Global| Oct 16 2007

Global| Oct 16 2007Confidence Among German Investors Holds Steady: Slight Improvement in Profit Expectations

Summary

Contrary to expectations, the excess of pessimists over optimists among German institutional investors and analysts who participate in the ZEW survey did not increase in October but remained at 18.1%. The German financial types are [...]

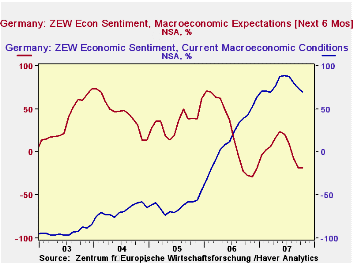

Contrary to expectations, the excess of pessimists over optimists among German institutional investors and analysts who participate in the ZEW survey did not increase in October but remained at 18.1%. The German financial types are still less pessimistic than they were a year ago in October 2006 when the excess of pessimists over optimists was 27.4%. Although less optimistic in October than in the peak of 88.7% in June, these financial types were still very optimistic concerning current macroeconomic conditions with optimists exceeding pessimists by 70.2%. The percent balances for expectations and for the appraisals of current conditions are shown in the first chart.

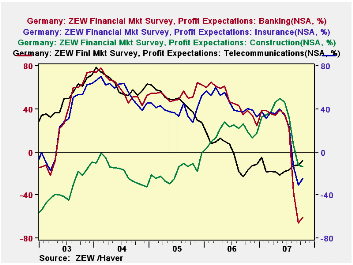

In the survey, participants are asked to appraise the outlook for profits in some 13 industries. Profit expectations for the banking, insurance and construction industries were especially hard hit as a result of the US sub prime mortgage problem and its ramifications. Profit expectation in the banking industry went from an excess of optimists over pessimists of 21.0% in July to excesses of pessimists over optimists of 37.3% in August and 65.9% in September. Corresponding figures for the insurance industry were +23.7%, -13.2% and -30.8% and for the construction industry, 32.3%, 6.2%, -12.1%. Profit expectations in the banking and insurance industries improved slightly in October but were still in negative territory. Profit expectations in the construction industry deteriorated further in October. Profit expectations for the banking, insurance and construction industries are shown in the second chart together with profits in the telecommunication industry, the other industry for which profit expectations are negative territory. The deterioration in expectations for profits in the telecommunications industry has been going on since early 2004.

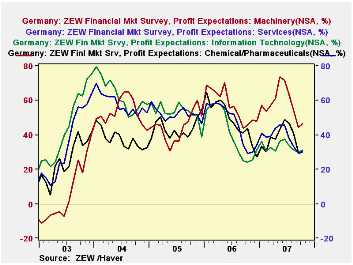

Even among those industries whose profits expectations are brightest, there have been declines in the excess of optimists over pessimists as can be seen in the third chart that shows the profit expectations of the machinery, services, information technology and chemical industries.

| ZEW SURVEY | Oct 07 | Sep 07 | Oct 06 | M/M Dif | Y/Y Dif | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| Expectations Next 6 Months (% balance) |

-18.1 | -18.1 | -27.4 | 0.0 | -9.3 | 22.3 | 34.8 | 44.6 |

| Current Conditions (% balance) | 70.2 | 74.4 | 42.9 | -4.2 | 27.3 | 18.3 | -61.8 | -67.7 |

| Profit Expectations Next 6 Months | Oct 07 | Sep 07 | Aug 07 | Jul 07 | Jun 07 | May 07 | ||

| Banking (% balance) | -60.6 | -65.9 | -37.3 | 21.0 | 35.0 | 39.2 | ||

| Insurance (% balance) | -24.4 | -30.8 | -13.2 | 23.7 | 33.8 | 39.7 | ||

| Construction (% balance) | -13.5 | -12.1 | 6.2 | 32.3 | 46.5 | 49.8 | ||

| Telecommunications (% balance) | -7.8 | -11.7 | -12.7 | -16.2 | -17.5 | -21.2 | ||

| Machinery (% balance) | 46.5 | 44.3 | 54.6 | 63.5 | 71.6 | 73.4 | ||

| Information Technology (% balance) | 30.9 | 30.4 | 31.3 | 34.0 | 37.5 | 36.4 | ||

| Chemicals (% balance) | 30.8 | 29.7 | 41.2 | 46.9 | 48.9 | 43.2 | ||

| Services (% balance) | 30.3 | 29.4 | 33.4 | 37.9 | 45.5 | 45.4 |