Global| Jul 16 2003

Global| Jul 16 2003CPI Tame

by:Tom Moeller

|in:Economy in Brief

Summary

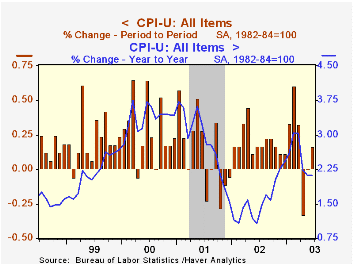

The Consumer Price Index (CPI-U) rose an expected 0.3% last month following no change in May. The CPI less food and energy was unchanged versus Consensus expectations for a 0.2% rise. A slowdown in services price inflation and [...]

The Consumer Price Index (CPI-U) rose an expected 0.3% last month following no change in May.

The CPI less food and energy was unchanged versus Consensus expectations for a 0.2% rise. A slowdown in services price inflation and continued deflation of goods prices resulted in the third unchanged "core" CPI this year.

Core services prices rose only 0.1% and that was below the 0.2% monthly average of this year. Shelter prices fell slightly (1.8% YTD AR) following the 0.6% gain in May. Medical care services prices were strong for the second consecutive month, up 0.4% (3.1% YTD AR).Education and communication prices fell for the fourth consecutive month. Public transportation prices rose 0.7% (5.2% YTD AR) following a 2.0% May gain.

Goods prices continued to deflate. New and used vehicle prices fell 0.3% for the fifth monthly decline this year. Prices for household furnishings and operation fell 0.2% for the fourth consecutive monthly drop. Apparel prices managed the first monthly increase since August of last year.

Energy prices increased moderately. A 1.3% rise in gasoline prices, the first gain in three months, was offset by the third consecutive decline in fuel oil prices and a moderate 0.7% rise in piped gas & electricity prices.

The chained CPI which adjusts for shifts in consumer buying behavior increased for the first month in three. It is similar to the PCE price deflator. The core price measure fell 0.2% after having been unchanged for two months (1.1% YTD AR).

Analysis by the Federal Reserve Bank of Atlanta titled "Inflation Persistence: How Much Can We Explain?" can be found here.

| Consumer Price Index | June | May | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Total | 0.2% | 0.0% | 2.1% | 1.6% | 2.8% | 3.4% |

| Total less Food & Energy | 0.0% | 0.3% | 1.5% | 2.3% | 2.7% | 2.4% |

| Goods less Food & Energy | -0.1% | -0.4% | -1.9% | -1.1% | 0.3% | 0.5% |

| Services less Energy | 0.1% | 0.5% | 2.9% | 3.8% | 3.7% | 3.3% |

| Energy | 0.8% | -3.1% | 9.4% | -5.8% | 3.7% | 16.9% |

| Food & Beverages | 0.4% | 0.3% | 2.2% | 1.8% | 3.1% | 2.3% |

| Chained CPI: Total (NSA) | 0.1% | -0.2% | 1.7% | 1.3% | 2.3% | 2.0% |

| Total less Food & Energy | -0.2% | 0.0% | 1.0% | 1.8% | 2.0% | 1.4% |

by Tom Moeller July 16, 2003

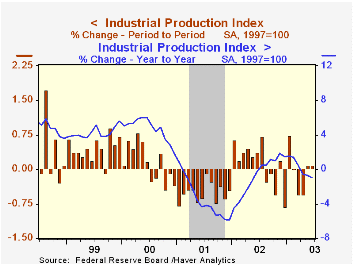

Industrial production rose 0.1% in June for the second month. Consensus expectations were for a 0.2% gain.

Output in the manufacturing sector surged 0.5% (-1.0% y/y) for the second consecutive monthly gain.

Output in selected high-technology industries added 1.0% (9.2% y/y) to strong gains in the prior five months. Excluding high-tech factory output in June rose 0.4% (-1.6% y/y). Motor vehicle output rose for the first month in five and output of electrical equipment rose for the second consecutive month. Output of furniture jumped 1.0% for the second consecutive monthly gain.

Total capacity utilization was unchanged at 74.3%, the lowest level since July 1983. Factory sector utilization rose slightly to 72.6%. Growth in capacity remained slow at 1.0% y/y versus 1.5% growth last year and 3.2% growth in 2001.

