Global| Nov 03 2005

Global| Nov 03 20053Q U.S. Productivity Strong

by:Tom Moeller

|in:Economy in Brief

Summary

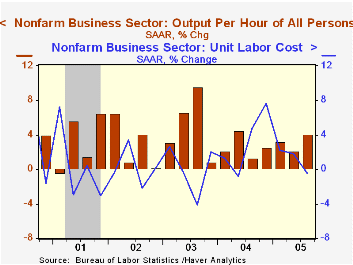

Growth in non-farm labor productivity of 4.1% last quarter was nearly double the upwardly revised growth during the prior quarter and easily surpassed Consensus expectations for a 2.5% rise. The increase lifted the year on year growth [...]

Growth in non-farm labor productivity of 4.1% last quarter was nearly double the upwardly revised growth during the prior quarter and easily surpassed Consensus expectations for a 2.5% rise. The increase lifted the year on year growth in worker productivity to 3.0%, its strongest since 2Q '04.

Output growth of 4.2% (4.2% y/y) was down slightly from a 4.4% increase during 2Q while hours worked grew a slight 0.1% (1.2% y/y).

The Bureau of labor Statistics indicated that the effects of Hurricanes Katrina & Rita could not be separately identified but that the effects were imbedded in the 3Q figures covering output, hours and compensation.

Unit labor costs fell 0.5%, the first quarterly decline since 2Q '04. The decline stemmed both from the strength in productivity as well as a moderate 3.6% (5.8% y/y) rise in compensation costs which was the slowest since 2Q '04.

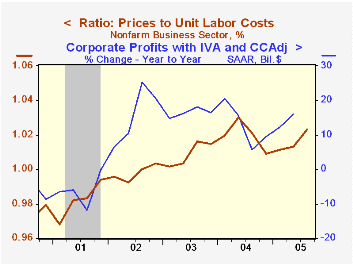

The implicit price deflator rose 3.3% (2.9% y/y) and the increase lifted the ratio of prices to unit labor costs to its highest since early last year. During the last ten years there has been a 58% correlation between the ratio and the y/y growth in corporate profits.

Factory sector productivity growth surged 4.5% (4.7% y/y) after a 3.6% rise during 2Q. Manufacturing compensation grew just 2.9% (7.2% y/y) which allowed unit labor costs to fall 1.6% (+2.5% y/y), the first decline since 2Q '04.Nonfinancial corporate sector productivity growth during 2Q was revised down to 6.3% (6.2% y/y) from 6.8% reported previously. Nevertheless, unit labor costs still fell 2.4% (+0.4% y/y) versus the initial estimate of a 2.6% decline. Output for this measure is gleaned from the income side of the National Income & Product Accounts (NIPA) as opposed to the non-farm output figures which are derived from the output side of the NIPA. Factory sector output is derived from the industrial production measures compiled by the Federal Reserve Board.

| Non-farm Business Sector (SAAR) | 3Q '05 | 2Q '05 | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Output per Hour | 4.1% | 2.1% | 3.0% | 3.4% | 3.8% | 4.0% |

| Compensation | 3.6% | 4.0% | 5.8% | 4.5% | 4.0% | 3.5% |

| Unit Labor Costs | -0.5% | 1.8% | 2.7% | 1.1% | 0.2% | -0.5% |

by Tom Moeller November 3, 2005

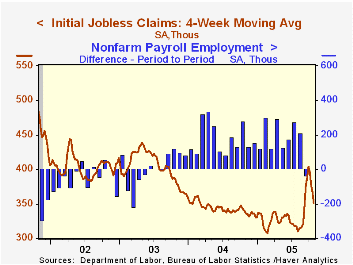

Initial claims for unemployment insurance fell 8,000 to 323,000 last week versus a little revised 26,000 decline during the prior period. Consensus expectations had been for 330,000 claims. The decline lowered the level of claims to the lowest since late August.

The four-week moving average of initial claims fell to 350,500 (+3.5% y/y).

Continuing claims for unemployment insurance fell 44,000 following a downwardly revised 5,000 increase during the prior week.

The insured rate of unemployment remained at 2.2% where it has been during the last six weeks.

| Unemployment Insurance (000s) | 10/29/05 | 10/22/05 | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Initial Claims | 323 | 331 | -3.6% | 343 | 402 | 404 |

| Continuing Claims | -- | 2,823 | 1.2% | 2,926 | 3,531 | 3,570 |

by Tom Moeller November 3, 2005

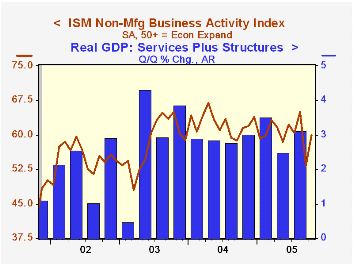

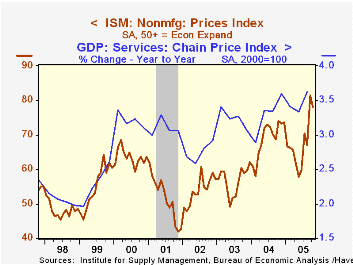

The October Non-manufacturing Sector Business Activity Index from the Institute for Supply Management recovered more than half of its September decline with a 6.7 point increase to 60.0. Consensus expectations had been for a lesser recovery to 57.0.

Since the series' inception in 1997 there has been a 50% correlation between the Business Activity Index and the q/q change in real GDP for services plus construction.

The orders index gained back just a piece of its September decline with a 1.6 point rise. Conversely, the employment index fell for the third month in the last four to the lowest level since January. Since the series' inception in 1997 there has been a 60% correlation between the level of the ISM non-manufacturing employment index and the m/m change in payroll employment in the service producing plus the construction industries.

Pricing power reversed just some of the 14.3 point September surge to a record high with a 3.4 point decline. Since inception eight years ago, there has been a 70% correlation between the price index and the y/y change in the GDP Services chain price index.

ISM surveys more than 370 purchasing managers in more than 62 industries including construction, law firms, hospitals, government and retailers. The non-manufacturing survey dates only to July 1997, therefore its seasonal adjustment should be viewed tentatively. Business Activity Index for the non-manufacturing sector reflects a question separate from the subgroups mentioned above. In contrast, the NAPM manufacturing sector composite index is a weighted average five components.Today's testimony by Fed Chairman Alan Greenspan on the Economic Outlook before the Joint Economic committee can be found here.

| ISM Nonmanufacturing Survey | Oct | Sept | Oct '04 | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Business Activity Index | 60.0 | 53.3 | 61.5 | 62.4 | 58.2 | 55.1 |

| Prices Index | 78.0 | 81.4 | 74.0 | 69.0 | 56.8 | 54.0 |

by Tom Moeller November 3, 2005

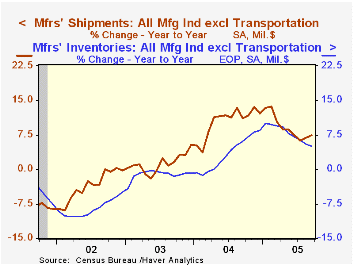

Factory inventories fell another 0.1% in September following a deepened 0.2% decline in August even though higher prices recently have boosted petroleum inventories, (+24.9% y/y). Less petroleum, factory inventories fell 0.1% (+4.1% y/y) in September for the third decline in the last four months and have been virtually unchanged since March.

Inventory declines last month centered mostly in nondurables industries where textile products fell 0.9% (-0.1% y/y) and paper products fell 0.8% (+2.5% y/y). Plastics & rubber products also fell a sharp 1.8% (+6.4% y/y) and paints & coatings inventories fell 1.0% (+6.3% y/y).

Electrical equipment inventories rose 1.0% (3.2% y/y) after four months of declines while machinery inventories rose 0.2% (9.3% y/y). Computers & electronic components rose 0.1% (-0.3% y/y) but electronic computer inventories rose 4.4% (0.9% y/y).

Factory shipments fell 0.5% after an upwardly revised 2.1% surge in August, however, less a 3.4% jump in shipments from petroleum refineries factory shipments fell 0.9% (3.9% y/y).

Factory sector orders fell 1.7%. The advance report of a 2.1% drop in durables goods orders was revised to -2.4%.

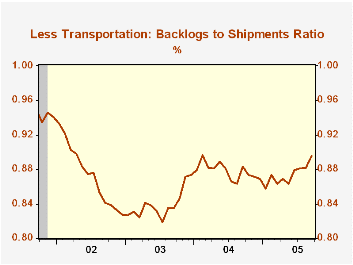

Unfilled orders jumped 0.7% on top of the 1.6% August spurt. Less the transportation sector backlogs surged 1.2% (8.9% y/y) and the ratio of unfilled orders to shipments jumped.

| Factory Survey (NAICS) | Sept | Aug | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Inventories | -0.1% | -0.2% | 4.9% | 7.7% | -1.1% | -5.4% |

| New Orders | -1.7% | 2.9% | 7.0% | 9.3% | 3.5% | -2.5% |

| Shipments | -0.5% | 2.1% | 6.6% | 9.5% | 1.5% | -2.5% |

| Unfilled Orders | 0.7% | 1.6% | 10.4% | 8.4% | 8.0% | -8.5% |

by Carol Stone November 3, 2005

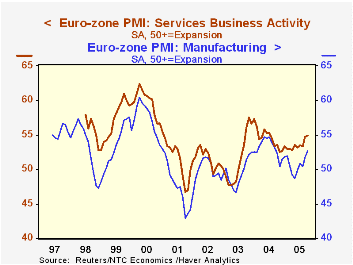

Purchasing manager surveys suggest economies in Europe and Japan are improving, while China might be showing signs of moderation. These monthly polls are published by NTC Research in London and conducted by local business organizations, such as Nomura in Japan and Reuters in the UK. The results are shown as diffusion indexes, which show the percentage of respondents that report increasing business for a given month. As with the ISM data in the US, manufacturing is reported on the first business day of the following month, with nonmanufacturing (mostly services) following two days later. The indexes are calculated as the percentage reporting rising business plus half of those reporting a flat performance. The resulting indexes are then seasonally adjusted.

In October, companies in the Euro-Zone saw business increase more broadly, with a manufacturing index of 52.69 and services, 54.95. Both show notable improvements from earlier in the year. European manufacturing faced a mild contraction (readings below 50%) in the spring and the service sector experienced sluggish growth in the year through August before picking up smartly in the last two months. Patterns in the UK recently have been somewhat similar, with a brief outright contraction in manufacturing during the spring, but some subsequent pickup; activity at UK service companies has held within a persistent and narrow range since the middle of 2004, indicating steady moderate growth.

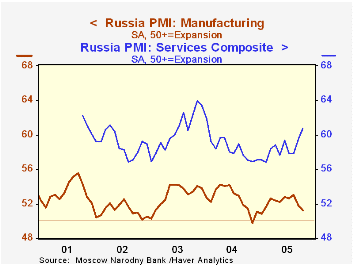

In contrast, growth in Russia's manufacturing sector has slowed in the last two months. This PMI index has ranged from roughly 50 to 55 over the last several years, with September and October dropping into the lower end of the span. Services, though, are holding up well with some strengthening evident so far in 2005. Price behavior in these sectors varies as well: input prices for manufacturers show a trendless, but widely varying oscillation, while service companies' input prices have risen at a dramatically larger number of firms recently.

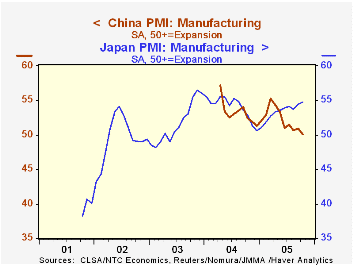

Only manufacturing surveys are taken in Japan and China. Japanese factories appear to be doing better, with that index ratcheting upward all year long. This firming even includes employment; this index worked its way above 50% during 2004, and since March of this year, it has averaged 52.5. While not high by world standards, it looks good for Japan. The survey began in October 2001, and both the total index and the employment component were down around 40 at the time. Such improvement in manufacturing seems at odds with the Japanese government's synthetic indexes reported here Monday by Louise Curley, in which marked slowing or even decline is indicated for the Japanese economy in Q3. Clearly, at the least, various data may diverge over brief time periods. In this case, the synthetic indexes are meant to describe demand conditions, while the PMI survey looks at supply, and that in only one sector. This makes judging the prospects for even the direction of business in Japan a tough call.

China is even more intriguing. Its manufacturing index has dropped steadily since its inception 18 months ago, and now stands just barely above 50%. The moderation appears in most of the survey components, including new orders and backlogs. Notably, output prices are below 50%, indicating declines at more companies than have increases. And in the last three months, employment at factories has been ever so slightly below 50%, basically indicating that it has stopped growing. These results feel odd for a country with GDP growth at about 9-1/2%, led by manufacturing. Perhaps the pattern is a relative one. With such a high growth trend, merely keeping up pace may give the impression of slowing, particularly from the high base that obtained in the spring of 2004 when the survey started. Asia is clearly full of interesting economic developments. We eagerly await more information on how they're doing.

| October 2005 | September 2005 | |

|---|---|---|

| Euro-Zone | ||

| Manufacturing | 52.69 | 51.74 |

| Services | 54.92 | 54.65 |

| UK | ||

| Manufacturing | 51.72 | 51.52 |

| Services | 56.14 | 55.05 |

| Russia | ||

| Manufacturing | 51.23 | 51.83 |

| Services | 60.75 | 59.48 |

| Japan | ||

| Manufacturing | 54.74 | 54.46 |

| China | ||

| Manufacturing | 50.07 | 50.85 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates