Global| May 06 2009

Global| May 06 2009ADP Report: Rate Of Job Loss Slowed During April

by:Tom Moeller

|in:Economy in Brief

Summary

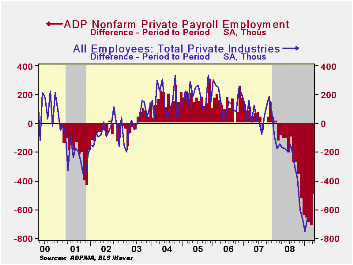

Perhaps the labor market showed a sign of improvement during April. That could be the implication of the latest report from the payroll processor ADP in their latest National Employment Report. It indicated that private nonfarm [...]

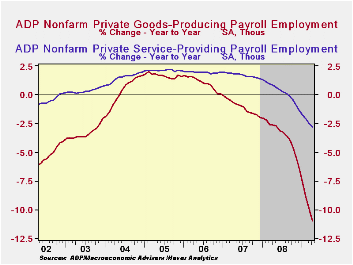

Employment in the service producing industry continued to fall sharply during April. The 229,000 (-2.8% y/y) decline was the thirteenth consecutive monthly decline. Medium-sized service payrolls fell 106,000 (-3.1% y/y) and small-sized payrolls were off 92,000 (-2.4% y/y). Large service producing payrolls dropped by 31,000 (-3.0% y/y).

ADP compiled the estimate from its database of individual companies' payroll information. Macroeconomic Advisers, LLC, the St. Louis economic consulting firm, developed the methodology for transforming the raw data into an economic indicator.

The ADP National Employment Report data is maintained in Haver's USECON database; historical figures date back to December 2000. The figures in this report cover only private sector jobs and exclude employment in the public sector, which rose an average 11,083 during the last twelve months.

Employment in the service producing industry continued to fall sharply during April. The 229,000 (-2.8% y/y) decline was the thirteenth consecutive monthly decline. Medium-sized service payrolls fell 106,000 (-3.1% y/y) and small-sized payrolls were off 92,000 (-2.4% y/y). Large service producing payrolls dropped by 31,000 (-3.0% y/y).

ADP compiled the estimate from its database of individual companies' payroll information. Macroeconomic Advisers, LLC, the St. Louis economic consulting firm, developed the methodology for transforming the raw data into an economic indicator.

The ADP National Employment Report data is maintained in Haver's USECON database; historical figures date back to December 2000. The figures in this report cover only private sector jobs and exclude employment in the public sector, which rose an average 11,083 during the last twelve months.The full ADP National Employment Report can be found here, and the ADP methodology is explained here.

| LAXEPA@USECON | April | March | Y/Y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|

| Nonfarm Private Payroll Employment (m/m Chg.) | -491,000 | -708,000 | -4.3% | -0.4 | 1.2% | 2.0% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.