Global| Feb 22 2011

Global| Feb 22 2011Another Look At The German Consumer Outlook

Summary

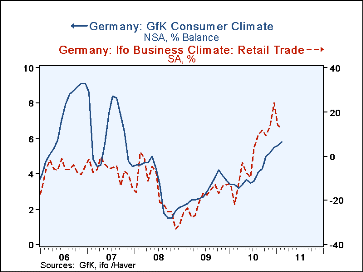

GfK, one of the largest market research companies in the world, reported today that German "consumer sentiment remains on the ascent"--the overall indicator has been rising steadily since June 2010, when it was 3.5, to 5.8 in February [...]

GfK, one of the largest market research companies in the world, reported today that German "consumer sentiment

remains on the ascent"--the overall indicator has been rising steadily since June 2010, when it was 3.5, to 5.8 in

February of this year. Moreover, GfK is forecasting a continued rise in March to 6.0. This view is in sharp contrast

to that of the merchants engaged in retail trade. Yesterday's release by Germany's IFO indicated that the excess

of optimists over pessimists of those engaged in retail trade declined to 12.5% in February from 14.0% in January and

24.1% in December. GfK's consumer sentiment and the IFO's business climate in retail trade are shown in the first chart.

GfK, one of the largest market research companies in the world, reported today that German "consumer sentiment

remains on the ascent"--the overall indicator has been rising steadily since June 2010, when it was 3.5, to 5.8 in

February of this year. Moreover, GfK is forecasting a continued rise in March to 6.0. This view is in sharp contrast

to that of the merchants engaged in retail trade. Yesterday's release by Germany's IFO indicated that the excess

of optimists over pessimists of those engaged in retail trade declined to 12.5% in February from 14.0% in January and

24.1% in December. GfK's consumer sentiment and the IFO's business climate in retail trade are shown in the first chart.

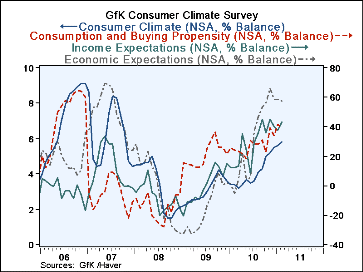

GfK's consumer sentiment indicator has three components: 1) Economic expectations 2) Income expectations 3) Consumption and buying propensity. The balance of those expecting the economy to improve over those expecting it to falter declined from 58.8% in January to 57.1% in February and the excess of participants in the survey who favored spending over those favoring saving declined from 41.8% in January to 38.9% in February. Nevertheless, the sentiment indicator continued to rise due to a sharp rise in the excess of those expecting an improvement in their incomes over those expecting a deterioration. The balance of opinion on income expectations rose 5.2 points from 37.7% in January to 42.9% in February. The GfK consumer sentiment indicator and its determinants are shown in the second chart.

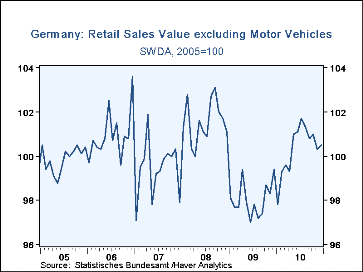

The good feeling about income expectations in the GfK survey is, no doubt, the result of rising wages and employment and the expectation that these trends will continue. Whether GfK's rising consumer sentiment indicator or the IFO's falling business climate in retail trade indicator will prove to be the better indicator depends on the whether the German consumer will save or spend his expected increased income. So far retail sales have not been encouraging. They show a declining trend toward the end of last year, as can be see in the third chart. And now, the February decline in the GfK's consumption and buying propensity indicator suggests that the propensity to spend is declining.

| Feb 11 |

Jan 11 |

Dec 10 |

Nov 10 |

Oct 10 |

Sep 10 |

Aug 10 |

Jul 10 |

Jun 10 |

|

|---|---|---|---|---|---|---|---|---|---|

| GfK Consumer Sentiment (Points) | 5.8 | 5.6 | 5.5 | 5.2 | 5.0 | 4.3 | 4.1 | 3.6 | 3.5 |

| Economic Expectations (% balance) | 57.1 | 58.8 | 58.8 | 65.8 | 56.0 | 53.5 | 46.6 | 36.8 | 5.5 |

| Income Expectations (% balance) | 42.9 | 37.7 | 40.0 | 44.9 | 36.0 | 45.2 | 36.0 | 29.1 | 8.2 |

| Consumption and Buying Propensity (% bal); | 38.9 | 41.8 | 33.8 | 39.3 | 22.5 | 32.7 | 27.9 | 27.9 | 30.4 |

| IFO Business Climate Retail Trade (% bal) | 12.5 | 14.0 | 24.1 | 13.3 | 9.3 | 11.9 | 9.6 | 4.1 | -9.6 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates