Global| Aug 19 2008

Global| Aug 19 2008Declines in Euro and Oil Price Improve ZEW Indicator of Expectations

Summary

The ZEW indicator of German economic sentiment among institutional investors and analysts improved in August. It remained, however at historically low levels. The percent balance between the pessimists and the optimists rose from [...]

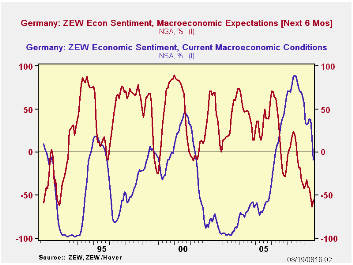

The ZEW indicator of German economic sentiment among institutional investors and analysts improved in August. It remained, however at historically low levels. The percent balance between the pessimists and the optimists rose from -63.9% in July to -55.5% in August. At the same time, the appraisal of current conditions by the financial community worsened and showed an excess of pessimists of 9.2%, the first negative since March 2006. The first chart shows the percent balances for expectations and current conditions.

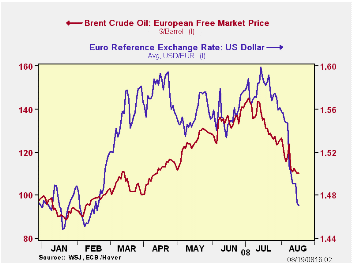

The recent declines in the euro and the price of oil may well have accounted for the improvement in sentiment concerning the outlook for the next six months. Lower oil prices should improve the profit outlook for business and the lower Euro should benefit exports. The second chart shows the daily price of oil and the value of Euro in dollar terms in the current year. The price of oil is down 23% from its high on July 11, and the Euro is down 8% since its high on July 15.

After Eurostat reported that Germany's second quarter GDP declined by 0.5%, it is not surprising that the pessimists have begun to exceed the optimists in their appraisal of current conditions.

| GERMANY | Aug 08 | Jul 08 | Jun 08 | May 08 | Apr 08 | Mar 08 | Feb 08 | Jan 08 |

|---|---|---|---|---|---|---|---|---|

| ZEW Indicator of Expectations (% bal) | -55.5 | -63.9 | -52.4 | -41.4 | -40.7 | -32.0 | -39.5 | -41.6 |

| ZEW Indicator of Current Situation (% bal) | -9.2 | 17.0 | 37.6 | 38.6 | 33.2 | 32.1 | 33.7 | 56.6 |

| High | Date | Recent | Date | % chg | ||||

| Oil Price (bbl) | 143.25 | 7/11 | 110.08 | 8/15 | -23.16 | -- | -- | -- |

| US/Euro | 1.599 | 7/15 | 1.470 | 8/18 | -8.04 | -- | -- | -- |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates