Global| Sep 21 2007

Global| Sep 21 2007Canada's Retail Trade Falls 0.8% in July, But Could Be Simple Offset to Earlier Strength

Summary

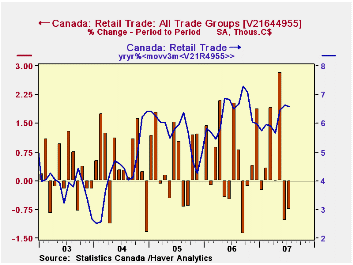

Retail trade in Canada fell 0.8% in July following on a 1.1% drop in June. May had been stronger, with a 2.8% increase. The July result year-on-year was up 3.8%. This was the weakest y/y increase since October 2005, although the [...]

Retail trade in Canada fell 0.8% in July following on a 1.1% drop in June. May had been stronger, with a 2.8% increase. The July result year-on-year was up 3.8%. This was the weakest y/y increase since October 2005, although the monthly swings in these growth rates make it a bit misleading to characterize the one month; the y/y change in a 3-month moving average, by contrast, was 6.6%, roughly in line with recent experience.

Several store groups shared the pattern of a strong May followed by decreases in June and July. The automotive sector, which accounts for about 34% of retail sales in Canada, gained 4.3% in May, but then fell 2.9% in June and 1.3% in July. But others duplicated this: home centers and hardware stores, clothing, and general merchandise, as examples.

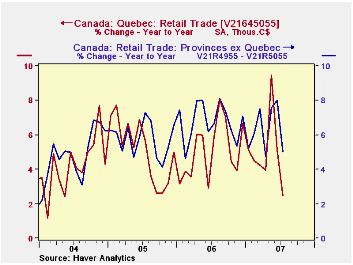

The strength in May's sales was believed by Statistics Canada and private analysts to be largely attributable to a government-worker pay settlement received by women in Quebec, one of a series of "pay equity" settlements achieved by unions and/or reflecting national legislation concerning salaries of women and men.  Sales in Quebec then were up 5.0% in May and they fell 4.1% in June and 0.7% in July. Sales among all the other Provinces, though, still rose 2.2% in May, so not all of the push was due to the payout to Quebec's workers.

Sales in Quebec then were up 5.0% in May and they fell 4.1% in June and 0.7% in July. Sales among all the other Provinces, though, still rose 2.2% in May, so not all of the push was due to the payout to Quebec's workers.

Among other of the big Provinces, Ontario saw 2.1% growth in May and then declines of 0.5% in June and 1.9% in July. Alberta sales rose 2.9% in May and 0.6% in June; they edged down 0.2% in July.

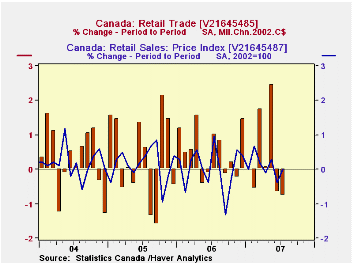

On a volume basis, sales showed the same monthly pattern. In chained 2000 C$, they rose 2.5% in May and fell back 0.7% in June and 0.8% in July. Prices were thus not the major reason for the swing in nominal sales. In May, the retail trade price index rose just 0.3%; it declined 0.4% in June and was flat in July.

As we noted at the outset, while these sales look to be slowing if July alone is compared to year-ago figures, it really does seem too early to conclude that the trend is shifting. However, the trend in the Canadian economy looks to be quite sensitive to the path of this key measure of consumer demand over the next month or two.

The national data for Canada are contained in Haver's CANSIM database, with that for the Provinces in CANSIMR.

| CANADA (% Chg) | Jul 2007* | Jun 2007* | May 2007* | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Retail Trade: All Groups | -0.8 | -1.1 | 2.8 | 3.8 | 6.4 | 5.6 | 4.7 |

| All Motor Vehicles & Parts Dealers | -2.3 | -3.6 | 5.0 | 3.7 | 6.0 | 5.0 | 0.1 |

| Total less MV & P | 0.3 | 1.9 | 0.1 | 4.7 | 6.4 | 6.5 | 6.2 |

| Gasoline Stations | -3.5 | 4.7 | 5.3 | 0.2 | 9.1 | 15.4 | 11.4 |

| Total less MV & P and Gasoline | 0.9 | 1.5 | -0.6 | 5.4 | 5.9 | 5.2 | 5.5 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates