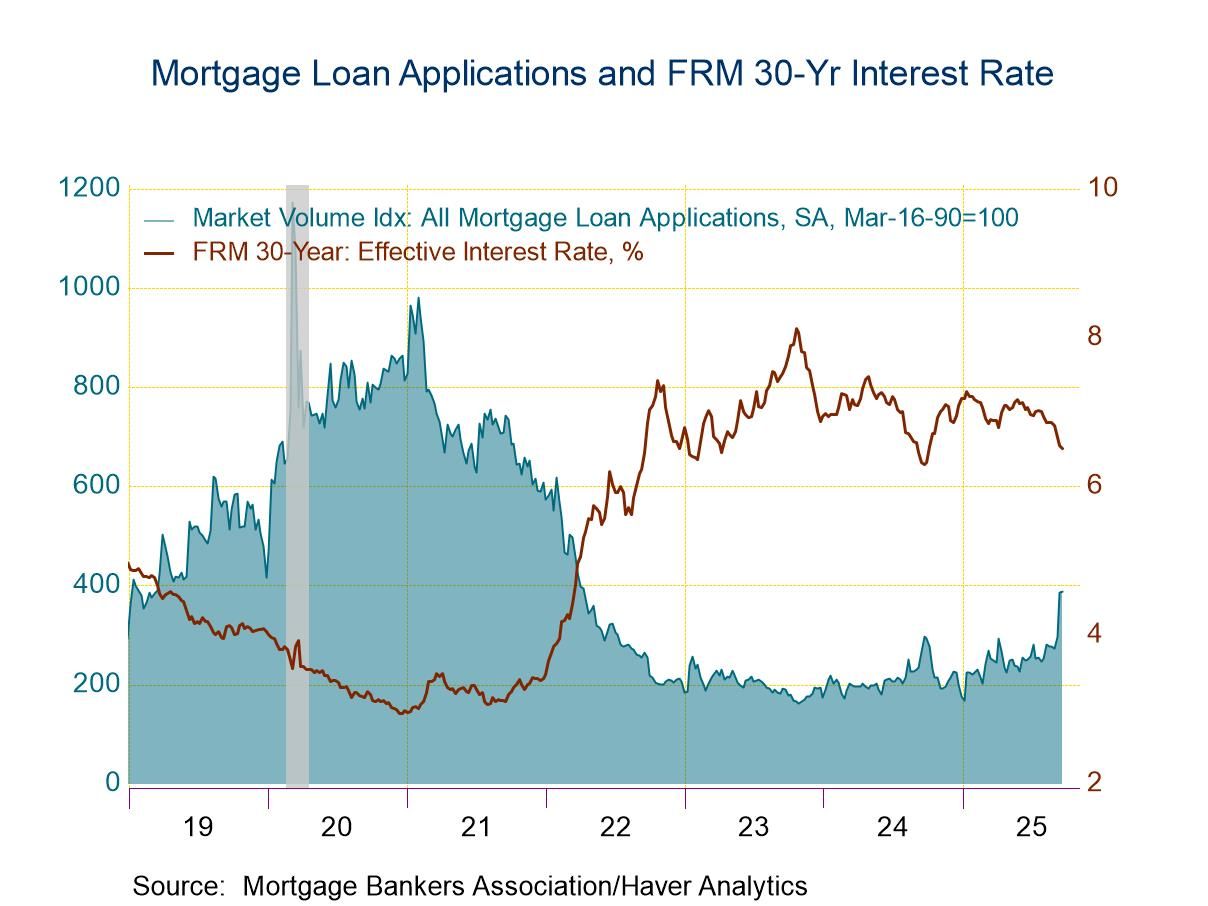

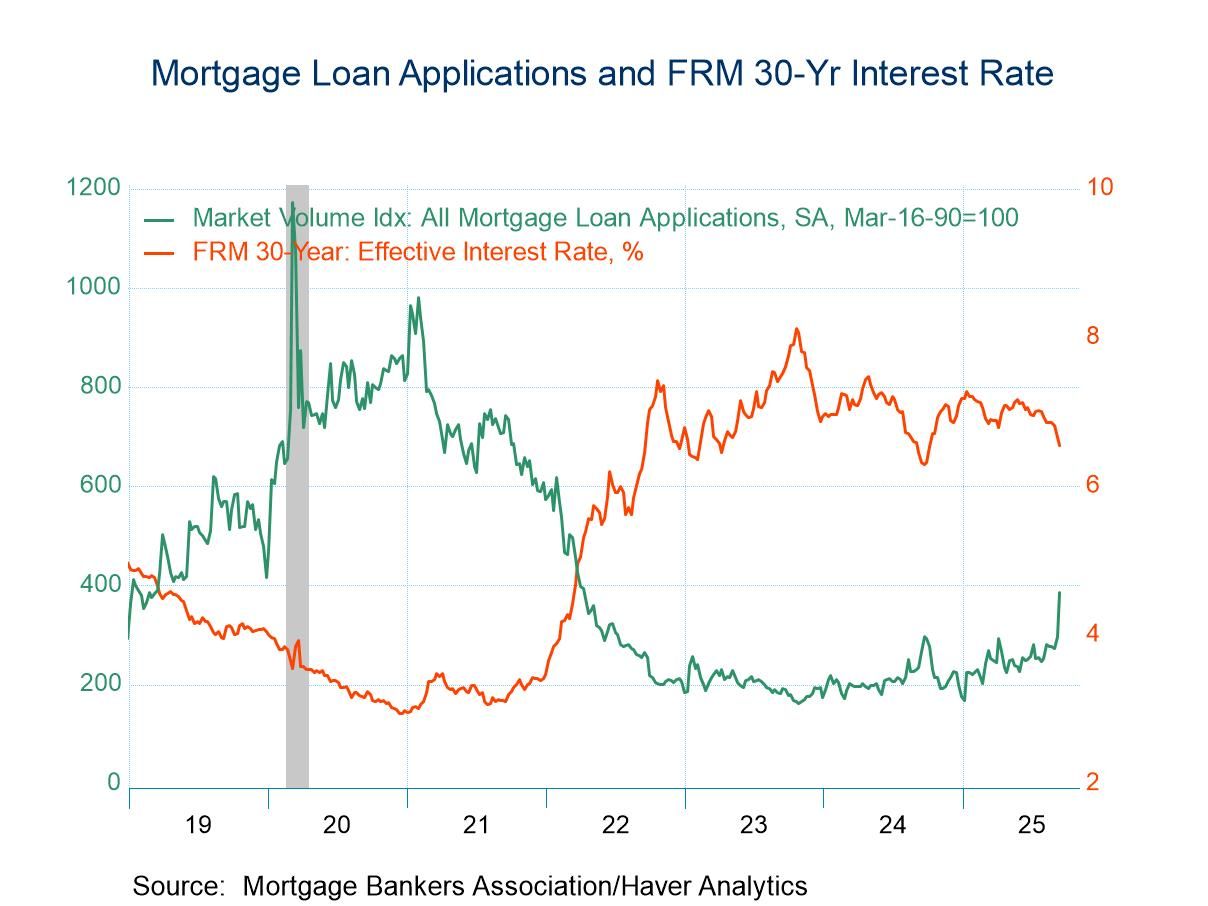

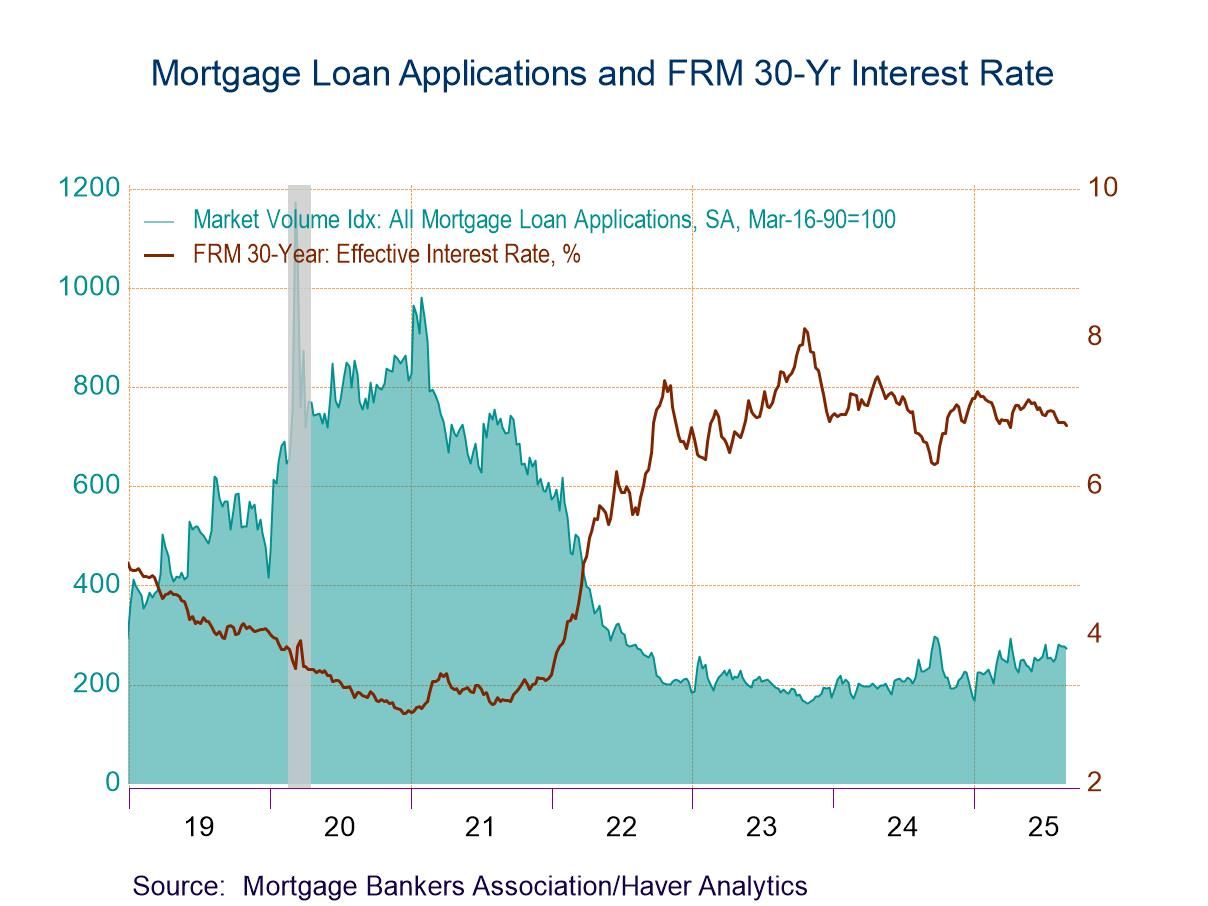

- Purchase applications fell 2.8% w/w; refinancing loan applications fell 3.6% w/w.

- Effective interest rate on 30-year fixed loans rose to 6.56%.

- Average loan size rose moderately.

Introducing

Kathleen Stephansen, CBE

in:Our Authors

Kathleen Stephansen is a Senior Economist for Haver Analytics and an Independent Trustee for the EQAT/VIP/1290 Trust Funds, encompassing the US mutual funds sponsored by the Equitable Life Insurance Company. She is a former Chief Economist of Huawei Technologies USA, Senior Economic Advisor to the Boston Consulting Group, Chief Economist of the American International Group (AIG) and AIG Asset Management’s Senior Strategist and Global Head of Sovereign Research. Prior to joining AIG in 2010, Kathleen held various positions as Chief Economist or Head of Global Research at Aladdin Capital Holdings, Credit Suisse and Donaldson, Lufkin and Jenrette Securities Corporation.

Kathleen serves on the boards of the Global Interdependence Center (GIC), as Vice-Chair of the GIC College of Central Bankers, is the Treasurer for Economists for Peace and Security (EPS) and is a former board member of the National Association of Business Economics (NABE). She is a member of Chatham House and the Economic Club of New York. She holds an undergraduate degree in economics from the Universite Catholique de Louvain and graduate degrees in economics from the University of New Hampshire (MA) and the London School of Economics (PhD abd).

Publications by Kathleen Stephansen, CBE

- USA| Dec 17 2025

U.S. Mortgage Applications Retreated in the Week of December 12

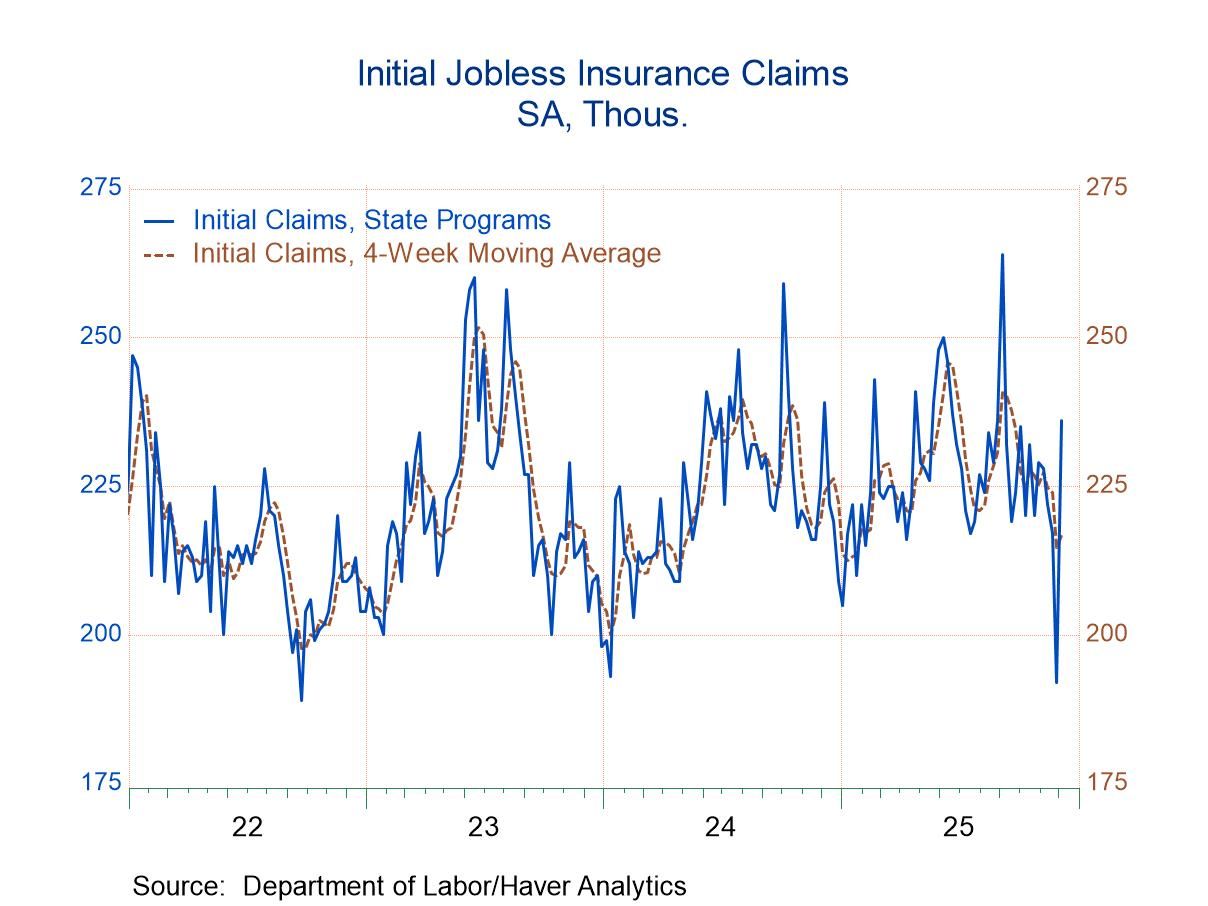

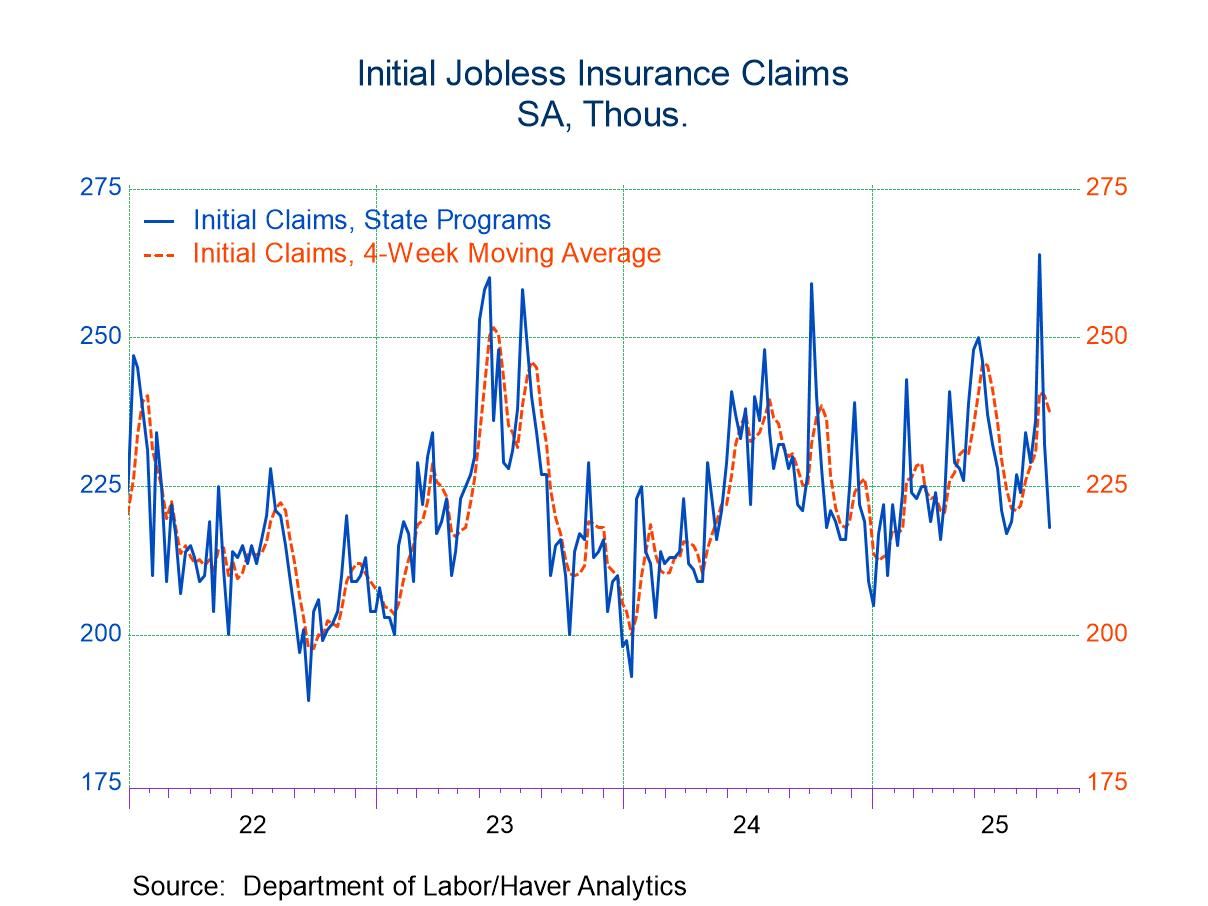

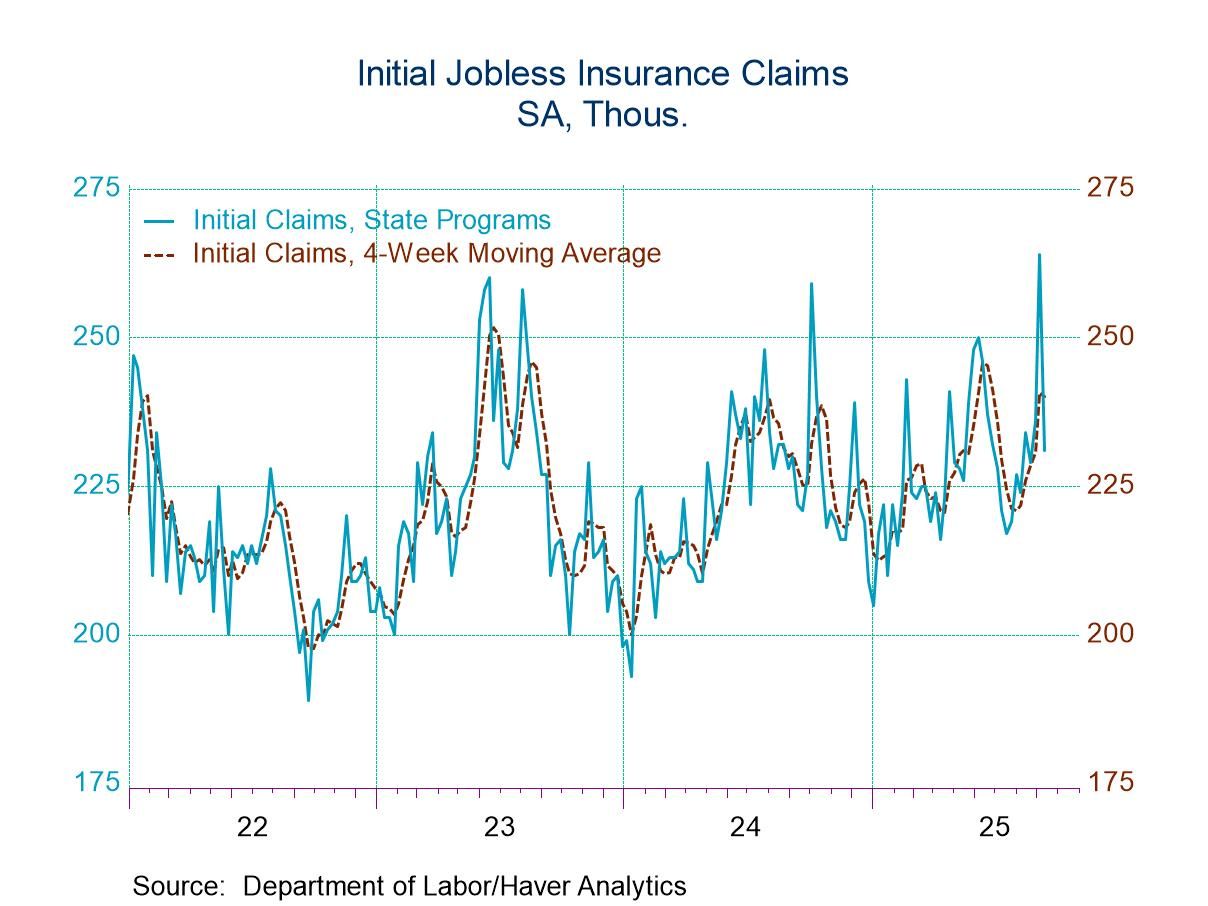

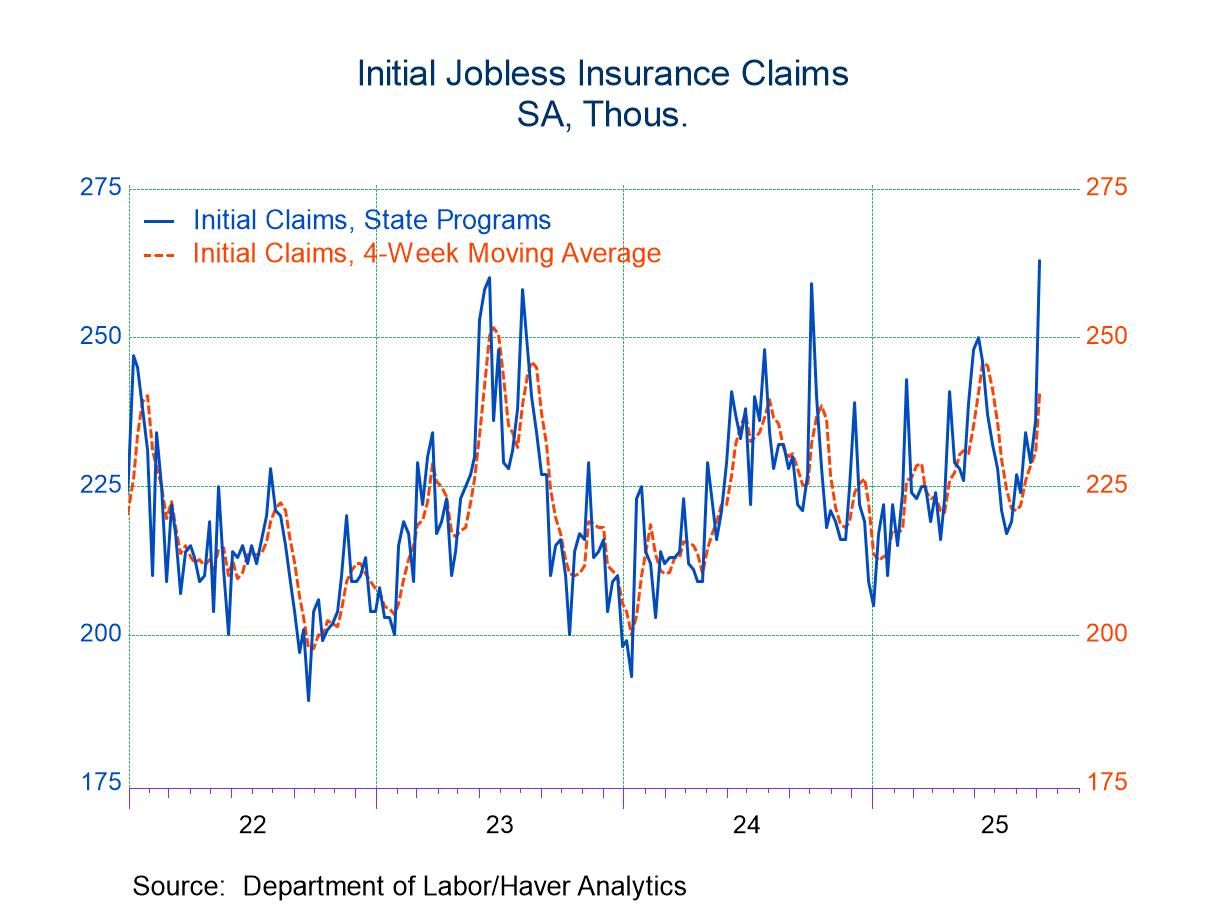

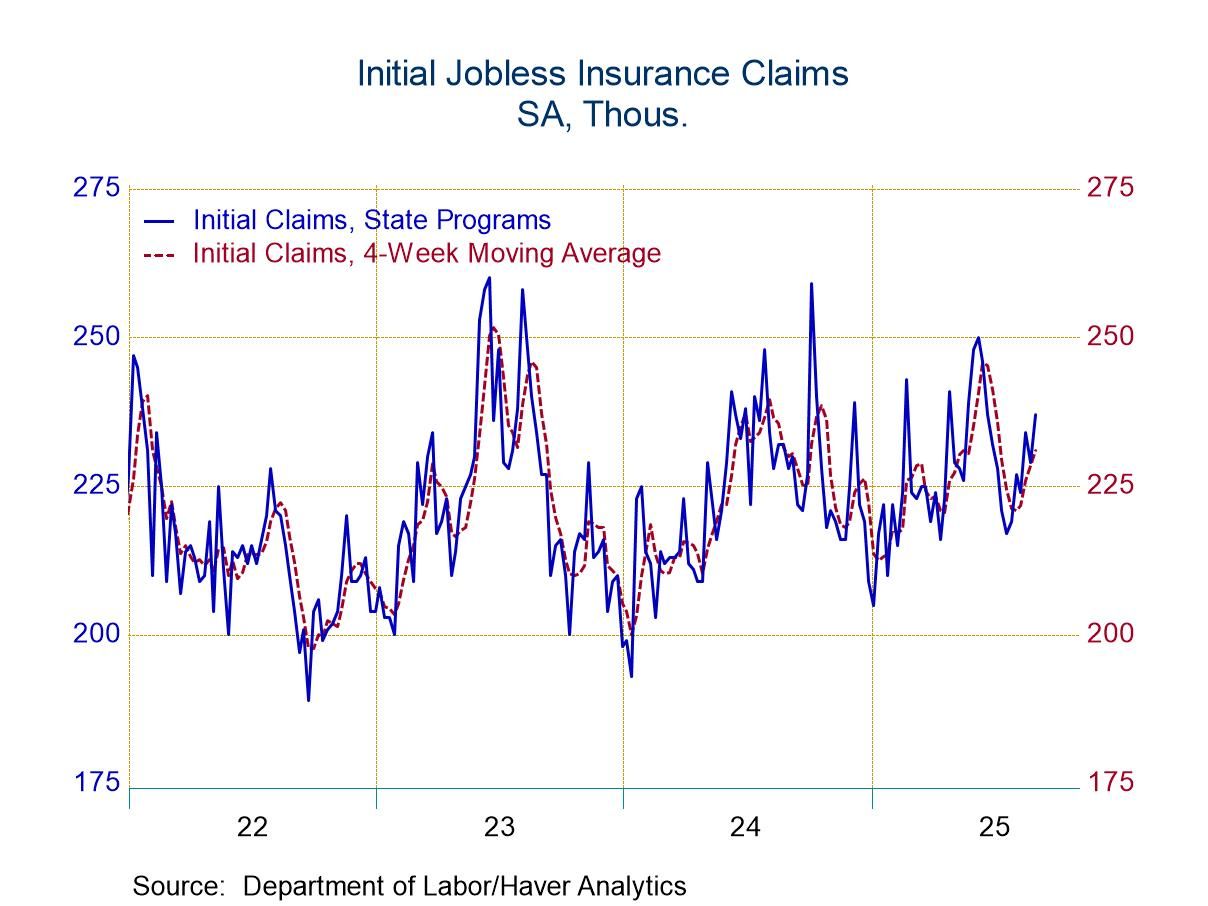

Initial claims for unemployment insurance rose 44,000 to 236,000 during the week of December 6, after declining to 192,000 during the week of November 29, revised from 191,000. The four-week moving average of initial claims was 216,750, an increase of 2,000 from the previous week unrevised average of 214,750, which was the lowest level since January 2025.

Federal government employees initially filed 643 (NSA) jobless insurance claims in the week ended November 29, after 1,126 filed in the week ended November 22, revised from 1,125.

Continuing claims for unemployment insurance posted a sharp decline of 99,000 to 1,838,000 in the week ending November 29, from 1,937,000 the prior week, revised from 1.939 million. The four-week moving average decreased by 27,000 to 1,918,000 in the week ended November 29, from 1945,250 the prior week, revised from 1.945 million. The insured unemployment rate stood at 1.2% in the week of November 29, a decrease from 1.3% in the prior week.

Federal government employees continuing benefits fell to 12,732 (NSA) in the week ended November 22, from 17,862 in the week ended November 15, revised from 17,851.

The insured unemployment rate varied greatly across individual states and territories. In the week ended November 22, the highest unemployment rates were in New Jersey (2.18%), Washington (2.23%), Massachusetts (1.95%), Connecticut (1.83%) and Rhode Island (1.82%). The lowest rates were in Florida (0.27%), South Dakota (0.34%), North Carolina (0.39%), Louisiana (0.42%), Alabama (0.44%), Virginia and Tennessee (both 0.46%), and Arkansas and Nebraska (both 0.48%). Rates in other notable states include California (1.74%), New York (1.63%), Pennsylvania (1.46%), Illinois (1.45%), and Texas (1.07%). These state data are not seasonally adjusted.

Data on weekly unemployment claims are from the Department of Labor itself, not the Bureau of Labor Statistics. They begin in 1967 and are contained in Haver’s WEEKLY database and summarized monthly in USECON. Data for individual states are in REGIONW back to December 1986.

- USA| Dec 10 2025

U.S. Mortgage Applications Jump in the Week of December 5

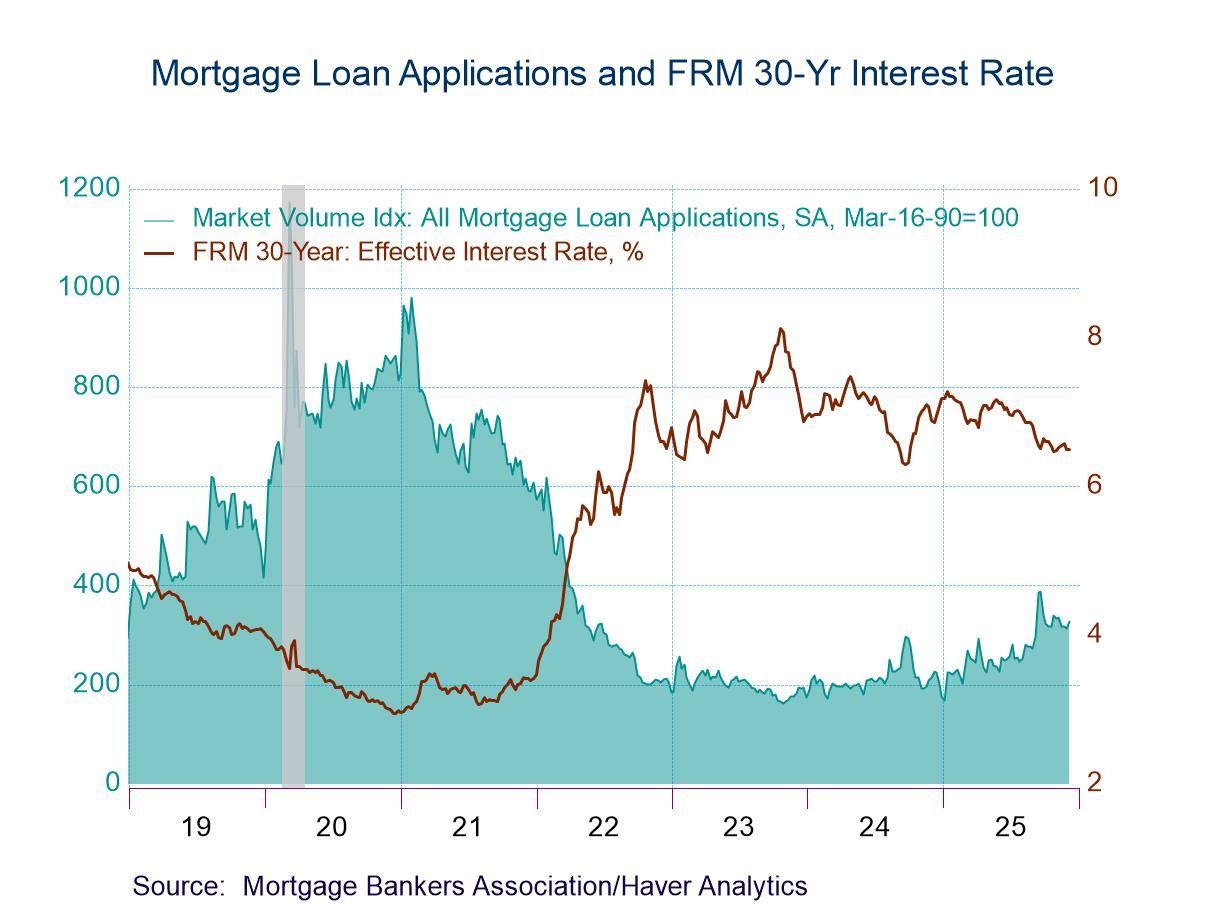

- Purchase applications fell 2.4% w/w; refinancing loan applications soared 14.3% w/w.

- Effective interest rate on 30-year fixed loans largely unchanged at 6.50%.

- Average loan size fell moderately.

- USA| Nov 26 2025

U.S. Weekly Mortgage Applications Inched Up in The Latest Week

- Applications for loans to purchase surged, while those for refinancing declined.

- Interest rates on 30-year fixed-rate mortgage inched up for the fourth consecutive week.

- Average loan size rose in the latest week.

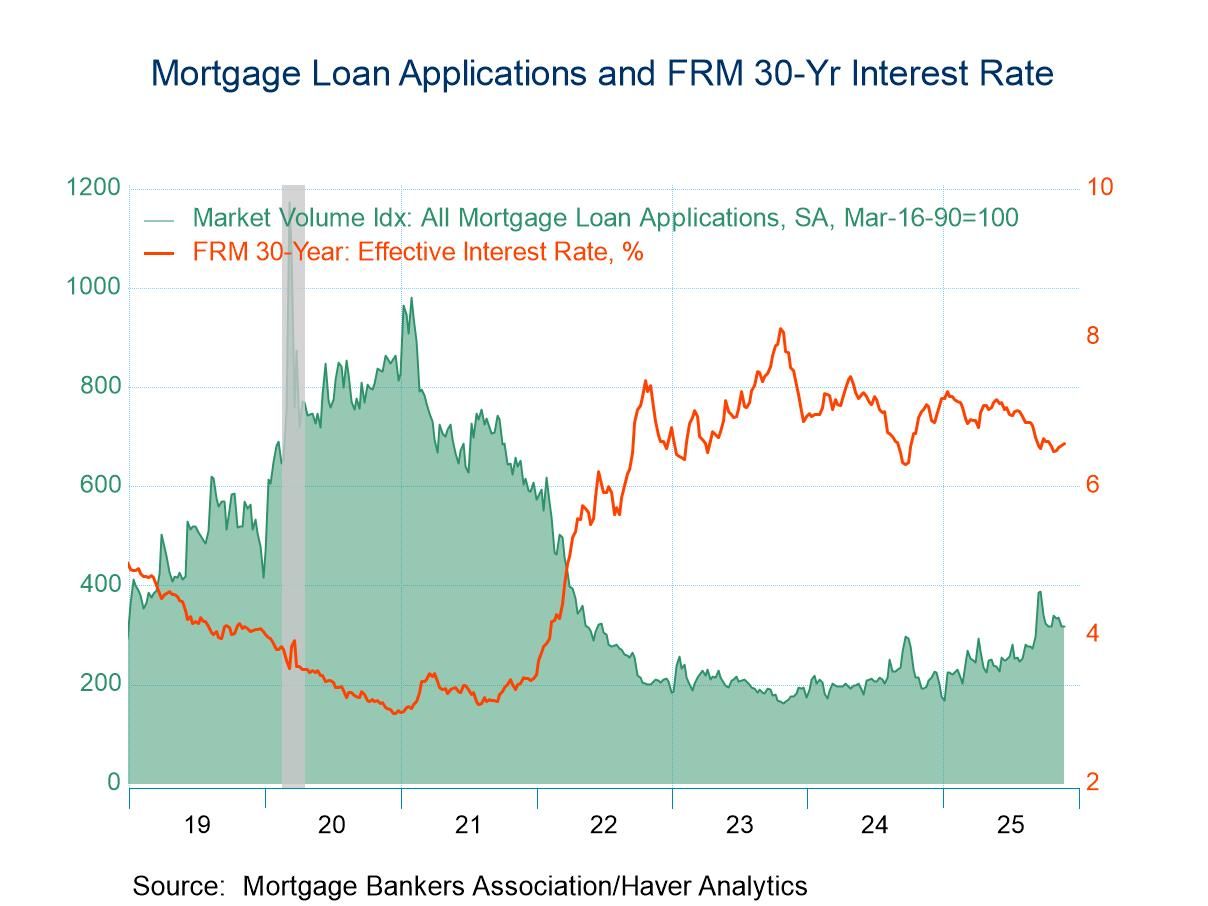

- Purchase loan applications dropped 1.0% w/w, and refinancing loan applications plummeted 20.6% w/w.

- Effective interest rate on 30-year fixed-rate loans rose 13 bps.

- Average loan size declined.

- Initial claims declined 14,000 in latest week.

- Continuing claims edged down slightly.

- Insured unemployment rate holds steady.

- Purchase loan applications edge up 0.3% w/w, and refinancing loan applications rise 0.8% w/w jump.

- Effective interest rate on 30-year fixed-rate loans falls to 6.15%, the lowest since September 2024.

- Average loan size decline.

- Initial claims declined 33,000 in latest week.

- Continuing claims were down slightly.

- Insured unemployment rate holds steady.

- USA| Sep 17 2025

U.S. Mortgage Applications Surge 29.7% in the September 12 Week

- Purchase applications rise 2.9% w/w; revival of refinancing loan applications with a 57.7% w/w jump.

- Effective interest rate on 30-year fixed-rate loans falls to 6.55%, the lowest since October, 2024.

- Average loan size posts double-digit rise.

- USA| Sep 11 2025

U.S. Initial Unemployment Insurance Claims Jumped in Latest Week

- Initial claims jumped 27,000 in latest week containing the Labor Day Weekend.

- Continuing claims were unchanged.

- Insured unemployment rate holds steady.

- Initial claims rose in latest week.

- Continuing claims declined.

- Insured unemployment rate holds steady.

- USA| Sep 03 2025

U.S. Mortgage Applications Declined in Latest Week

- Purchase applications dropped while loan refinancing edged up.

- Fixed-interest rate on 30-year loan holds at a 4-month low.

- Average loan size edged up.

- of18Go to 2 page