Global| Jun 03 2014

Global| Jun 03 2014EMU Inflation Walks the Line

Summary

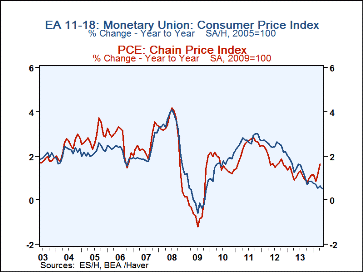

Inflation in the United States has been running lower than in the European Monetary Union since around 2010. Over the last few months the US PCE inflation rate has turned higher while inflation in Europe has continued to drop. In May, [...]

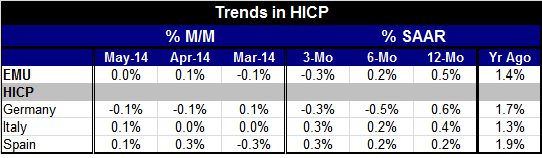

Inflation in the United States has been running lower than in the European Monetary Union since around 2010. Over the last few months the US PCE inflation rate has turned higher while inflation in Europe has continued to drop. In May, the flash HICP inflation rate for Europe was flat, after rising by 0.1% in April and falling by 0.1% in March. The three-month annualized inflation rate is -0.3%; its six-month pace is 0.2%; its year-over-year pace is 0.5%. At this very low level of inflation, inflation in the EMU is still decelerating. Decelerating! HELP!

Inflation in the United States has been running lower than in the European Monetary Union since around 2010. Over the last few months the US PCE inflation rate has turned higher while inflation in Europe has continued to drop. In May, the flash HICP inflation rate for Europe was flat, after rising by 0.1% in April and falling by 0.1% in March. The three-month annualized inflation rate is -0.3%; its six-month pace is 0.2%; its year-over-year pace is 0.5%. At this very low level of inflation, inflation in the EMU is still decelerating. Decelerating! HELP!

In the United States, President of the Federal Reserve Bank of St. Louis, James Bullard, has said that if inflation in the US fell to about 0.5%, that would be reason for the Fed to stop its tapering operation. Before the financial crisis, Europe had generally held to lower inflation rates than the US and seems to have been comfortable doing so. That's true if you look at the US PCE vs. Europe's HICP and even truer if you look at the US CPI vs. the HICP.

This drop in inflation in Europe poses a dilemma for European Central Bank President Mario Draghi. In this cycle, the ECB has been consistently underestimating the deflationary forces operating in Europe. This is despite the fact that a number of European economies have been operating under austerity plans- even when they have emerged from formal austerity programs they have continued to follow relatively strict fiscal rules.

ECB President Draghi has been saying that the central bank could act soon to come to grips with the concerns about deflation in the EMU. It would seem that economic data now have called his bluff.

There are questions, however, about exactly what the ECB can do. There are charter limitations that the Bundesbank is going to make sure that the ECB respects. Additionally, there are market limitations because the European markets simply don't have the depth and availability of financial instruments that the US financial markets have. That could limit the ECB if it sought some kind of a liquidity program.

Unlike the Federal Reserve, the ECB has a single objective. That is to keep inflation at 2%. When the ECB's preferred inflation measure, the HICP comes in at 0.5%. It's running at one quarter of the inflation rate that the ECB has targeted. The ECB's preferred inflation measure, the HICP, has been below its 2% objective since March 2012. That is a period of over two years. While Europeans seem somewhat more content with low inflation, in the US the Fed policy statement released each month admits that if inflation were to run below the Fed's target, it could be a problem for the economy. The exact statement says: "The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, and it is monitoring inflation developments carefully for evidence that inflation will move back toward its objective over the medium term." For Europe inflation has been below 2% for a period of over two years...and running. It is not headed back toward its target. But maybe Europe is different.

I don't mean to be putting words into the mouth of ECB policymaking officials. In the case of the ECB, there are many different voices on the question of inflation. Yet, there has been a tremendous tendency for Europe to adopt what would have been the inflation choices of the Bundesbank. In recent years, under financial stress, ECB President Draghi has been more adventuresome and has tested the limits of the ECB charter. Whatever positive contributions these actions may had in stabilizing Europe during a period of stress, they have not boosted inflation back toward the ECB's objective.

While markets expect some action from the ECB, it is unclear what the ECB will be able to deliver. At this point even with inflation hovering at 0.5% year-over-year, Draghi probably does not have the support to try to implement the European-style quantitative easing. However, even if he wanted to do so, it's unclear whether the European markets have sufficient financial assets for the ECB to press ahead with such a program.

Clearly, the low inflation environment has put more pressure on the ECB. Its ability to act is limited by both the charter and by the financial markets in which it operates. As we can see from the chart, there are similar deflationary forces operating in economies as diverse as the United States and Europe. Japan is trying to emerge from its own deflationary spiral. However, central banks continue to try to go it alone and fighting against this trend. All eyes are focused on the ECB this week to see what it decides to do. Economic data from the recent weakness in Europe's PMI indices to the weak flash HICP measure are calling for the ECB to do something this week. What will it be, a simple rate cut or something more?

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates