Global| Jan 14 2008

Global| Jan 14 2008Decline in British Pound Complicates U.K. Monetary Policy, Dampens Euro Area Export Prospects

Summary

In recent months, the British Pound has taken a sharp fall. From its peak of 102.89 (January, 2005 = 100) in early November, the Broad Effective Exchange rate of the British pound had declined 7.6% by last Friday. By contrast, during [...]

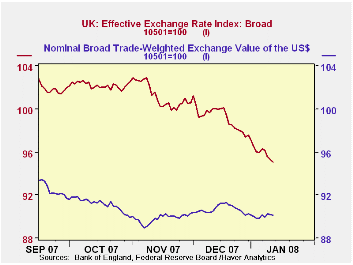

In recent months, the British Pound has taken a sharp fall. From its peak of 102.89 (January, 2005 = 100) in early November, the Broad Effective Exchange rate of the British pound had declined 7.6% by last Friday. By contrast, during this time, the Broad Effective Exchange rate of the US dollar rose 0.56% from 89.63 to 90.13. The first chart compares the effective exchange rates of the two countries. The inflationary implications of decline in the pound are likely to complicate monetary policy.

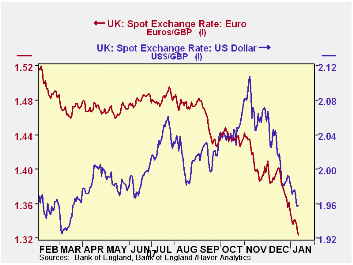

The pound has depreciated somewhat more against the euro than the dollar. From the November peak of 1.43 euros, the pound declined 8.3% to 1.32 euros on January 11, while the pound declined 7.1% from the peak of $2.11 to $1.96 over the same period. The value of the pound in dollar and euro terms is shown in the second chart. The sharp decline in the pound relative to the euro is likely to have a dampening effect on the Euro Area's exports to the U. K.

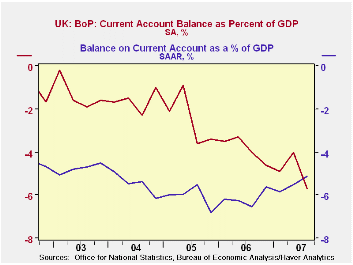

In hindsight, the earlier rise in the value of the pound appears to have been somewhat anomalous. The British current account as a percentage of GDP, which had been relatively high, was even higher than that of the U.S. in the third quarter of last year as can be seen in the third chart.

| GERMAN MANUFACTURING NEW ORDERS AND SALES (2000=100) | Jan 11, 2008 | Nov 11, 2007 | % Chg | ||

|---|---|---|---|---|---|

| Broad Effective Exchange Rates (Jan, 2005=100) | |||||

| U. K . | 95.04 | 102.89 | -7.63 | -- | -- |

| U. S. | 89.63 | 90.13 | 0.56 | -- | -- |

| Pound/ Euro | 1.32 | 1.44 | -8.33 | -- | -- |

| Pound/Dollar | 1.96 | 2.11 | -7.11 | -- | -- |

| Q3 2007 | Q2 2007 | Q3 2006 | Q/Q Dif | Y/Y Dif | |

| Current Account/ GDP (%) | |||||

| U. K . | 5.7 | -4.0 | -4.0 | -1.7 | 0 |

| U. S. | 5.1 | 5.4 | 6.6 | -0.3 | -1.5 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates