Global| Jun 16 2014

Global| Jun 16 2014EMU Inflation Continues to Sink

Summary

Inflation in the European Monetary Union continues to fall. In May the overall index for the EMU was flat after rising by just 0.1% in April and falling by 0.1% in March. The core reading excluding energy and unprocessed food fell by [...]

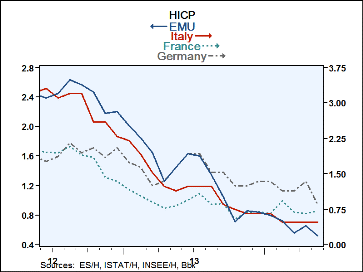

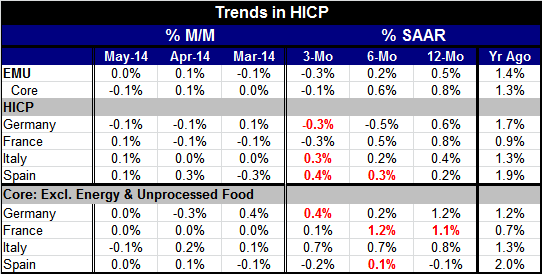

Inflation in the European Monetary Union continues to fall. In May the overall index for the EMU was flat after rising by just 0.1% in April and falling by 0.1% in March. The core reading excluding energy and unprocessed food fell by 0.1% after rising by 0.1% in April and being flat in March. The three-month trend for headline inflation in the EMU has dropped from 0.5% year-over-year to 0.2% over six months to -0.3% over three months. Similarly, the core inflation rate is at 0.8% over 12 months, at 0.6% over six months and at -0.1% over three months - steadily falling.

Inflation in the European Monetary Union continues to fall. In May the overall index for the EMU was flat after rising by just 0.1% in April and falling by 0.1% in March. The core reading excluding energy and unprocessed food fell by 0.1% after rising by 0.1% in April and being flat in March. The three-month trend for headline inflation in the EMU has dropped from 0.5% year-over-year to 0.2% over six months to -0.3% over three months. Similarly, the core inflation rate is at 0.8% over 12 months, at 0.6% over six months and at -0.1% over three months - steadily falling.

The European Central Bank has announced special measures to try to re-stimulate growth and to push inflation back up toward its objective. At this time, the ECB is fighting a battle on a fairly broad front. Inflation is very subdued across the four largest economies and is still dropping under economies that had been under austerity.

Over three months. Germany and France showed headline inflation dropping by 0.3% at an annual rate. For Italy inflation is rising at a 0.3% pace and for Spain it's rising by 0.4%, all at annualized rates. Over 12 months, the French inflation rate is the highest at 0.8%. Germany is next at 0.6%, followed by Italy at 0.4% and Spain at 0.2%. Year-over-year inflation remains very contained for these countries. For two of these nations, the rate is below the 0.5%. That seems to be the level that has given the ECB the jitters on the inflation front.

Looking at core inflation in May, we see that inflation, excluding energy and unprocessed food, shows no change in May for 3 of 4 countries, while Italy showed a 0.1% decline. Core inflation is running at a 0.7% rate over three months in Italy, at a 0.4% pace in Germany, at a 0.1% pace in France, and falling at a 0.2% pace in Spain. Year-over-year core German inflation is up by 1.2%; in France it's up by 1.1%; in Italy it's up by 0.8%; and in Spain it is down by 0.1%.

The core inflation readings suggested that there may be more inflation than signaled by the headline readings alone, possibly indicating that commodity price weakness is creating some excessive weakness in headline inflation. Over six months the same thing is true that the core inflation rates are stronger than the headline inflation rates for Germany, France and Italy with Spain once again as an exception. And that same trend holds over three months.

Spain, one of the countries that had to undergo a good deal of austerity, is still showing more temperance in its core inflation rate compared with headlines in the three largest EMU nations.

On balance, we see that inflation in the euro area is very well contained. We also see that is contained well past the point that is required; it probably continues to vex the ECB. Policies are being put in place to stimulate the local economies and to cause inflation to rise. However, these programs mostly are trying to increase the availability of credit. With euro area banks still struggling to get on firmer footing, it's not all that clear what their appetite will be for extending loans. At the same time, it's not clear that there's much of an appetite on the part of borrowers to borrow more. A program that is supposed to work primarily through increasing the quantity of credit therefore may not be targeting the Achilles' heel of European weakness.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.