Global| Sep 19 2005

Global| Sep 19 2005ECRI Leading Index: Down But Not Out

by:Tom Moeller

|in:Economy in Brief

Summary

The leading index of the US economy published weekly by the Economic Cycle Research Institute (ECRI) fell during four of the last five weeks. The latest 0.4% w/w decline reflected, in part, the sharp rise in initial claims for [...]

The leading index of the US economy published weekly by the Economic Cycle Research Institute (ECRI) fell during four of the last five weeks. The latest 0.4% w/w decline reflected, in part, the sharp rise in initial claims for unemployment insurance due to Hurricane Katrina.

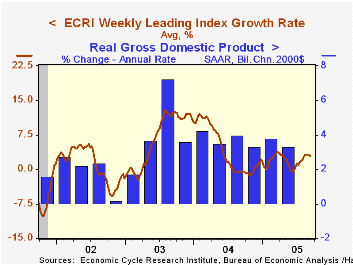

These weekly declines, however, are modest compared to past periods when economic recession was indicated. The six month growth rate of the leading index has held at roughly 3%, still up from the June low of -0.6% and from the -5% to -7% growth rates which preceded the last recession.

During the last ten years there has been a 53% correlation between the change in the weekly leading index and US real GDP growth during the following quarter. The correlation has risen to 76% during the last five years.

ECRI's research director indicated that "The economy was at a phase of the business cycle where it was relatively resilient to any type of shock. The reality is that the potency of a shock, how much influence it can have, really depends on where we are in the business cycle."

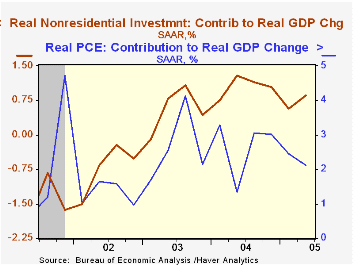

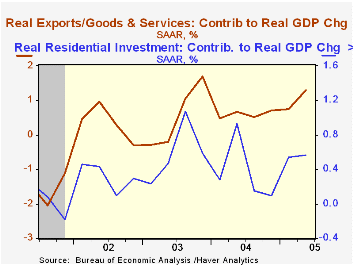

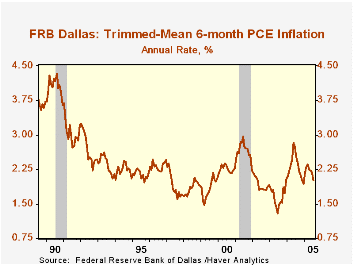

The accompanying charts indicate some of that resiliency. Recent US economic growth has been less due to consumer spending & housing and more due to exports & business fixed investment. Moreover, core price inflation recently has been low and declining rather than high and rising.

Visit the Economic Cycle Research Institute for analysis of US and international business cycles.

| Economic Cycle Research Institute | 09/09/05 | 12/31/04 | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Weekly Leading Index | 135.2 | 135.8 | 2.9% | 132.6 | 124.9 | 119.8 |

| 6 Month Growth Rate | 2.9% | 3.1% | 4.2% | 6.7% | 1.1% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates