Global| May 06 2009

Global| May 06 2009Commodity Prices And Exchange Rates

Summary

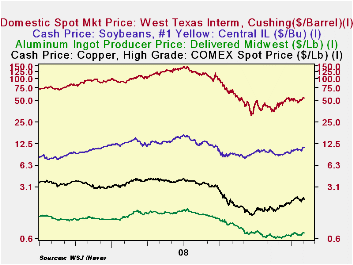

Among the signs that the global downturn may be bottoming are recent increases in some commodity prices. The Commodity Research Bureau Index of Spot Prices is up 11.2% from its recent low of 305.59 (1967=100) reached on March 18, as [...]

Among the signs that the global downturn may be bottoming are

recent increases in some commodity prices. The Commodity Research

Bureau Index of Spot Prices is up 11.2% from its recent low of 305.59

(1967=100) reached on March 18, as shown in the first chart. Even the

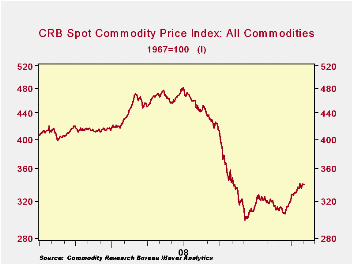

price of oil has recently begun to rise as can be seen in the second

chart that shows the daily prices of such specific commodities as

aluminum, copper, soybeans and oil.

As a result of the rise in prices, commodity producing countries are experiencing increased demand for their for their currencies. Many of these countries have seen substantial appreciation of the currencies within the past two months or so. Since March 6th for example, the South African Rand has appreciated 23.4%. Other commodity producing countries, such as Brazil, Australia and Indonesia have seen their currencies appreciate by 9.2%, 12.2%, and 13.3% respectively. Japan and the Euro Area are much less dependent on commodities than say, Indonesia, and therefore the rise in commodity prices has had little effect on their exchange rates.The yen actually depreciated slightly in this period and the Euro appreciated 4.9%.

Reflecting these and other exchange rate changes, the U.S. Dollar has depreciated about 5.1% over the past two months according to the J.P. Morgan Effective Nominal Trade Weighted Exchange Rate.

| (EXCHANGE RATES | Wk Ending May 1st | Wk Ending Mar 6th | Appreciation /Depreciation | |

|---|---|---|---|---|

| Brazil | Real/USD | 2.3735 | 2.1730 | 9.2% |

| Australia | USD/A$ | .6381 | .7162 | 12.24 |

| South Africa | Rand/USD | 10.4100 | 23.41 | |

| Indonesia | Rupiah/USD | 11990 | 10585 | 13.27 |

| South Korea | Won/USD | 1554.8 | 1345.4 | 15.56 |

| Japan | Yen/USD | 98.15 | 99.10 | -0.96 |

| Euro | USD/Euro | 1.2658 | 1.3275 | 4.87 |

| USD | Broad Trade Wtd | 98.5 | 93.4 | -5.08 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates