Global| Aug 15 2007

Global| Aug 15 2007Daily Fed Open Market Operations: The Pattern of Fed Liquidity Provision

Summary

Every business day at about 9:30, the New York Federal Reserve Bank's trading desk announces the day's "temporary open market operation". These are routine transactions in which the NY Fed buys securities from the group of "primary [...]

Every business day at about 9:30, the New York Federal Reserve Bank's trading desk announces the day's "temporary open market operation". These are routine transactions in which the NY Fed buys securities from the group of "primary dealers" together with an agreement to sell them back at a later time, the familiar "repo" transaction. This is usually the next day, but can also be 3, 4, 7 or 15 days later. The effect is to add reserves to the banking system for that corresponding period, that is, to provide liquidity. If there is a surfeit of liquidity, the NY Fed may do "reverse repurchase agreements", selling securities with an arrangement to buy them back, thus draining some reserves for the day or 2 or 3 during which the transaction is in force.

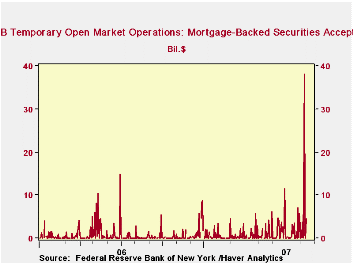

In the wake of the Fed's extraordinary repo operations late last week, Haver has added some series to the DAILY database, which show the amount of each day's operations and the type of collateral used. These are simple series, with only the total dollar amount in a given day's combined transactions. The objective, then, of these series is to show the amount of liquidity added or drained, and not the market conditions prompting the operations or the specifications of individual transactions beyond the securities used for collateral.

The source for this information is a "user-friendly" page on the New York Fed's website. The current day's transactions are described along with a link to the previous 25 transactions and to a search facility that allows reference to periods from a single specified day to the entire history since July 7, 2000. All of the information can be exported to an Excel spreadsheet.

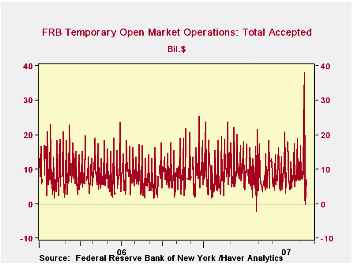

As we see in the first graph, the daily amounts of these reserve provisions vary widely. Most of the transactions are related to ordinary seasonal flows in the banking system. Today, for example, is August 15, the settlement date for the regular quarterly issues of new debt by the US Treasury. It is also the last day of a Federal Reserve "maintenance period", the bi-weekly time span over which banks are required to "meet" their reserve requirement. Today's operation added $7.0 billion. Other examples relate to developments in the real economy: in December when shopping is at its highest volume of the year, so are reserve needs. In January, when business slows way down after the holidays and in the depths of winter, reserve needs decrease markedly. There is nothing unusual about Federal Reserve additions in December or draining operations in January.

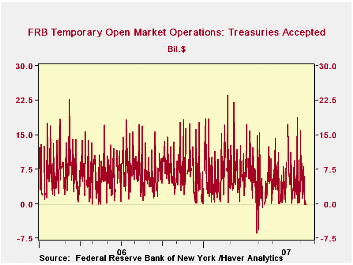

The transactions on Thursday and Friday deserve special mention. On Thursday, they totaled $24 billion. This seems large if we don't follow these daily operations. But additions on Thursdays routinely run $15 billion or more and often around $20 billion. So this alone wasn't all that dramatic an intervention. Friday's operations, though, were quite distinctive. They totaled $38 billion, the largest single day's addition since the days immediately following September 11, 2001, when a number of New York dealers were briefly shut down. Also, they used mortgage-backed collateral exclusively. Demand for Treasury securities is strong in the midst of market uncertainty, so it is likely that the Fed didn't want to restrain the floating supply of those securities. But mortgages, of course, are the source of much of the present market dislocations. Our third graph here shows how unusual the volume of these repos is. At the same time, the Fed did not buy these securities outright, they only bought them to hold over the weekend. On Monday, they did a modest $2 billion operation and none on Tuesday, so those MBS returned to the markets. Even so, note that the federal funds rate remained very low on Monday and Tuesday. This indicates that normal banking system operations were providing reserves on those days, obviating the need for more Federal Reserve intervention.

| Million $ | Aug 13 | Aug 10 | Aug 9 | July* | June* | May* |

|---|---|---|---|---|---|---|

| Total | 2,000 | 38,000 | 24,000 | 8,810 | 8,464 | 8,250 |

| Treasury | 700 | 0 | 8,099 | 5,710 | 4,238 | 4,073 |

| Agency | 144 | 0 | 4,971 | 1,946 | 2,379 | 3,230 |

| Mortgage-Backed | 1,156 | 38,000 | 10,930 | 1,154 | 1,847 | 947 |

by Tom Moeller August 15, 2007

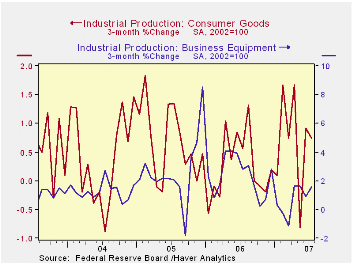

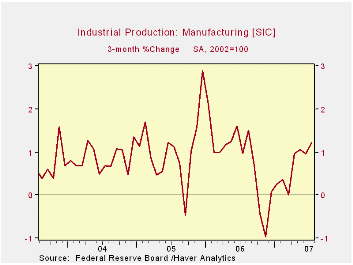

Industrial production rose an expected 0.3% following an upwardly revised gain of 0.6% during June.

Factory output surged another 0.6%, bringing the three month change in output to 1.2%, its best gain in about one year.

Consumer goods output grew 0.4% (2.4% y/y) after the upwardly revised 1.0% June jump. Higher output of automotive products, up 2.4% (8.7% y/y), accounted for much of the gain. Production of computers & electronics fell 0.1% (+16.4 y/y) while output of furniture & appliances fell 1.2% (-4.0% y/y). Production of apparel also fell by 1.4% (-4.0% y/y.

Production of business equipment rose 0.9% (3.8% y/y). Output of industrial & other equipment rose 1.0% (1.4% y/y) and information processing & related equipment output increased 0.7% (7.9% y/y) for the second consecutive month.

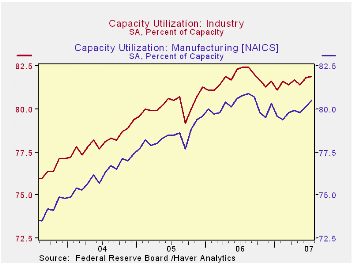

Capacity utilization rose to 81.9%from 81.8% in June as capacity rose 0.1% (2.1% y/y).

How Accurate Are Real-Time Estimates of Output Trends and Gaps? from the Federal Reserve Bank of Richmond can be found here.

| INDUSTRIAL PRODUCTION (SA) | July | June | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Total | 0.3% | 0.6% | 1.4% | 4.0% | 3.2% | 2.5% |

| Manufacturing | 0.6% | 0.6% | 2.0% | 4.7% | 3.9% | 2.9% |

| Mining | 0.7% | 0.4% | 0.4% | 2.7% | -1.6% | -0.6% |

| Utilities | -2.1% | 0.2% | -2.7% | 0.2% | 2.0% | 1.4% |

by Tom Moeller CPI Total 0.1%, Core Rose 0.2%August 15, 2007

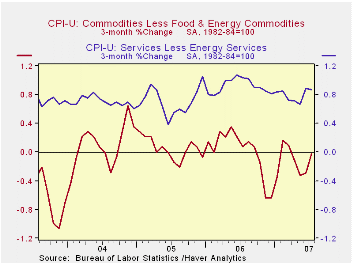

In July, the consumer price index (CPI-U) rose an expected 0.1%. The 0.2% rise in prices less food & energy also was in line with expectations and equaled the average monthly increase so far this year.

The year to year gain in core consumer prices of just under 2.2% was its lowest since last September.

Core goods prices rose 0.1%, the first increase in five months. A 0.4% (-0.3% y/y) rise in apparel prices was the first increase in five months and it was accompanied by a 0.7% rise in the prices of used motor vehicles (-4.3% y/y). New vehicle prices were unchanged (-1.1% y/y) for the fourth month this year. A 0.3% (2.7% y/y) increase in appliance prices was offset by a 0.3% (-0.8% y/y) decline in furniture & bedding costs.These detailed series are available in Haver's CPIDATA data base.

Core services prices rose 0.3% (3.4% y/y) for the fourth consecutive month. Shelter prices rose just 0.2% (3.6% y/y) as the owner's equivalent rent series rose 0.2% (3.1% y/y). Medical care services prices rose a firm 0.6% (5.4% y/y) but public transportation prices fell 0.1% (-0.7% y/y). Tuition costs rose 0.5% (5.5% y/y), however, information technology & hardware prices fell 0.7% (-16.9% y/y).

Energy prices fell 1.0% (+1.0% y/y due to the 1.7% (-1.1%) flop in gasoline prices. So far in August gas prices have fallen another 5.4% from the July average to $2.77 per gallon. Fuel oil prices rose 3.4% (1.6% y/y) last month but natural gas & electricity prices fell 0.5% (+3.8% y/y).

Food & beverage prices rose 0.3% (4.2% y/y) but prices for meats, poultry & fish fell 0.4% (+6.3% y/y).The chained CPI, which adjusts for shifts in the mix of consumer purchases, fell 0.1% (+2.1% y/y) and the core figure was unchanged (1.8% y/y) for the third consecutive month.

Are Global Prices Converging or Diverging? from the Federal Reserve Bank of San Francisco is available here.

| Consumer Price Index | July | June | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Total | 0.1% | 0.2% | 2.4% | 3.2% | 3.4% | 2.7% |

| Total less Food & Energy | 0.2% | 0.2% | 2.2% | 2.5% | 2.2% | 1.8% |

| Goods less Food & Energy | 0.1% | -0.1% | -0.6% | 0.2% | 0.5% | -0.9% |

| Services less Energy | 0.3% | 0.3% | 3.2% | 3.4% | 2.8% | 2.8% |

| Energy | -1.0% | -0.5% | 1.0% | 11.1% | 16.9% | 10.8% |

| Food & Beverages | 0.3% | 0.5% | 4.2% | 2.3% | 2.4% | 3.4% |

| Chained CPI: Total (NSA) | -0.1% | 0.2% | 2.1% | 2.8% | 2.9% | 2.5% |

| Total less Food & Energy | 0.0% | 0.0% | 1.8% | 2.3% | 1.9% | 1.7% |

by Tom Moeller August 15, 2007

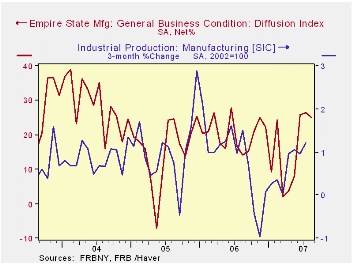

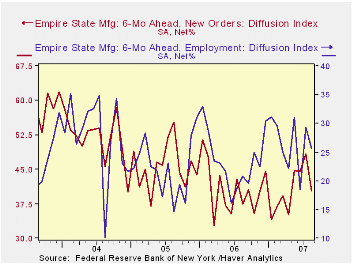

The index of manufacturing activity in New York State for August slipped from its improve level of July & June. The Index of General Business Conditions fell 1.4 points after a 0.7 point rise in July. The figures are reported by the Federal Reserve Bank of New York.

Since the series' inception in 2001 there has been a 75% correlation between the index level and the three month change in U.S. factory sector industrial production.

The index for new orders fell hard as did the index for employment. The shipments index was negative for the second consecutive month.

Like the Philadelphia Fed Index of General Business Conditions, the Empire State Business Conditions Index reflects answers to an independent survey question; it is not a weighted combination of the components.

Pricing pressure also fell considerably with the prices paid index and the prices received index falling into negative territory. Since 2001 there has been an 88% correlation between the index of prices paid and the three month change in the core intermediate materials PPI.

The Empire State index of expected business conditions in six months improved to its best level in two years, mostly due to improved expected delivery times.

The Empire State Manufacturing Survey is a monthly survey of manufacturers in New York State conducted by the Federal Reserve Bank of New York. Participants from across the state in a variety of industries respond to a questionnaire and report the change in a variety of indicators from the previous month. Respondents also state the likely direction of these same indicators six months ahead. April 2002 is the first report, although survey data date back to July 2001.For more on the Empire State Manufacturing Survey, including methodologies and the latest report, click here.

| Empire State Manufacturing Survey | August | July | Aug. '06 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| General Business Conditions (diffusion index) | 25.06 | 26.46 | 14.11 | 20.33 | 15.62 | 28.70 |

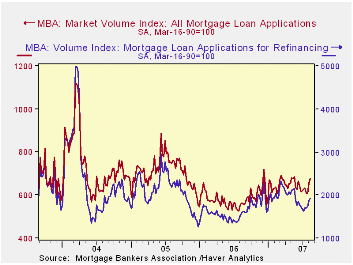

by Tom Moeller U.S. Mortgage Application Surge QuestionableAugust 15, 2007

The total number of mortgage applications surged another 3.4% last week following the 8.1% jump during the week prior, according to the Mortgage Bankers Association.

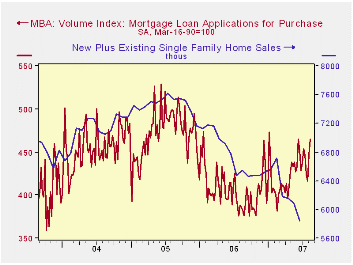

Purchase applications were strong again and posted a 3.9% gain on top of the 7.4% jump the prior week.

What makes these gains questionable is not whether or not they occurred. But whether they are indicative of the prospective health of the housing business. The mortgage credit crunch now underway has led borrowers to file applications with multiple lenders to better ensure funds at closing.

During the last ten years there has been a 58% correlation between the y/y change in purchase applications and the change in new plus existing single family home sales.

Applications to refinance rose 2.6% after a 9.1% increase during the prior week.

The effective interest rate on a conventional 30-year mortgage rose slightly w/w to 6.76%, near the lowest since early June. Rates averaged 6.91% during July, up from 6.28% in December. Rates for 15-year financing similarly rose to 6.48% last week. Interest rates on 15 and 30 year mortgages are closely correlated (>90%) with the rate on 10 year Treasury securities.

During the last ten years there has been a (negative) 79% correlation between the level of applications for purchase and the effective interest rate on a 30-year mortgage.

The Mortgage Bankers Association surveys between 20 and 35 top lenders in the U.S. housing industry. Then it derives its refinance, purchase and market indexes. The weekly survey covers roughly 50% of all U.S. residential mortgage applications processed each week by mortgage banks, commercial banks and thrifts. Visit the Mortgage Bankers Association site here.

The July 2007 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve Board can be found here.

| MBA Mortgage Applications (3/16/90=100) | 08/03/07 | 7/27/07 | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Total Market Index | 678.7 | 656.5 | 20.9% | 584.2 | 708.6 | 735.1 |

| Purchase | 464.9 | 447.4 | 20.5% | 406.9 | 470.9 | 454.5 |

| Refinancing | 1,929.6 | 1,881.1 | 21.5% | 1,633.0 | 2,092.3 | 2,366.8 |

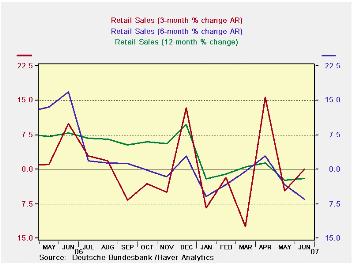

by Robert Brusca German Retail Sales Rebound in June August 15, 2007

Although the Q2 GDP number is already in release, Q2 German nominal ex-auto retail sales now show a 4.6% gain (saar) over the previous quarter. Real retail sales on this same basis are up by 3.4% saar and while that sounds strong, it comes after a Q1 annual rate drop of 9%.

The plot of ex-auto German real retail sales shows that they just have not been the same since January when the VAT kicked in. Obviously the VAT would hammer the Yr/Yr sales pace lower. But the six-month and the three-month growth rates have shown no life in recent months. The three-month growth which takes calculations in June compared to the post VAT month of March still shows a negative growth rate of -1.1%. With GDP in Q2 across the Euro area coming up as a disappointment, expectations of a strong consumer turnaround have turned to a question mark. Now, with financial sector turmoil swirling about it is less certain if the consumer will throw his lot in with the growth crowd. At least the Euro has backed off, that is one silver ling in the midst of these other difficult events, at least for the growth outlook.

| Nominal | Jun-07 | May-07 | Apr-07 | 3-MO | 6-MO | 12-MO | Yr Ago |

| Retail Ex auto | 1.3% | -3.1% | 1.9% | 0.0% | -6.4% | -1.9% | 7.9% |

| MV and Parts | -1.5% | 6.4% | -2.9% | 6.9% | -37.3% | -2.7% | 11.8% |

| Food Beverages & Tobacco | 1.0% | -2.9% | 2.4% | 1.8% | -0.5% | -2.0% | 6.4% |

| Clothing footwear | 5.3% | -12.1% | 6.6% | -5.4% | -1.5% | 0.1% | 10.8% |

| Real | |||||||

| Retail Ex auto | 1.3% | -3.1% | 1.5% | -1.5% | -8.0% | -2.4% | 7.3% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates