Global| Jan 08 2007

Global| Jan 08 2007Bank of Canada Survey: A Subdued Outlook

Summary

The results of the Bank of Canada's Winter Business Outlook Survey were released today. The survey is conducted by analysts at the bank's regional offices who interviews senior management of approximately 100 firms. The regional [...]

The results of the Bank of Canada's Winter Business Outlook Survey were released today. The survey is conducted by analysts at the bank's regional offices who interviews senior management of approximately 100 firms. The regional offices tally the percent of respondents who see improvement over the next twelve months, those who see deterioration and those whose see no change.The balance of opinion is the difference between those who see improvement and those who see deterioration.

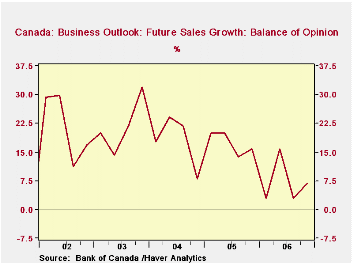

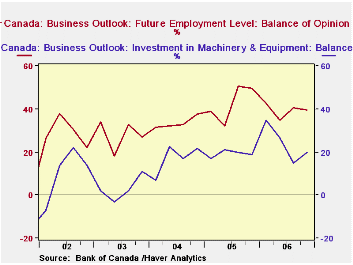

While there are bright spots in Winter Survey, the overall impression one gets is that of a slowing economy. The balance of opinion on sales improved in the current survey to 6.93% from 2.97% in the Fall Survey, but was 8.91 percentage points below the 2005 Winter Survey. Managements, in general, have tended to be less optimistic about future sales since early 2004, as can be seen in the first chart. They have, however, continued to invest in machinery and equipment and to take on employees, as seen in the second chart. However, although the Winter Survey showed an almost 5 percentage points increase in the percent balance expecting to increase investment spending to 19.80%, this level is significantly lower than the 34.65% and 26.73% shown in the first and second quarters of the year.

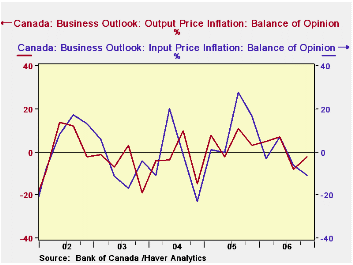

The balance of opinion on input and output price inflation is the difference between expectations of an acceleration and a deceleration of prices. The Fall Survey showed that managements were beginning to see a deceleration in both input and output prices. The current survey shows that the balance of opinion on input prices is -10.89% and that of output prices, -1.95%. (See the third chart)

Managements are seeing some increase in the difficulty of meeting demand, but there has been a slight decline in the balance of those who expect "significant" difficulty as shown in the table below.

| BANK OF CANADA OUTLOOK SURVEY (% Balance) | Q4 06 | Q3 06 | Q5 05 | Q/Q Dif | Y/Y Dif | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| Sales | 6.93 | 2.97 | 15.84 | 3.96 | -8.91 | 4.18 | 17.43 | 17.91 |

| Investment in Machinery and Equipment | 19.80 | 14.95 | 19.00 | 4.95 | 0.80 | 24.01 | 19.20 | 16.95 |

| Employment Level | 39.60 | 40.59 | 49.50 | -0.99 | -9.90 | 39.35 | 42.75 | 33.42 |

| Input Price Inflation | -10.89 | -5.94 | 16.83 | -4.95 | -27.72 | -3.22 | 11.39 | -3.54 |

| Output Price Inflation | -1.95 | -7.92 | 2.97 | 5.94 | -4.95 | 0.49 | 4.96 | -3.19 |

| Ability to Meet Demand | ||||||||

| Some Difficulty | 35.60 | 31.70 | 34.70 | 3.90 | 0.90 | 33.43 | 32.58 | 34.00 |

| Significant Difficulty | 13.90 | 14.90 | 14.90 | -1.00 | -1.00 | 13.65 | 11.20 | 7.25 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates