Global| Oct 01 2007

Global| Oct 01 2007Broad Slowdown in Euro-area MFG

Summary

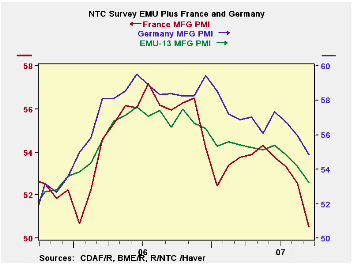

The finalized Euro area MFG PMIs from NTC show a picture of a weakening MFG sector. All countries for which up-to-date MFG readings are available show MFG is still expanding in September on a country by country basis in EMU (i.e. [...]

The finalized Euro area MFG PMIs from NTC show a picture of a weakening MFG sector. All countries for which up-to-date MFG readings are available show MFG is still expanding in September on a country by country basis in EMU (i.e. readings on the NTC index are still above 50). Yet the red monthly figures show period-to-period declines are now common and have been so for the region as a whole. All the large EMU economies (Germany, France, Italy and Spain) show month-to-month declines in MFG PMI for three straight months with the exception of Italy’s m/m rise in August. If we view these reading as a time series and ask which of the MFG sectors is at reading that is low compared to its own history only France is below the mid-range mark. Its 50.51 reading in September is below the midpoint of the range for France since March of 2000. For EMU as a whole the MFG index is in about the 60th percentile of its range for this period.

On balance, the EMU region is showing a loss in momentum. The EC Commission is complaining about the ill effects of a euro that is too strong. Manufacturing is fading in the Euro area although the current readings are still relatively firm and show ongoing expansion. But these readings are no longer strong and the momentum clearly points lower.

| NTC MFG Indexes | ||||||

|---|---|---|---|---|---|---|

| Sep-07 | Aug-07 | 3Mo | 6Mo | 12Mo | Percentile | |

| Euro-13 | 53.21 | 54.34 | 54.15 | 54.73 | 55.42 | 61.4% |

| Germany | 54.87 | 55.96 | 55.86 | 56.33 | 57.22 | 73.5% |

| France | 50.51 | 52.55 | 52.13 | 53.06 | 53.75 | 37.2% |

| Italy | 52.39 | 53.63 | 53.12 | 53.71 | 54.15 | 61.1% |

| Spain | 50.80 | 52.16 | 52.06 | 53.42 | 54.89 | 53.6% |

| Austria | 55.37 | 54.48 | 54.55 | 54.02 | 55.68 | 77.6% |

| Greece | 53.83 | 53.56 | 53.78 | 53.68 | 52.97 | 63.8% |

| Ireland | 54.35 | 54.32 | 53.92 | 53.50 | 53.02 | 86.3% |

| Netherlands | 56.36 | 56.19 | 56.91 | 57.01 | 56.77 | 79.8% |

| EU | ||||||

| UK | 55.08 | 56.15 | 55.65 | 55.08 | 54.32 | 89.0% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates