Global| Oct 01 2010

Global| Oct 01 2010Construction Spending Manages Small Rise in August, Due to Public Sector

Summary

The value of construction-put-in-place increased in August by 0.4%, following a downwardly revised 1.4% decline in July and an upwardly revised 0.6% rise in June. The August result compared with Consensus forecasts of a 0.4% decline, [...]

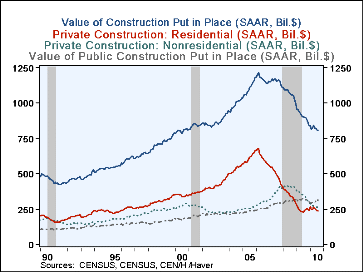

The value of construction-put-in-place increased in August by 0.4%, following a downwardly revised 1.4% decline in July and an upwardly revised 0.6% rise in June. The August result compared with Consensus forecasts of a 0.4% decline, so it can be characterized as "better than expected". However, the gain came in the public sector, up 2.5%, while private construction activity fell once again, by 0.9%. As seen in the first graph here, public construction has been rising, albeit gradually, since last February, and we wonder if this uptrend represents completion of some of the stimulus projects.

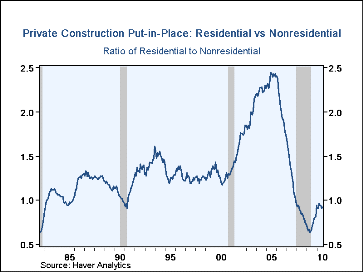

Residential activity remains discouraging as it declined 0.3% in August, but at least that indicated some stabilization after drops of 3.5% in July and 1.6% in June. This relative improvement came in "improvements", which jumped 5.0%; new housing continued down for a fourth consecutive month, falling 4.9% to $121.4 billion SAAR, a new low for this cycle. Sigh. In one sense, though, we can hardly be surprised at this persistent sluggishness. We extended our graph back a number of years to show how residential construction became so far out of line in the early to mid-2000s with other segments of construction activity. Indeed, prior to 1995, residential construction was the same order of magnitude as nonresidential, generally averaging within 115% of it. But residential climbed to more than 240% of nonresidential in 2005, indicating a considerable imbalance. That's now being corrected, and it's not instantaneous.

In August, nonresidential building fell back by 1.4%, and both July and June were revised lower. Every sector except education and health had some kind of decrease in August; spending on health care facilities was unchanged, and that for education rose 0.5%. The decreases in office construction, amusements and manufacturing were all marginal, but power projects, commercial buildings, transportation, communications and religious structures all fell 1%-3%.

In contrast, the spending in the public sector had a wide variety of sizable increases. Publicly financed commercial structures rose 8.2%, residential was up 6.7%, health care 5.1%, streets and highways 5.0%, sewage and waste disposal and public safety both more than 4%. Only power facilities and education had decreases in the month. It is this variety of growth that suggests to us that the fiscal stimulus programs may be reflected in these figures.

The construction put-in-place figures are available in Haver's USECON database. Our first graph here uses a feature of Haver's DLX software enabling the user to change the magnitude of the series, in this case, data reported in millions of dollars are graphed in billions.

| Construction Put in Place (%) | August | July | June | Y/Y | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| Total | 0.4 | -1.4 | 0.6 | -10.0 | -14.9 | -7.5 | -1.4 |

| Private | -0.9 | -1.6 | -11.6 | -14.8 | -21.9 | -12.2 | -5.5 |

| Residential | -0.3 | -3.5 | -1.6 | -1.7 | -29.9 | -29.0 | -19.7 |

| Nonresidential | -1.4 | 0.2 | -1.6 | -24.2 | -15.0 | 10.5 | 23.9 |

| Public | 2.5 | -1.1 | 3.0 | -1.0 | 2.2 | 6.6 | 13.1 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates