Global| Jun 14 2002

Global| Jun 14 2002Business Inventories Fell As Expected

by:Tom Moeller

|in:Economy in Brief

Summary

Total business inventories fell in April an expected 0.2%. The previously reported decline in March inventories was deepened due mostly to a lowered estimate of wholesale inventories. Retail inventories, reported for the first time, [...]

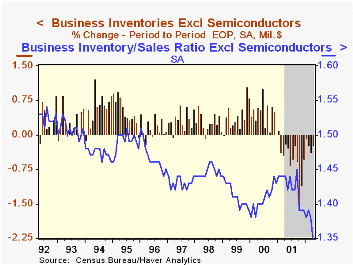

Total business inventories fell in April an expected 0.2%. The previously reported decline in March inventories was deepened due mostly to a lowered estimate of wholesale inventories.

Retail inventories, reported for the first time, rose for the third month this year. Nonauto retail inventories fell slightly, the third drop this year. Nonauto retail inventories are down 2.2% since the peak in January 2001.

Inventories of autos, furniture & home furnishings and building materials have been rising for several months. Conversely, general merchandise inventories have been declining steadily and apparel inventories recently have been flat-to-lower.

Overall business sales rose 1.8% (0.6% y/y) on the strength of higher retail, wholesale and factory sales.

The inventory-to-sales ratio fell to 1.35 on the strength of sales.

For a comprehensive discussion of inventory behavior during the recent cycle, see the NY Fed's analysis at http://www.newyorkfed.org/rmaghome/curr_iss/html/civ8n5/civ8n5.html .

| Business Inventories | April | Mar | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Total | -0.2% | -0.4% | -6.1% | -6.1% | 5.5% | 5.0% |

| Retail | 0.1% | -0.1% | -2.5% | -5.0% | 6.1% | 7.7% |

| Retail excl. Autos | -0.0% | -0.2% | -1.9% | -2.0% | 4.1% | 5.7% |

| Wholesale | -0.7% | -0.3% | -7.0% | -5.5% | 6.6% | 6.0% |

| Manufacturing | -0.2% | -0.6% | -8.6% | -7.5% | 4.3% | 2.2% |

by Tom Moeller June 14, 2002

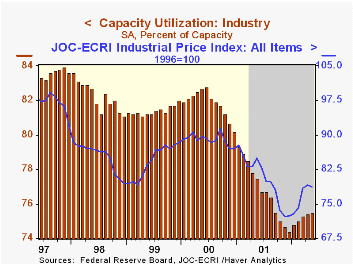

Industrial production rose less than expected in May, but it still was the fifth consecutive monthly rise. April's gain was revised slightly lower. Factory sector output rose 0.2%, the same as in April for the fifth gain this year.

Excluding high tech, production rose 0.1% following three months of 0.3% gain. High tech output rose 1.2% on the strength of strong semiconductor output and higher computer production.

Output of consumer goods was flat, held back by lower auto and nondurable production but buoyed by strength of home electronics and appliances.

Output of business equipment rose slightly following three months of decline. Output of transportation equipment fell 3.1% for the fourth very-weak month this year

Capacity utilization rose for the fifth month this year. Monthly gains in capacity have been 0.1% since April of last year.

| Production & Capacity | May | April | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Industrial Production | 0.2% | 0.3% | -1.6% | -3.7% | 4.5% | 3.7% |

| Capacity Utilization | 75.5% | 75.4% | 77.5%(5/01) | 76.8% | 81.8% | 81.4% |

by Tom Moeller June 14, 2002

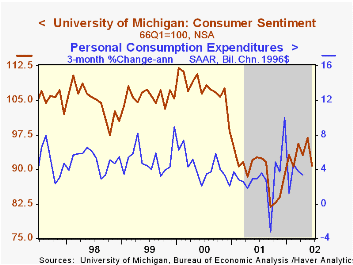

The mid-June reading of Consumer Sentiment from the University of Michigan fell unexpectedly versus May.

Sentiment nearly reversed all of the gains of the prior three months.

The University of Michigan survey is not seasonally adjusted.

During the past five years there has been a 37% correlation between the level of consumer sentiment and the 3-month change in real PCE.

| Univ. of Michigan | Mid-June | May | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Consumer Sentiment | 90.8 | 96.9 | -1.9% | 89.2 | 107.6 | 105.8 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates