Global| Mar 19 2012

Global| Mar 19 2012Brazil Combats the Rise in its Currency with Intervention and Capital Controls

Summary

The rise in its currency, the real, and a slowdown in economic activity has prompted the Brazilian government to impose foreign exchange restrictions and capital controls. Brazil's current problems and its progress in meeting them can [...]

The rise in its currency, the real, and a slowdown in economic activity has prompted the Brazilian government to impose foreign exchange restrictions and capital controls. Brazil's current problems and its progress in meeting them can be monitored with reference to Haver data bases, particularly, EMERGELA and INTDAILY.

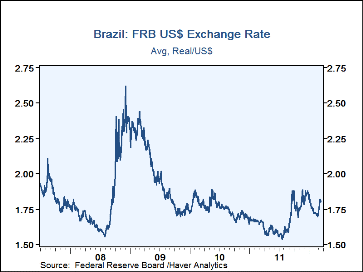

The real began to rise in mid 2008 as economic growth in Brazil accelerated and the flow of foreign funds into the economy rose. The first chart shows the real vs the dollar over the past five years. (The data code is X111BRB@INTDAILY.) The appreciation of the currency is shown in a downward sloping line as fewer reais are needed to equal the dollar as the currency appreciates.

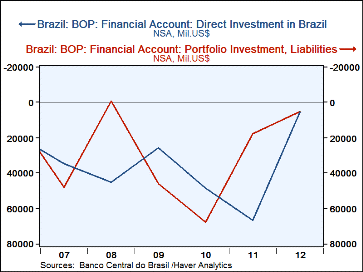

Capital flows into and out of the country are found in the Balance of Payments data. The rise in direct and portfolio investment in Brazil over the past five years is shown in the table below and in the second chart. There has been a significant increase in both portfolio and direct investment, but portfolio investment tends to be more volatile than direct investment

| 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | |

|---|---|---|---|---|---|---|

| Portfolio Investment in Brazil | 17.5 | 67.8 | 46.2 | -0.8 | 48.1 | 9.1 |

| Direct Investment In Brazil | 66.7 | 48.5 | 25.9 | 45.1 | 34.61 | 18.8 |