Global| Feb 03 2021

Global| Feb 03 2021Composite PMIs Show Very Mixed Global Conditions

Summary

The J.P.Morgan global PMI index is weaker month-to-month in January 2021. Emerging markets are weaker on the month, but developed economies are slightly stronger. In January, 10 of 22 countries report weaker conditions than one month [...]

The J.P.Morgan global PMI index is weaker month-to-month in January 2021. Emerging markets are weaker on the month, but developed economies are slightly stronger. In January, 10 of 22 countries report weaker conditions than one month ago. Three of four aggregates show conditions are weaker. This accounting adds the EMU to the three categories reported below (global, developed and emerging).

The J.P.Morgan global PMI index is weaker month-to-month in January 2021. Emerging markets are weaker on the month, but developed economies are slightly stronger. In January, 10 of 22 countries report weaker conditions than one month ago. Three of four aggregates show conditions are weaker. This accounting adds the EMU to the three categories reported below (global, developed and emerging).

The problem is complicated. The virus has hit service sectors hard while manufacturing is still engaged in a more substantial ongoing and durable-looking recovery. A country that nourishes its own domestic demand more fully might find that service sector weakness drags down its manufacturing recovery. An economy that is more export-oriented might find that manufacturing performs better helping services… of course, depending on the extent to which demand is maintained in its export markets. Then there is the issue of the virus itself. If the virus is flaring up at home, all bets are off.

January finds a new sweep of virus activity engaged and that is holding back services. Yet, a global services gauge on business activity in January fell only to 51.6 from 51.8 in December (not shown). The U.S. services sector backed down slightly in January while China weakened more substantially. These two countries have services sectors queue rankings of 96% (on data back to January 2017) for the U.S. and only 4% for China, underscoring the wide disparities internationally. The U.K. also has a very weak 6% standing for services because of its ongoing lockdown as well as Brexit-related issues. These ranking are reflected in the overall composite rankings for these countries.

The difference between the PMI readings of the services and manufacturing sectors rank in the top 26% of all such divergences globally and in the top 15% among developed economics (since January 2017). The developed economies have more developed services sectors and they may be more fragile and more easily affected by conditions brought on by the virus. They are seeing the most disparity in manufacturing vs. services performance.

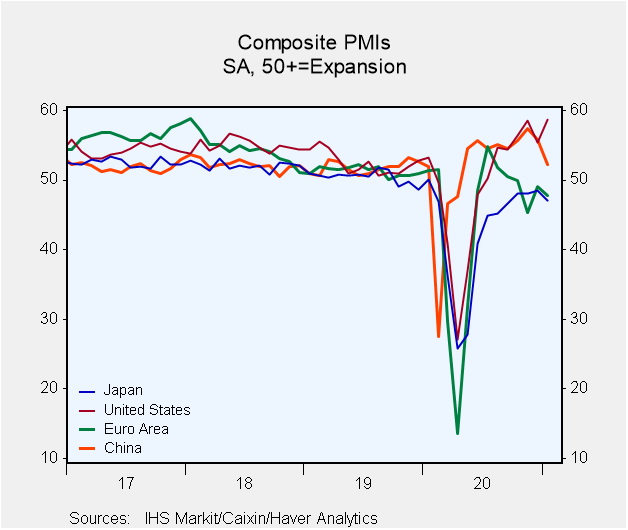

The composite PMI situation is perhaps best understood by looking at the graphic. The graphic covers only a few 'representative' countries. But it is clear from its plots that since the virus-induced drop and snap back, there have been more of countries 'going their own way' and less of a herd or trend result. Only the U.S. that has used a tremendous amount of stimulus and that had monetary stimulus to add to the pot (unlike some others) has created a stronger set of readings than what prevailed prior to the virus.

While the Trump administration is pilloried for how it handled the virus in the U.S., U.S. economic performance has been excellent...as for death rates and the like we see the virus coming back to sting some that thought they had done an excellent jobs in the first place. The virus leaves little room for any government to gloat about how well it handled the virus per se. Large countries with a lot of international connections and travel faced the worst of it- that is why the U.S. was hit so hard. But some have handled the economic consequences better than others. Clearly government responses matter and they continue to matter. Having acted with force initially, will policymakers know when to stop? Will they stop too soon? Will they do too much or too little? It's a complicated judgement with few precedents to learn from and with fractious debates afoot everywhere. This situation is not like the Great Recession at all. Until the vaccine is in widespread usage, it is hard to see stimulus efforts broadening success. The services sector requires face-to-face meetings to be brought back to where it was. How long before that happens? And then, how long until he people's trust is restored?

Commentaries are the opinions of the author and do not reflect the views of Haver Analytics.Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates