Global| Feb 15 2008

Global| Feb 15 2008BOF Biz Indicators Softens

Summary

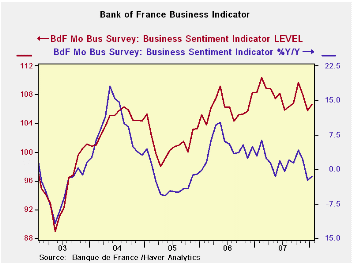

The Bank of France monthly business survey for January 2008 shows that production has held up but that there is a clear gnawing away at past trends. The chart at the top shows that the Biz indicators have been fairly flat recently but [...]

The Bank of France monthly business survey for January 2008

shows that production has held up but that there is a clear gnawing

away at past trends. The chart at the top shows that the Biz indicators

have been fairly flat recently but viewed as a percentage from a Year

ago there is clear degradation in the index’s momentum. The sentiment

index itself now sits just below the middle of this two year range in

the 45th percentile. The production outlook is near the top third of

its range in the 64th percentile. Order book reading are in the 60th

percentile and foreign order books have slipped to their 35th

percentile. New orders at 56.9% stand above their midpoint at the

56.9th percentile.

Despite some slippage in the year over year reading most of

the index levels for January are still very near their respective

12-month averages. The Bank of France views the index as a positive in

the outlook for growth in Q1. However the index is clearly losing its

momentum.

| Bank of France Monthly INDUSTRY Survey: SUMMARY | ||||||

|---|---|---|---|---|---|---|

| 12 MO | Since Jan-87 | 2Yr Percentile | ||||

| Jan-08 | Dec-07 | Nov-07 | AVERAGE | Average | rank/range | |

| Production-latest mo | ||||||

| Total Industry | 19.07 | -4.08 | 3.83 | 8 | 7 | 98.0% |

| Production Outlook | ||||||

| Total Industry | 16.57 | 21.79 | 15.87 | 16 | 15 | 64.1% |

| Demand | ||||||

| Overall order books | 25.35 | 25.66 | 27.43 | 27 | 4 | 60.1% |

| Foreign Orders | 10.97 | 8.95 | 8.59 | 11 | 9 | 35.0% |

| New Orders | ||||||

| Total Industry | 12.53 | 9.55 | 7.9 | 11 | 9 | 56.9% |

| Stocks: Finished Goods | ||||||

| Total Industry | -1.88 | -4.77 | -2.87 | -3 | -2 | 63.4% |

| Capacity Utilization | 83.44 | 80.83 | 83.69 | 84 | 83 | 62.1% |

| Hiring | ||||||

| Latest Mo | 2.44 | -1.55 | 1.01 | 0 | -1 | 98.0% |

| Outlook | -1.7 | -0.81 | -0.89 | -2 | -4 | 74.4% |

| Industry Sentiment Index | 106.62 | 105.8 | 108.01 | 108 | 107 | 45.6% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates