Global| Jun 15 2010

Global| Jun 15 2010Confidence Among German Investors And Analysts Down Sharply

Summary

While German analysts and institutional investors who participate in the ZEW Survey have become less negative about current conditions, they have become much more concerned about the economic outlook six months ahead. The percentage [...]

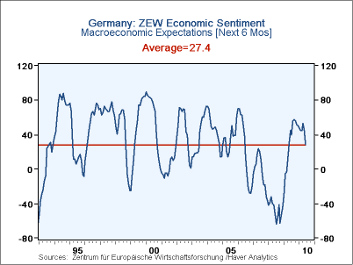

While German analysts and institutional investors who participate in the ZEW Survey have become less negative about current conditions, they have become much more concerned about the economic outlook six months ahead. The percentage excess of those looking for improvement over those looking for deterioration dropped to 28.7% in June from 45.8 % in May. The June value is close to the long term average of 27.4%, as seen in the first chart. The sovereign debt crisis in the Euro Area and the plans to improve government imbalances through stringent budgetary measures have, no doubt, been responsible for much of the sharp change in sentiment.

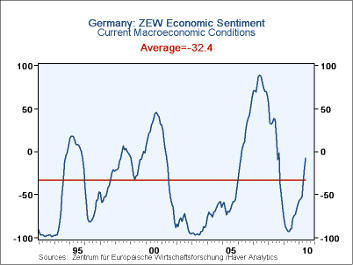

Increases in industrial production and exports and declines in the unemployment rate have resulted in a less negative appraisal of current condition. The pessimists among the German financial community exceeded the optimists by 7.9% in June, down from an excess of pessimist of 21.6% in May. German financial types tend to be pessimistic about current conditions. Over the entire period from December 1991 to the present, the average appraisal of current conditions is minus 32.4%, as seen in the second chart.

Last month, the participants in the survey were optimistic about the outlook for profits. The balance of people between those expecting increases in profits and those expecting decreases in profits rose for the Automotive, Chemical/Pharmaceutical, Steel, Machinery, Consumption/Trade, Construction, Utilities, Service, Telecommunication and Information Technology industries. Only Banking and Insurance industries were expected to do poorly. This month the balances between the people expecting increases in profits and those expecting decreases in profits have changed dramatically. Only in the Automotive, Chemical/Pharmaceutical and Machinery industries have the balances of opinion increased. In all other cases, expectations are for a deceleration in profit growth, and in the case of the consumption/trade industry, the participants expect a decline in profits, as can be seen in the table below.

| Jun 10 | May 10 | Apr 10 | Mar 10 | Feb 10 | Jan 10 | Dec 09 | Nov 09 | |

|---|---|---|---|---|---|---|---|---|

| Macroeconomic Expectation 6 mo Ahead (%Bal) | 28.7 | 45.8 | 53.0 | 44.5 | 45.1 | 47.2 | 50.4 | 51.1 |

| Current Economic Conditions (%Bal) | -7.9 | -21.6 | -39.2 | -51.9 | -54.8 | -56.6 | -60.6 | -65.6 |

| Responding Increase - Decrease in Profits (%Bal) | ||||||||

| Banking | 5.6 | 18.2 | 28.2 | |||||

| Insurance | 4.9 | 13.7 | 15.8 | |||||

| Automotive | 32.9 | 29.1 | 3.1 | |||||

| Chemical/Pharmaceutical | 59.4 | 56.4 | 48.2 | |||||

| Steel | 43.7 | 46.7 | 37.2 | |||||

| Electronics | 48.0 | 48.5 | 41.2 | |||||

| Machinery | 63.4 | 61.2 | 52.1 | |||||

| Consumption/Trade | -9.1 | 0.4 | -2.3 | |||||

| Construction | 0.4 | 11.0 | 10.4 | |||||

| Utilities | 0.8 | 21.5 | 20.5 | |||||

| Service | 19.6 | 29.4 | 30.6 | |||||

| Telecommunications | 6.2 | 10.8 | 7.8 | |||||

| Information Technology | 38.9 | 46.0 | 45.3 | |||||