Global| Jun 30 2009

Global| Jun 30 2009Decline In Case-Shiller Home PriceIndex Eases

by:Tom Moeller

|in:Economy in Brief

Summary

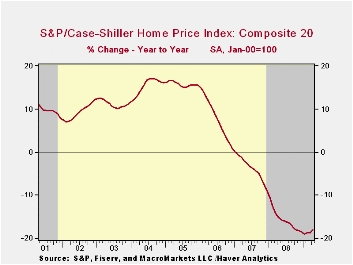

S&P/Case-Shiller Home Price Composite Index of twenty metro-markets slipped just 0.9% during April versus March. The latest monthly decline was the smallest since late 2007; however, it still left prices 18.1% lower during the last [...]

The series dates back only to 2001. The S&P/Case-Shiller home price series can be found in Haver's USECON database and the city data highlighted below is in the REGIONAL database.

The

Case-Shiller index of 20 U.S. cities and their

surrounding areas is weighted to reflect price changes due to extensive

remodeling, home additions or extreme neglect. For example,

smaller weights are assigned to sales of homes that have undergone

extensive remodeling.

The

Case-Shiller index of 20 U.S. cities and their

surrounding areas is weighted to reflect price changes due to extensive

remodeling, home additions or extreme neglect. For example,

smaller weights are assigned to sales of homes that have undergone

extensive remodeling.

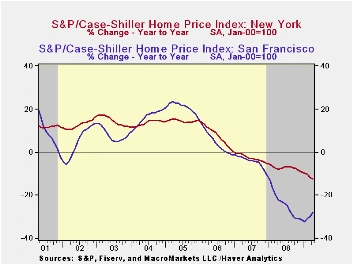

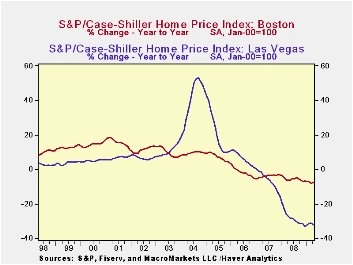

The Case-Shiller composite index of homes in 10 metropolitan areas, which has a longer history and dates back to 1987, also fell a lessened 1.0% and was down 18.0% year-to-year. The measure also was down by nearly one-third since the 2006 peak.· Less Weak Regions: In Cleveland, Ohio prices ticked up slightly m/m (-10.5% y/y) and in Dallas prices rose slightly as well (5.0% y/y). Prices also rose 0.7% in Denver (-4.9% y/y). In addition, in Boston the monthly decline in prices moderated substantially (-7.7% y/y) and in Chicago home prices were roughly unchanged m/m (-18.7% y/y). In New York, the price decline showed little moderation (12.5% y/y), off roughly 20% from their 2006 peak. In Charlotte, North Carolina prices also continued down moderately (10.0% y/y.

Weakest

Regions: Home prices in Phoenix, Nevada were quite weak and

fell 35.3% y/y and in San Francisco prices fell a lessened 28.0% y/y.

However, they still were off by nearly one-half from their early-2006

peak. Home prices in Las Vegas, Nevada continued their rapid rate of

decline, 32.1% y/y, and also were down by roughly one half from their

peak. The rate of price decline in Miami eased slightly (27.3% y/y

while home prices in Los Angeles continued to fall sharply 21.2% y/y.

In Tampa, the rate of monthly price decline slowed slightly (-21.3%

y/y). In Detroit, the monthly rate of price decline also eased

considerably (-25.4% y/y) but was off by early one-half from the

peak.

Weakest

Regions: Home prices in Phoenix, Nevada were quite weak and

fell 35.3% y/y and in San Francisco prices fell a lessened 28.0% y/y.

However, they still were off by nearly one-half from their early-2006

peak. Home prices in Las Vegas, Nevada continued their rapid rate of

decline, 32.1% y/y, and also were down by roughly one half from their

peak. The rate of price decline in Miami eased slightly (27.3% y/y

while home prices in Los Angeles continued to fall sharply 21.2% y/y.

In Tampa, the rate of monthly price decline slowed slightly (-21.3%

y/y). In Detroit, the monthly rate of price decline also eased

considerably (-25.4% y/y) but was off by early one-half from the

peak.

Here is a link to the latest press release from Standard & Poor's. An overview of the S&P/Case-Shiller home price series can be found here.

The history of the Case-Shiller data is available in Haver's USECON database.

| S&P/Case-Shiller Home Price Index (SA, Jan 00 = 100) | March | February | Y/Y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|

| 20 City Composite Index | 140.10 | 141.36 | -18.1% | -15.8% | -3.8% | 7.6% |

by Tom Moeller June 30, 2009

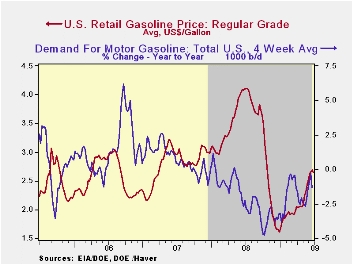

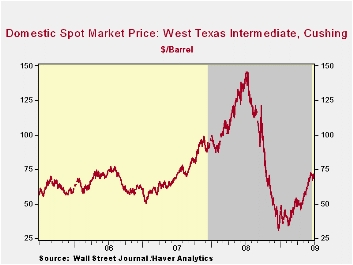

For all of last week, the energy markets continued to discount weakness in the economic environment. The likelihood of an easing in demand lowered the weekly average retail price for a gallon of regular gasoline slipped to $2.64 per gallon, down a nickel from the prior week. Yesterday, however, that decline stalled with heightened concerns regarding Mideast crude oil supplies. The Monday spot market price for a gallon of unleaded gasoline jumped roughly ten cents from last week's average to $1.90 per gallon. That jump did not, however, recover the price declines during prior weeks from the daily high of $2.04. The figures are reported by the U.S. Department of Energy and can be found in Haver's WEEKLY & DAILY databases.

The energy market's volatility was notably evident in crude

oil prices. The price for a barrel of West Texas Intermediate crude oil

jumped to $71.49 yesterday which was the highest level since the first

week of the month. Prices averaged $68.76 per barrel last week. Against

this backdrop crude oil production rose 3.6% y/y during the latest four

weeks. In addition, supplies of crude oil continue plentiful as

evidenced by a 13.3% y/y rise in inventories of crude oil &

petroleum products. The figures on crude oil production and inventories

are available in Haver's OILWKLY database.

The gasoline demand figures continued to improve modestly but the comparisons still are negative. Year-to-year gasoline demand last week fell by 1.3%. That remained improved from the roughly 5.0% y/y decline of last fall. The change in demand is measured using the latest four weeks versus the same four weeks in 2008. Demand for all petroleum products was down 6.6% y/y in the latest week led by a 15.1% drop in distillate demand. These numbers also are available in Haver's OILWKLY database.

Finally, natural gas prices remained weak last week and fell to $3.86 per mmbtu (-70.0% y/y). Yesterday, natural gas prices held steady at $3.88 per mmbtu. Current prices are down by two-thirds from the high reached in early-July of $13.19/mmbtu.

Developing a Liquid Market for Inflation-Indexed Government Securities: Lessons from Earlier Experiences from the Federal Reserve Bank of St. Louis can be found here.

| Weekly Prices | 06/29/09 | 06/22/09 | Y/Y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|

| Retail Regular Gasoline ($ per Gallon, Regular) | 2.64 | 2.69 | -35.5% | 3.25 | 2.80 | 2.57 |

| Light Sweet Crude Oil, WTI ($ per bbl.) | 68.76 | 70.61 | -49.9% | 100.16 | 72.25 | 66.12 |

by Robert Brusca June 30, 2009

‘Official’ train wreck?? Maybe I shouldn’t

say ‘officially’ since no one in officialdom has really declared it so.

And I don’t want those with policies at Lloyds to come running for

remuneration because they are insured against injury inflicted by a

train gone amok. Still, the sharp downward revision to UK GDP is

stunning and it gives us a new take on reality.

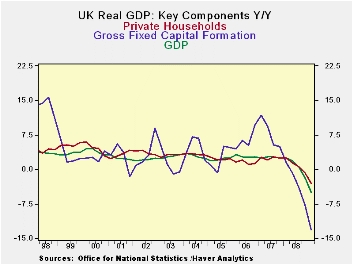

Capital spending takes a dive – If capital

spending were a prize-fighter, the boxing officials would be streaming

in for an investigation of such a sudden dive. UK capital spending in

Q1 ‘did in’ an already weak UK GDP showing in 2009-Q1 by falling at an

even steeper 27% annual rate. The annualized drop in UK GDP as a result

has sunk back to near double digit losses, showing a decline of at a

pace of 9.3% compared to -7.3% as last reported. And, yeah, they are

both bad numbers, but 9.3% is simply awful.

Bigger than a pot-hole: The GDP hole that

the UK must dig itself out of is deeper than we thought. And in this,

the UK is not alone. Not seasonally adjusted Irish GDP was revised

lower in Q1 to an annual rate drop of 8.5% from 7.5% previously.

Excluding its key international sector, Ireland’s GDP fell 12% in Q1.

Downward revisions have been an ongoing theme…

Yes we have no INFLATION!!! (for now) --

These sorts of downward revisions business activity help to explain

some of the other ‘news du jour’ such as the lowest inflation rate in

40 years in Italy (+0.5% Yr/Yr in June); the first-time-ever drop in

the EMU CPI (-0.1% in the twelve months ended in June); and, the lowest

inflation reading in at least 38 years for the OECD area (+0.1% Yr/Yr

in May).

Let’s do the twist...or let’s not -- There

has been some great twisting of inflation trends recently. As short a

time ago as July of 2008 OECD inflation had reached an 11-year high at

4.9% Yr/Yr; the plunge in the rate of inflation has a lot to do with

the global credit crisis and the deflating of the individual OECD

economies as well as the global economy. To the extent we may wish to

consider it a separate event, it also has to do with oil prices

falling. Energy prices in the OECD fell by 16.2% in the 12 months to

May obviously having a lot to do with the drop in that headline

inflation rate. That which twists can untwist…

The GDP-Gap trap - These huge hits to GDP

are behind us. The legacy of those hits is something economists call

the GDP-Gap. The Gap is the difference between where GDP is currently

compared to where it could have been had the economy grown at its

‘full-potential’. You get a good simple approximation of this by just

extending GDP’s growth trend before the economy slowed and fell and

looking at the resulting gap of that extrapolated line Vs actual GDP.

That gap will persist for some time into the future even if the economy

grows swiftly for several quarters.

The plot thickens - While no one expects

declines of the past order of magnitude to continue going forward,

there is considerable debate about the speed of the individual

economies and of the global economy. The turning point location for GDP

growth rates to become positive and the pace at which growth will

proceed once that happens are critical ingredients in the outlook for

inflation.

Risk source: Gap trap Vs central bankers at nap -

To Keynesian types these issues are the key; to others ‘the Gap’ is

still an issue that matters but monetarists look for the impact on

inflation to come from all the special reserve injections by various

central banks.

Market pricing, or groping - So the stage

is set. We can expect these issues to continue to be contentious as the

recession slows and recoveries re-start. Stock markets have rebounded

less on the expectation of strong GDP recovery growth rates and more on

the notion that huge drops in GDP are behind us and the companion

thought that at least some growth lies ahead. Bonds have been battered

back by those with fears of inflation from central-bank reserve growth

and the notion that the special times for distress pricing and the

flight to quality are behind us.

Markets will continue to toss and turn on these issues. Some

will revel in the existence of the GDP-Gap as a protector against

inflation. Others will dismiss it or diminish it. It is the wave of the

future.

| UK GDP | ||||||||

|---|---|---|---|---|---|---|---|---|

| Consumption | Capital Formation | Domestic | ||||||

| GDP | Private | Public | Total | Housing | Exports | Imports | Demand | |

| % change Q/Q | ||||||||

| Q1-09 | -9.3% | -5.0% | 0.9% | -26.9% | -41.5% | -25.0% | -24.1% | -9.5% |

| Q1-09 Previous | -7.3% | -4.7% | 1.2% | -14.2% | #N/A | -22.1% | -21.5% | -7.6% |

| Q4-08 | -7.0% | -4.3% | 4.3% | -4.7% | -12.7% | -15.6% | -20.2% | -8.7% |

| Q3-08 | -2.9% | -1.5% | 1.9% | -10.7% | -25.6% | -1.7% | -2.8% | -3.1% |

| Q2-08 | -0.2% | -1.5% | 4.0% | -8.8% | -21.9% | -1.8% | -5.3% | -1.2% |

| % change Yr/Yr | ||||||||

| Q1-09 | -4.9% | -3.1% | 2.8% | -13.2% | -26.2% | -11.6% | -13.6% | -5.7% |

| Q4-08 | -1.8% | -0.8% | 3.5% | -7.8% | -15.9% | -3.8% | -7.7% | -2.9% |

| Q3-08 | 0.5% | 0.7% | 2.6% | -3.9% | -14.8% | 0.5% | -1.7% | 0.1% |

| Q2-08 | 1.8% | 1.4% | 2.9% | -0.8% | -8.6% | 2.8% | 3.5% | 2.2% |

| 5-Yrs | 0.9% | 1.2% | 1.8% | 0.7% | -5.1% | 1.7% | 1.1% | 0.8% |

by Tom Moeller; June 30, 2009

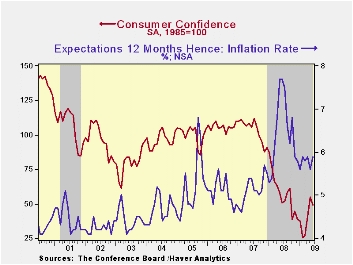

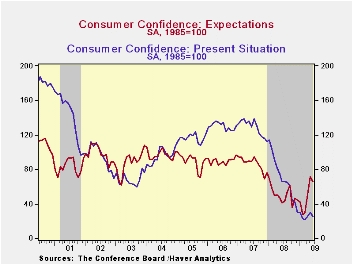

According to the Conference Board, consumer confidence slipped this month following gains during the prior three months. The slip did not, however, alter the picture of improvement in consumer attitudes. Confidence remained up by more than one-half from the February low and roughly equal to the year ago level. The Conference Board data can be found in Haver's CBDB database.

During the last ten years there has been an 86% correlation between the level of consumer confidence and the y/y change in real consumer spending.

The expectations component of confidence slipped the most last month with an 8.4% decline following three strong monthly increases. Still, the index remained near the highest level since late 2007. The percentage of respondents expecting business conditions to improve slipped to 21.2% but that remained near the highest level since 2004. A much reduced 20.2% expected conditions to worsen. That improvement was expected by 17.4 of respondents to generate more jobs, more than double the percentage at the recent low.

Consumers' assessment of the current economic conditions also

slipped m/m and remained near its recent low. It remained off by nearly

two-thirds from a year earlier. Jobs were seen as hard to get by a

still-high 44.8% of respondents and jobs were seen as plentiful by only

4.5% of respondents. Business conditions were seen as good by just 8.0%

and that was near the 1991 low. Consumers who thought business

conditions were bad rose slightly to 45.6%, still near the highest

since 1983.

Expectations for the inflation rate in twelve months have been roughly stable at 5.9%. That's down from last year's high of 7.7%. Expectations about interest rates have increased sharply with 51.7% of respondents expecting higher rates while 16.3% expect rates to fall. A greatly increased 31.5% of respondents expected stock prices to rise.

| Conference Board (SA, 1985=100) | June | May | Y/Y % | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|

| Consumer Confidence Index | 49.3 | 54.8 | -3.3 | 57.9 | 103.4 | 105.9 |

| Present Situation | 24.8 | 29.7 | -62.1 | 69.9 | 128.8 | 130.2 |

| Expectations | 65.5 | 71.5 | 58.2 | 50.0 | 86.4 | 89.7 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.