Global| Jun 28 2019

Global| Jun 28 2019EMU Inflation Stabilizes As the Core Shows Some Pressure

Summary

EMU inflation rose by 0.1% in June with the core rate rising by 0.2%. Over three months, the pace is muted. Inflation also is muted over six months and 12 months. Headline inflation has no trend, but it is slightly faster-rising over [...]

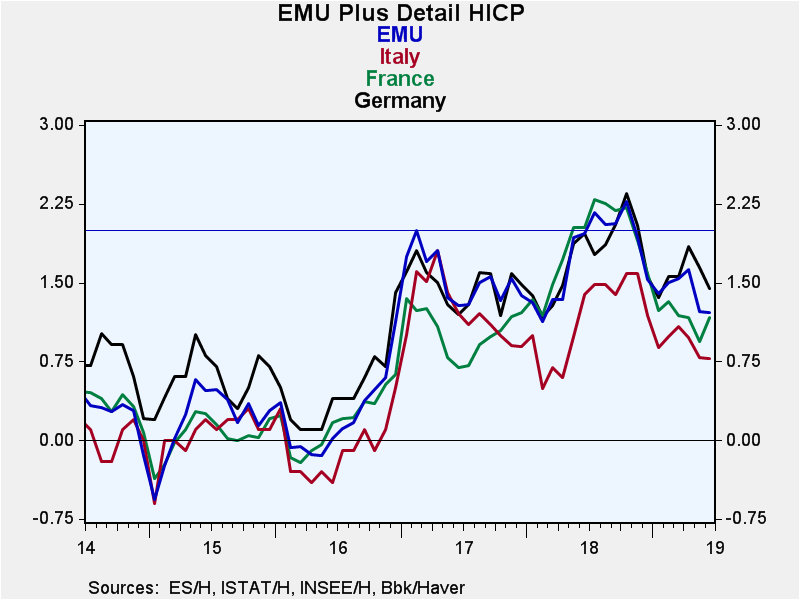

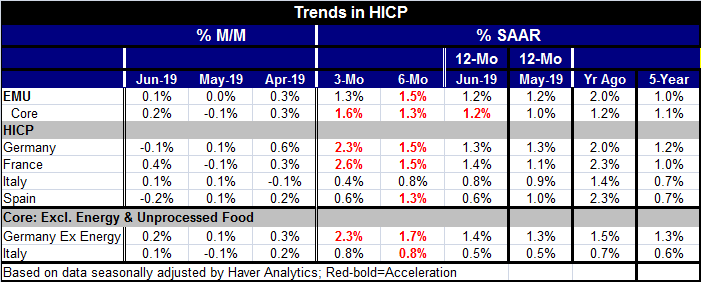

EMU inflation rose by 0.1% in June with the core rate rising by 0.2%. Over three months, the pace is muted. Inflation also is muted over six months and 12 months. Headline inflation has no trend, but it is slightly faster-rising over three months than over 12 months. Core inflation is accelerating from 1.2% over 12 months to 1.3% over six months to 1.6% over three months. Also this month the headline 12-month pace was unchanged from May to June while the core pace rose from 1% to 1.2%. There is some pressure, but the pace is still well below ‘target.’

EMU inflation rose by 0.1% in June with the core rate rising by 0.2%. Over three months, the pace is muted. Inflation also is muted over six months and 12 months. Headline inflation has no trend, but it is slightly faster-rising over three months than over 12 months. Core inflation is accelerating from 1.2% over 12 months to 1.3% over six months to 1.6% over three months. Also this month the headline 12-month pace was unchanged from May to June while the core pace rose from 1% to 1.2%. There is some pressure, but the pace is still well below ‘target.’

The early read on core or ex-energy inflation for Germany shows the ex-energy pace stepping up from a 1.4% rate over 12 months to 1.7% over six months to 2.3% over three months. Italy reports core inflation early and it shows the core pace at 0.5% over 12 months, stepping up to 0.8% over six months then staying at 0.8% over three months. This is a modest step up. Italy’s year-on-year pace of 0.5% in June is the same as in May. So the trends for core inflation shows some pressure and Germany seems to be a big part of that.

Meanwhile, for the Big Four EMU economies, France logged the biggest increase in headline inflation 0.4% in June with Italy’s headline up by 0.1%, Germany’s falling by 0.1% and Spain’s falling by 0.2%.

The progression for headline inflation from 12-months to six-months to three-months finds acceleration in both Germany and France. In Spain, the 0.6% gain over 12 months rises to 1.3% over six months then falls back to 0.6% over three months. Italy logs a 0.8% rise over 12 months and six months that steps down to a 0.4% pace over three months, posting a mild deceleration.

Comparing the year-over-year headline rates in May and June, only France shows acceleration and that is a step up to 1.4% from 1.1%. In Germany, the pace is steady at 1.3%. In Italy, the year-on-year pace drops to 0.8% from 0.9%. In Spain, it drops to 0.6% from 1%.

These figures show that while there may be some pressures percolating in the core whatever the pressures they are as yet mild and not widespread. Germany and France show that there is some headline progression underway. Oil prices that have been rising since December have turned in the past month to a steadying influence on trend with little impact on the inflation numbers in June. Overall, there are still lots of problems with the oil market and risk around the Straits of Hormuz. When it comes to oil, right now just about anything goes. When the last IEA estimates were released before the Middle East heated up, forecasts for oil demand were being cut. So oil right now is caught in a hot/cold vortex.

Inflation remains muted in Europe, Japan and the United States. Growth has also slowed. Now, all eyes are looking to Asia and everyone is eager to see what comes of the Trump-Xi meeting about trade. Will the war heat up or will it stabilize? Will it show any signs of backing off? Growth and inflation dynamics are hanging in the balance. It is cold on growth dynamics and hot on geopolitics.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.