Global| Sep 23 2013

Global| Sep 23 2013EMU Services Sector Drives Recovery- But Where To?

Summary

The overall PMI metric for the European Monetary Union (EMU) improved in September on the back of a significant improvement in the services sector. The services diffusion reading moved up to 52.12 in September from 51.0 in August. In [...]

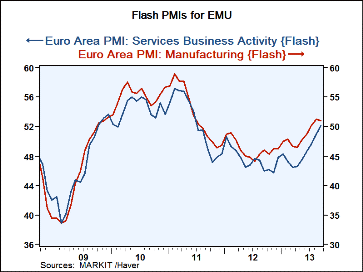

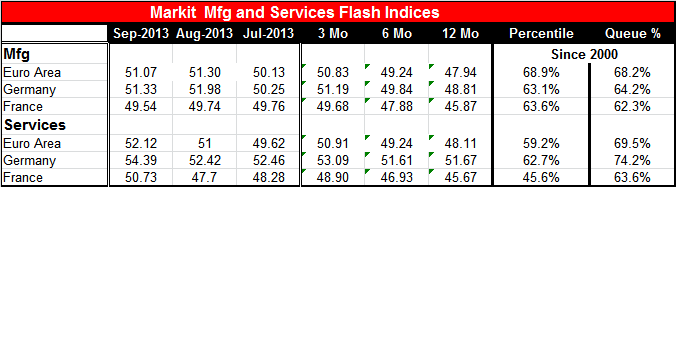

The overall PMI metric for the European Monetary Union (EMU) improved in September on the back of a significant improvement in the services sector. The services diffusion reading moved up to 52.12 in September from 51.0 in August. In contrast the area's manufacturing metric which engaged in some backsliding slipping back to 51.07 from 51.30, consistent with a still-growing sector but with weaker activity.

The overall PMI metric for the European Monetary Union (EMU) improved in September on the back of a significant improvement in the services sector. The services diffusion reading moved up to 52.12 in September from 51.0 in August. In contrast the area's manufacturing metric which engaged in some backsliding slipping back to 51.07 from 51.30, consistent with a still-growing sector but with weaker activity.

At these levels the manufacturing index sits at the 68.9th percentile of its historic high-low range while the services metric sits at the 59.2 percentile of its high low range.

Theses indices have much closer standings when we look at their queue positioning (the far right column of the table). With each current reading placed in its respective historic queue of data, the euro area manufacturing index sits in the 68.2 percentile with the services index in the 69.5 percentile. The standings are roughly consistent with their nominal diffusion levels in September. And, by that I mean that the services diffusion value is higher and its queue standing is also higher, in each case by roughly 1 point.

When we look to Germany and France what we see is that both Germany and France saw manufacturing indices backslide in September. In the queue standings, for both of the manufacturing sectors in Germany and France, we find lower queue positioning than for the euro area overall. This tells us that the relative strength of manufacturing in Germany and France is lagging behind the relative strength in the rest of the monetary union.

Looking at services we find a different situation. Germany's service sector is in the 74.2 percentile of its historic queue. That puts it above the euro area standing at 69.5. However, the standing for France is in the 63.6 percentile, below the queue standing for services in the Zone as a whole. We see that the service sector in Germany is pressing ahead faster than the services sector for the euro area. Not surprisingly, France a country that is still struggling to a large degree, has a service sector that is well behind Germany's and also significantly behind the average for the euro area.

Other PMI data today showed more substantial improvement in China's manufacturing sector than what had been expected. The Markit view of manufacturing in the United States, which is a diffusion report that comes out ahead of the ISM, showed a setback as the manufacturing gauge slipping to 52.8 in September from 53.1 in August on a preliminary basis.

The US, which came out of the gate in the wake of the financial crisis more strongly than Europe and sustained its expansion, has been losing some momentum after, