Global| Jun 18 2010

Global| Jun 18 2010Balance of Payments Capital Flows Rebound in Q1 -- Both in and Out of the U.S.

Summary

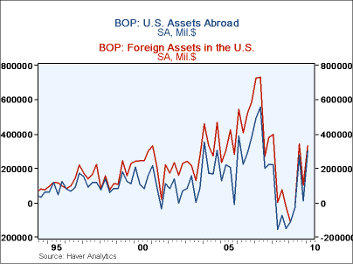

The financial account portion of yesterday's balance of payments report shows sizable capital flows both in and out of the United States in Q1. U.S. assets abroad increased on net by $300.8 billion in the quarter, following a tiny [...]

The financial account portion of

yesterday's balance of payments report shows sizable capital flows both

in and out of the United States in Q1. U.S. assets abroad increased on

net by $300.8 billion in the quarter, following a tiny $8.7 billion in

Q4 (revised substantially from $99.1 billion reported before). The

small Q4 amount occurred in government accounts, reflecting more

liquidation of the Federal Reserve's currency swap program. Private

investors had continued investing abroad in Q4, though by a smaller

amount than before, $55.8 billion. They increased their net purchases

of assets aboard by $309.6 billion in Q1, including larger direct

investment outflows and a swing in banks' claims on foreigners from

liquidation in Q4 to a sizable gain in Q1.

The financial account portion of

yesterday's balance of payments report shows sizable capital flows both

in and out of the United States in Q1. U.S. assets abroad increased on

net by $300.8 billion in the quarter, following a tiny $8.7 billion in

Q4 (revised substantially from $99.1 billion reported before). The

small Q4 amount occurred in government accounts, reflecting more

liquidation of the Federal Reserve's currency swap program. Private

investors had continued investing abroad in Q4, though by a smaller

amount than before, $55.8 billion. They increased their net purchases

of assets aboard by $309.6 billion in Q1, including larger direct

investment outflows and a swing in banks' claims on foreigners from

liquidation in Q4 to a sizable gain in Q1.

Foreign investment in the U.S. picked up in Q1, to $332.1 billion

following more restrained inflows in Q4 of $103.4 billion. The increase

in Q1 was in "other" investment, that is, not official assets. These,

mostly private, investments accelerated to $257.0 billion after a

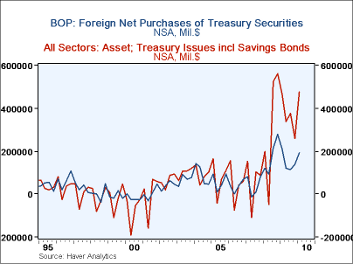

liquidation of $13.2 billion in Q4. Net purchases of U.S. Treasury

securities by this group surged by $105.4 billion in Q1, in contrast

with the slim gain of $13.8 billion in Q4 and net liquidations the

prior two quarters. Banking activity increased $88.6 billion, turning

around from a $63.8 billion liquidation in Q4.  Foreign official assets

in the U.S. increased $75.0 billion in Q1, somewhat less than their

$116.8 billion gain in Q4. Official purchases of Treasuries eased to

$89.1 billion from $124.4 billion in Q4. Overall, foreign buying of

Treasuries amounted to $192.4 billion, up from $139.6 billion. The

largest quarter ever for this item is Q4 2008, which saw $279.5 billion

in foreign purchases.

Foreign official assets

in the U.S. increased $75.0 billion in Q1, somewhat less than their

$116.8 billion gain in Q4. Official purchases of Treasuries eased to

$89.1 billion from $124.4 billion in Q4. Overall, foreign buying of

Treasuries amounted to $192.4 billion, up from $139.6 billion. The

largest quarter ever for this item is Q4 2008, which saw $279.5 billion

in foreign purchases.

In the first graph here, we show the financial flows in and out of the U.S. financial system. The balance of payments data have the convention of showing capital outflows with a minus sign, and in graphing U.S. assets abroad here, we multiplied them by -1 to put them on the same side of the axis as foreign assets in the U.S. We see there that flows in both directions are currently running along the same general tracks. In the second graph, we show total foreign purchases of Treasury securities; this comes in the BOP array as the sum of official purchases and other purchases of Treasuries. We compare that with the total net increase in Treasury securities from the Flow-of-Funds data. Despite impressions from press reports, foreign investors have not been buying up every last Treasury bill, note or bond -- domestic investment in them is in fact quite large

The summary of Balance of Payments data is included in Haver's USECON database, with further detail in USINT. The flow-of-funds data is in the FFUNDS database.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.