Global| May 16 2006

Global| May 16 2006A Stronger Euro and Rising Oil Prices Shake German Investors' Confidence

Summary

German investors and analysts, who report to the ZEW Center for European Economic Research, have become less optimistic regarding the economic outlook over the next six months. The excess of those expecting better conditions over [...]

German investors and analysts, who report to the ZEW Center for European Economic Research, have become less optimistic regarding the economic outlook over the next six months. The excess of those expecting better conditions over those expecting worsening conditions dropped sharply from 62.7% in April to 50.0% in May. It is, however, still above the historical average of 35.3%. The consensus had expected a more modest drop. There has been a steady erosion of confidence since January when the percent balance reached 71.1%.

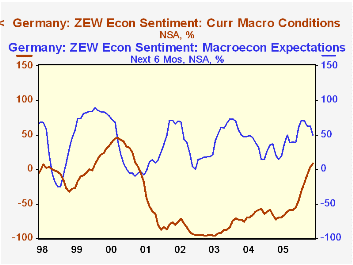

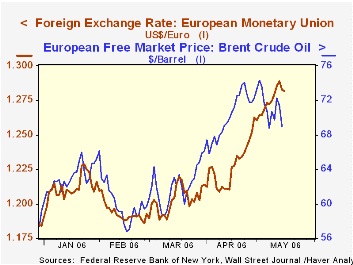

At the same time, the excess of those German investors and analysts who rate current conditions as "good" over those who rate them "bad" rose from 2.9% in April to 8.7% in May. These two ratings were the first positive ratings since April 2001. They may have reflected the improvement in the economy as measured by the 0.04% increase in GDP in the first quarter of this year, up from 0.01% in the fourth quarter of 2005. From the beginning of the this year until April, the price of a barrel of oil had remained below $66 and the euro had ranged in a fairly narrow band between $1.19 and $1.23. Investor expectations and appraisals of current conditions are shown in the first chart.

Since then, however, the price of oil has spiked up to more than $74 a barrel and the euro has climbed to $1.29. (See the second chart.) The threat to German exports from a higher euro and the impact of higher oil prices on consumer demand have, no doubt, made investors and analysts more cautious.

| Germany: ZEW | May 06 | Apr 06 | May 05 | M/M dif | Y/Y dif | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|

| Expectations | 50.0 | 62.7 | 13.9 | -12.7 | 36.1 | 34.8 | 44.6 | 38.4 |

| Current conditions | 8.7 | 2.9 | -69.3 | 5.8 | 78.0 | -61.8 | -67.7 | -92.6 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates