Global| Jun 18 2002

Global| Jun 18 2002CPI Total Unchanged, Core Prices Weak

by:Tom Moeller

|in:Economy in Brief

Summary

Consumer prices were unchanged last month versus Consensus expectations for a 0.1% rise. Less food & energy prices rose an expected 0.2%. Tobacco prices partially reversed their April surge and fell 2.7%. Excluding tobacco, the core [...]

Consumer prices were unchanged last month versus Consensus expectations for a 0.1% rise. Less food & energy prices rose an expected 0.2%.

Tobacco prices partially reversed their April surge and fell 2.7%. Excluding tobacco, the core CPI rose 0.2% (2.4% y/y) for the sixth consecutive month.

Energy prices fell for the second month this year. Gasoline prices fell 2.8% (-17.2% y/y) but fuel oil prices rose 1.0% (-13.4% y/y). Piped gas and electricity prices rose 1.1%s.

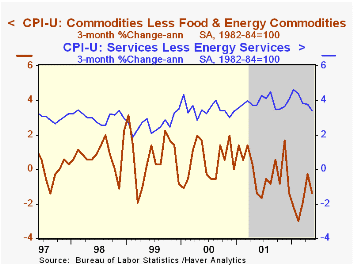

Core inflation was quite tame. Home furnishings and operation prices rose 0.3% but are unchanged y/y. New vehicle prices fell for the fifth consecutive month. Apparel prices fell for the third month this year.

Core services prices rose moderately. Shelter prices rose just 0.2% (4.0% y/y) but medical care services were again strong, up 0.6% (5.1% y/y). Public transportation prices also were strong, up 2.1% (1.2% y/y).

| Consumer Price Index | May | April | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Total | 0.0% | 0.5% | 1.2% | 2.8% | 3.4% | 2.2% |

| Total less Food & Energy | 0.2% | 0.3% | 2.5% | 2.7% | 2.4% | 2.1% |

| Goods less Food & Energy | -0.3% | 0.1% | -0.9% | 0.3% | 0.5% | 0.7% |

| Services less Energy | 0.3% | 0.4% | 4.0% | 3.7% | 3.3% | 2.7% |

| Energy | -0.7% | 4.5% | -12.2% | 3.7% | 16.9% | 3.6% |

| Food & Beverages | -0.2% | 0.1% | 2.0% | 3.1% | 2.3% | 2.1% |

by Tom Moeller June 18, 2002

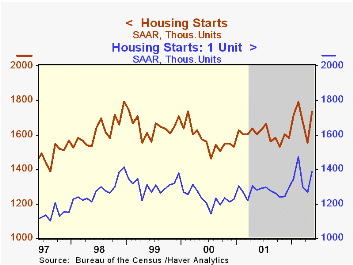

Housing starts were much stronger than expected last month owing to gains in single and multi-family starts. April starts were little revised.

Single-family starts rose 9.6% following two months of decline, though starts did not reach their February peak level.

Multi-family starts surged 20.3% due to gains in the 5+ category which had fallen sharply in April.

Starts in each of the country's regions rose quite strongly.

Building permits rose moderately after a slight April gain. Permits are roughly 2.0% below the peak levels of this past winter.

| Housing Starts (000s, AR) | May | April | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Total | 1,733 | 1,553 | 8.0% | 1,603 | 1,573 | 1,647 |

| Single Family | 1,389 | 1,267 | 8.4% | 1,273 | 1,232 | 1,306 |

| Multi Family | 344 | 286 | 6.5% | 330 | 341 | 341 |

by Tom Moeller June 18, 2002

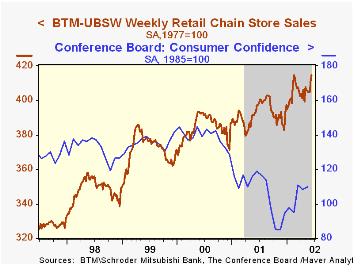

Chain store sales rose 0.7% in the second week of June following a surge the prior week, according to the BTM-UBSW survey.

So far in June sales are up 1.8% from the May average.

The leading indicator of chain store sales published by BTM fell moderately in early June after surging the end of May.

During the last ten years there has been a 40% correlation between the year-to-year percent change in monthly chain store sales and the change in general merchandise store sales.

| BTM-UBSW (SA, 1977=100) | 6/15/02 | 6/8/02 | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Total Weekly Retail Chain Store Sales | 414.6 | 411.6 | 4.3% | 2.1% | 3.4% | 6.7% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates