Global| Jan 06 2009

Global| Jan 06 2009Decline in Production and Lower Inflation in Brazil: A Reduction in the Target Rate (Selic)?

Summary

On a seasonally adjusted basis, industrial production in Brazil fell 5.2% in November from October, following a 2.8% decline in October from September. The November decline is one of the largest month to month declines on record. On a [...]

On a seasonally adjusted basis, industrial production in

Brazil fell 5.2% in November from October, following a 2.8% decline in

October from September. The November decline is one of the largest

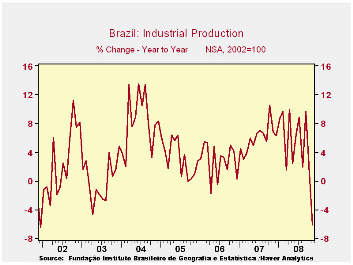

month to month declines on record. On a seasonally unadjusted basis,

industrial production was 6.2% below November 2007, the largest year to

year decline since December 2001. The year to year declines in

production are shown in the first chart.

The Automobile, Office machinery and equipment and the Electrical material, devices and communication equipment industries were among the hardest hit, showing year to year declines of 31%, 30% and 21% respectively.

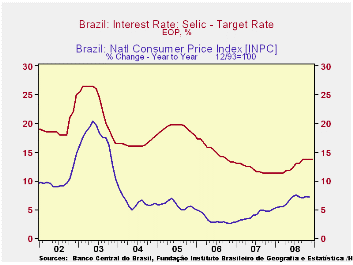

The sharp fall in industrial production has raised the

possibility of a reduction in the target interest rate at the next

meeting of the Monetary Policy Committee (COPOM) of the Central Bank of

Brazil scheduled for January 20, 21, 2009. COPOM has been targeting

inflation and raised the target rate, Selic, from 11.25% in March 2008

to 11.75% in April 2008 . Further increases took place in June, July

and September, when the rate reached 13.75% where it has since

remained. Inflation has now begun to lessen, if only slightly. The

increase in the national consumer price index (INCP) was 7.20% in

November, down from 7.56% in July. The rate of inflation and the target

rate of interest are shown in the second chart.

There is a more general price index--the General Price Index (IGP M)--which is a weighted average of the CPI, WPI and the Cost Construction Indexes and measures the change in prices from the 21st of the previous month to the 20th of the current month. Since the year to year changes in the (IGP M) index are closely correlated with the those of the (INCP) as can be seen in the third chart, the trend in the (IGP M) changes is a good indicator of the trend in the national consumer price index. This Index is published about a week before the national consumer price index and suggests that inflation as measured by the CPI has continued to decline. in December.

| BRAZIL | Dec 08 | Nov 08 | Oct 08 | Sep 08 | Aug 09 | July 08 | June 08 |

|---|---|---|---|---|---|---|---|

| Industrial Production | |||||||

| Month to Month % Change (SA) | -- | -5.16 | -2.83 | 1.80 | -1.28 | 0.74 | 3.03 |

| Year to Year % Change (NSA) | -- | -6.18 | 1.07 | 9.65 | 1.95 | 8.76 | 6.50 |

| Rate of Inflation (INPC) %) | -- | 7.20 | 7.26 | 7.04 | 7.15 | 7.56 | 7.28 |

| Rate of Inflation (IGP M) (%) | 9.81 | 11.88 | 12.23 | 12.31 | 13.63 | 15.12 | 13.44 |

| Target Interest Rate (Selic) (%) | 13.75 | 13.75 | 13.75 | 13.75 | 13.00 | 13.00 | 12.25 |