The influence of trend output growth on the US economy's "speed limit" is discussed by the Federal Reserve Bank of San Francisco here.

| Production & Capacity | June | May | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Industrial Production | 0.1% | 0.1% | -1.0% | -0.8% | -3.5% | 4.7% |

| Capacity Utilization | 74.3% | 74.3% | 75.9%(6/02) | 75.6% | 77.3% | 82.7% |

by Tom Moeller July 16, 2003

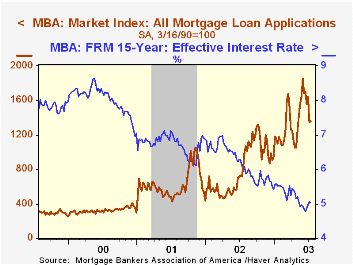

The index of mortgage applications compiled by the Mortgage Bankers Association nudged up 0.9% last week following the 17.7% decline the week earlier.

Applications for home purchase jumped 8.0% and recouped all of the 5.5% decline the previous week. So far in July, mortgage applications for home purchase are setting a new record.

During the last ten years there has been a 51% correlation between the y/y change in purchase applications and the change in new plus existing home sales.

Applications to refinance fell another 1.6% following the 21.3% w/w decline the previous week.

Interest rates on a conventional 30-Year mortgage fell slightly w/w with the effective rate at 5.62% versus 6.13% averaged in December. The effective rate on a 15-year mortgage also fell to 5.04%.

The Mortgage Bankers Association surveys between 20 to 35 of the top lenders in the U.S. housing industry to derive its refinance, purchase and market indexes. The weekly survey accounts for more than 40% of all applications processed each week by mortgage lenders.

Visit the Mortgage Bankers Association site at www.mbaa.org.

| MBA Mortgage Applications (3/16/90=100) | 7/11/03 | 7/4/03 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|

| Total Market Index | 1,358.2 | 1,346.3 | 799.7 | 625.6 | 322.7 |

| Purchase | 447.2 | 414.1 | 354.7 | 304.9 | 302.7 |

| Refinancing | 6,657.2 | 6,768.3 | 3,388.0 | 2,491.0 | 438.8 |

by Tom Moeller July 16, 2003

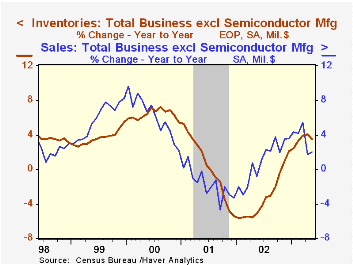

Total business inventories fell unexpectedly in May. The 0.2% decline was versus Consensus expectations for a 0.1% rise.

Retail inventories fell sharply. The 0.3% decline reflected lower inventories of motor vehicles and parts as well as a huge 1.5% decline in general merchandise store inventories.

Overall business sales fell slightly m/m (2.0% y/y) following a 1.7% April drop.

The inventory-to-sales ratio was stable m/m at 1.40 and versus 1.38 last year.

| Business Inventories | May | April | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Total | -0.2% | 0.0% | 3.5% | 2.1% | -5.4% | 5.4% |

| Retail | -0.3% | 0.2% | 7.3% | 7.6% | -2.9% | 6.0% |

| Retail excl. Autos | -0.3% | -0.1% | 2.9% | 2.5% | -1.2% | 3.7% |

| Wholesale | -0.3% | -0.3% | 2.3% | 0.4% | -4.9% | 6.1% |

| Manufacturing | -0.1% | -0.1% | 0.7% | -1.9% | -8.0% | 4.5% |

by Tom Moeller July 16, 2003

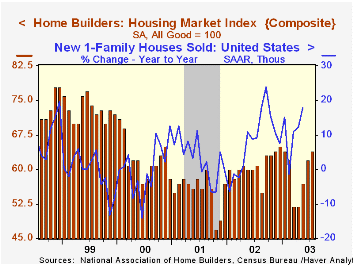

The National Association of Home Builders (NAHB) reported that their Composite Housing Market Index rose another two points in July to 64. The index was up 4.9% from July of last year.

During the last fifteen years there has been a 68% correlation between the y/y change in the NAHB index and the change in new home sales.

The index of current market conditions for home sales rose (6.2% y/y) as the percentage of builders indicating "good" conditions rose to 50% from 47%.

The index which measures expected home sales in six months rose to 73 (5.8% y/y) versus an average of 69 during all of last year.

Traffic of prospective buyers again rose sharply to near the high for this year.

The NAHB index is a diffusion index based on a survey of builders. Readings above 50 signal that more builders view conditions as good than poor.

For a description of the housing market index from the National Association of Home Builders, visit the NAHB website.

| Nat'l Association of Home Builders | July | June | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Composite Housing Market Index | 64 | 62 | 61 | 61 | 56 | 62 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.