Global| Sep 18 2007

Global| Sep 18 2007ĀPessimism Grows in the German Financial Community: Zew Measure Falls to -18.1ĀĀĀĀ

Summary

The ZEW indicator of expectations for the outlook six months ahead among institutional investors and analysts fell to -18.1% in September from -6.9% in August. This is the second month in which pessimists outnumbered optimists and is [...]

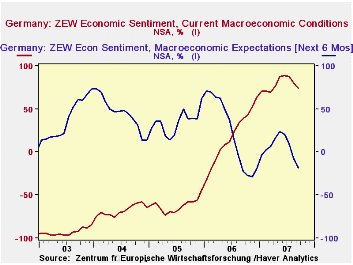

The ZEW indicator of expectations for the outlook six months ahead among institutional investors and analysts fell to -18.1% in September from -6.9% in August. This is the second month in which pessimists outnumbered optimists and is the lowest value since late 2006. The appraisal of the current situation also declined to 74.4% from 80.2%, but still showed a healthy excess of optimists over pessimists. Expectations of output six months ahead and appraisals of current conditions by the financial community are shown in the first chart.

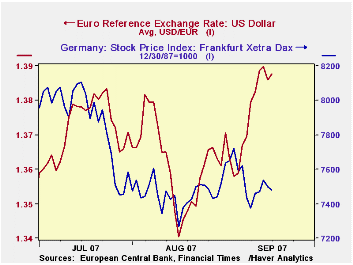

The decline in the stock market and rise in the exchange rate were, no doubt, factors that affected the opinions in the financial community. The turmoil in financial markets that has followed the emergence of trouble in the US sub prime mortgage market spread to European markets beginning in July. In Germany, the Frankfurt Xetra Dax index of stock prices has declined some 9% from the peak of July 16th. At the same time, the rise in the euro that has gained strength against the dollar and reached an all time high of $1.3886 on September 12th, has cast doubts on continued expansion in exports, a major source of growth in Germany. The courses of the stock market and the euro are shown in the second chart.

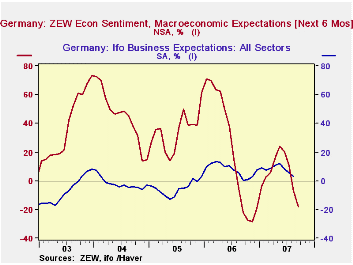

Opinions in the financial community tend to be more volatile than those of the business community as can be seen in the third chart that compares the IFO measure, based on business expectations with the ZEW measure. The IFO measure is expected to be released early in October.

| ZEW (Percent Balance) | Sep 07 | Aug 07 | Sep 06 | M/M Chg | Y/Y Chg | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| Expectations 6-months Ahead | -18.1 | -6.9 | -22.2 | -11.2 | 4.1 | 22.3 | 34.8 | 44.6 |

| Current Conditions | 74.4 | 80.2 | 38.9 | -5.8 | 35.5 | 18.3 | -61.8 | -67.7 |