Global| Mar 09 2006

Global| Mar 09 2006Bank of Japan To Implement "Un-Ease": A Follow-Up

Summary

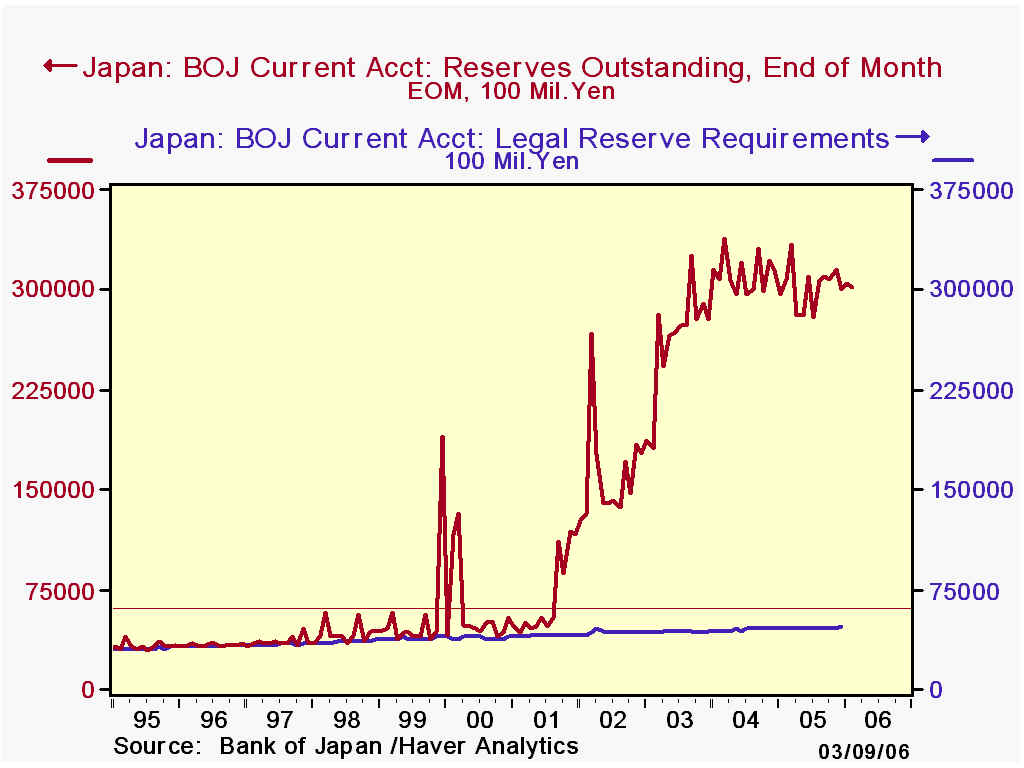

We wrote yesterday in the midst of the monetary policy meeting of the Bank of Japan; we described the voluminous amount of reserves the BoJ has pumped into the banks. As widely expected, the Bank announced that it would reduce this [...]

We wrote yesterday in the midst of the monetary policy meeting of the Bank of Japan; we described the voluminous amount of reserves the BoJ has pumped into the banks. As widely expected, the Bank announced that it would reduce this level of reserves, pulling it back toward its more traditional amount. Because bank deposits are not near the levels permitted by the current volume of reserves, no immediate change in short-term interest rates is likely and the Bank indicates that the overnight call money rate should remain near zero.

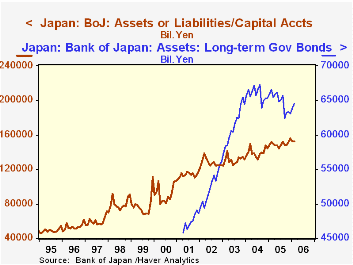

However, the bank provided these reserves, a liability item on its balance sheet, by substantially increasing its assets, as evident in the first graph here. The BoJ's assets grew quite significantly during two periods of the last 10 years, late 1997-98 following the Asian currency crisis, and from the spring of 2001 through 2002. In this latter period, it bought huge quantities of government securities, particularly bonds, and it began outright buying of short-term commercial bills.

So as the Bank sheds the excess reserves "over a few months", it will be interesting to see what happens to interest rates on the assets the Bank will also shed. The Bank's statement says that it will continue buying long-term government bonds, and that its "un-easing" [our terminology] will occur in short-term money markets. So the Bank is attempting to minimize the impact on interest rates all together. Whether they succeed remains to be seen and it likely depends on the accompanying vigor in the Japanese economy.

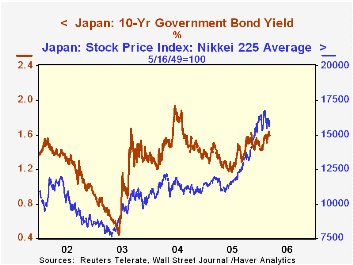

Meantime, after the Bank's announcement in mid-afternoon, markets were actually encouraged, seeing this change in policy as a "vote of confidence" in the Japanese economy. Stock prices rose, with the Nikkei-225 up a whopping 2.6% on the day. And bond yields were little changed, in fact easing ever so slightly. Notably, in addition, even as the BoJ has added significantly to its holdings of government bonds in recent years, yields on them have not moved much. Thus, the yield curve has remained upward sloping, suggesting that investors believed the Bank's policy would eventually work, as it appears to be doing.

[The BoJ accounts and aggregate open market operations are included in Haver's JAPAN database. Daily stock market indexes and interest rates are shown in INTDAILY.]

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.