Global| Dec 09 2010

Global| Dec 09 2010Credit Market Borrowing Regains Some Strength, But Bank Lending Still Contracting

Summary

Credit market borrowing grew $1,062 billion, seasonally adjusted annual rate, in Q3, almost twice as strong as Q2's $549 billion and the first push above $1 trillion since the market implosion in late 2008. These data are from the [...]

Credit market borrowing grew $1,062 billion, seasonally adjusted annual rate, in Q3,

almost twice as strong as Q2's $549 billion and the first push above $1

trillion since the market implosion in late 2008. These data are from the Federal Reserve's flow-of-funds

dataset, published today for Q3 and contained in

Haver's FFUNDS database. Aggregate revisions of Q2 data were

modest.

Credit market borrowing grew $1,062 billion, seasonally adjusted annual rate, in Q3,

almost twice as strong as Q2's $549 billion and the first push above $1

trillion since the market implosion in late 2008. These data are from the Federal Reserve's flow-of-funds

dataset, published today for Q3 and contained in

Haver's FFUNDS database. Aggregate revisions of Q2 data were

modest.

The federal government continued in Q3 as the largest user of funds by far, although at "only" $1,396 billion, the amount was markedly less than the $2,003 billion in Q2 and last year's total of $1,444 billion. Among domestic nonfinancial sectors, nonfarm corporations were the only other net borrower, at a seasonally adjusted annual rate of $329 billion. Households and noncorporate business continued to pay down debt, by $232 billion and $163 billion, respectively.

The financial sector also continues to pull in, paying down $585 billion of debt in Q3, although this compares with over $1 trillion each in Q2 and Q1 (all annualized) and the total of almost $1.9 trillion in 2009. However, this sector did turn around its activity as lenders, lending a net $425 billion in credit markets in Q3, the first positive contribution since Q4 2008. In one sizable development, commercial banks turned their total lending around from a contraction of $573 billion in Q2 to $833 billion in Q3, their first positive lending period since Q3 2008. This was, however, spread mainly among securities purchases, with foreign banking offices in the U.S., in particular, adding $440 billion to corporate bond holdings. Other banking groups purchased noticeable amounts of Treasuries and GSE securities. Conventional bank loans, known in the Flow of Funds as "bank loans not elsewhere classified", continued to contract, this time by $183 billion SAAR. This amount, as well as those in Q2 and Q1, are much smaller than during 2009, which totaled $774 billion. But it remains disappointing that a main source of funding to domestic economy activity is still so sluggish.

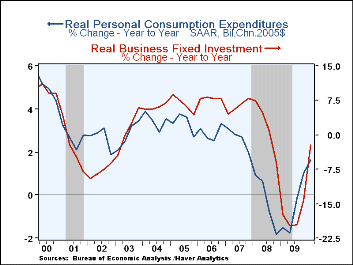

While we can bemoan the lack of growth in bank loans, among other financial assets, we have to remember that the entire financial system is still experiencing, for want of a better term, the symptoms of a hangover which follows a huge debt and credit binge in the mid-2000s. See graph 3 for a depiction of the differences between "then" and both before then and after then.

| Flow of Funds (SAAR, Bil.$) | ||||||

| Q3'10 | Q2'10 | Q1'10 | 2009 | 2008 | 2007 | |

| Total Credit Market Borrowing | 1062 | 549 | 355 | -644 | 2585 | 4483 |

| Federal Government | 1396 | 2003 | 1602 | 1444 | 1239 | 237 |

| Households | -232 | -293 | -292 | -240 | 36 | 873 |

| Nonfinancial Corporate Business | 329 | 267 | 374 | 1 | 364 | 752 |

| Nonfarm, Noncorporate Business | -163 | -270 | -321 | -291 | 211 | 455 |

| Financial Sectors | -585 | -1079 | -1250 | -1859 | 906 | 1790 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates