Global| May 27 2005

Global| May 27 2005BBA Data Show Tentative Firming in UK Mortgage Lending; Consumer Credit Still Soft

Summary

British Bankers Association data on lending to individuals have recently been added to Haver's "UK" database. The April figures were reported today and updated by our "European shift", the manager and crew who work from roughly [...]

British Bankers Association data on lending to individuals have recently been added to Haver's "UK" database. The April figures were reported today and updated by our "European shift", the manager and crew who work from roughly midnight in New York to 8:00AM.

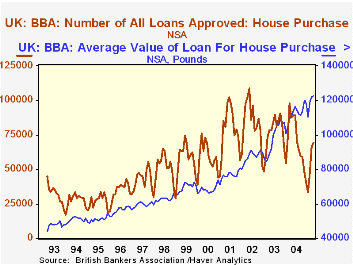

Gross new mortgage lending gave a tentative sign of stabilizing after a period of deep weakness during the winter. New loans totaled £14,120 million, up 2.9% from March, although still 12.6% below the April 2004 amount. The number of loans approved for house purchase, 69,323, was off 21.0% from a year ago, but this is the smallest 12-month decline since last August. Intervening months have seen 30%-40% rates of decline.

The average value of newly approved loans has been increasing, but more slowly in recent months. The April figures show a 10.7% rise from a year ago. This is stronger than several months of single-digit increases since last summer, but weaker than the 15%-20% gains prior to that. This general tapering trend is reflected in house prices, with the Halifax Standardised Price, for example, virtually flat for the first four months of 2005. The UK housing market appears to have cooled, and other data on the industry have turned in a mixed, basically indeterminate performance so far this year.

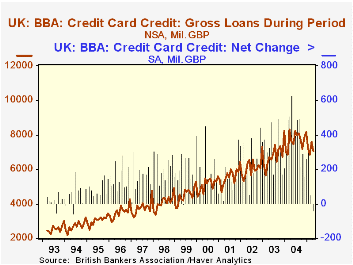

The BBA figures on consumer credit show weakness. The amount of new credit card debt was £7,064 million in April, down 7.2% from a year ago. More, the total amount of credit card debt outstanding fell by a seasonally adjusted £40 million in April, the first monthly decline since August 1994. The recent sluggishness coincides to a decline in UK retail sales of 2.7% in value since September.

The BBA lending data are cited in two sections of our UK database, both in "Financial Data" and also in "Housing and Construction". They cover several "major banking groups", the so-called "MBBG" and are styled to parallel some similar concepts reported by the Bank of England for all banks, building societies and other mortgage lenders. Those broader data are due for release on Wednesday 1 June.

| United Kingdom Mil.GBP (NSA except where noted) |

Apr 2005 | Mar 2005 | Feb 2005 | Year Ago | Monthly Averages|||

|---|---|---|---|---|---|---|---|

| 2004 | 2003 | 2002 | |||||

| Gross New Loans | 14,120 | 13,721 | 11,938 | 16,150 | 15,701 | 15,071 | 12,586 |

| Loan Approvals- Number | 69,323 | 65,635 | 47,365 | 87,800 | 69,244 | 76,105 | 83,915 |

| - Average Value (£) | 122,700 | 121,600 | 119,000 | 110,800 | 112,083 | 97,817 | 87,367 |

| - 12-mo. % change | 10.7 | 14.6 | 12.0 | 14.3 | |||

| Credit Card Debt- Gross | 7,064 | 7,586 | 6,842 | 7,610 | 7,707 | 6,818 | 6,105 |

| - Outstanding EOP | 34,015 | 33,628 | 33,728 | 31,139 | 33,973 | 28,689 | 26,409 |

| - Net Change SA | -40 | 134 | 50 | 388 | 310 | 266 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.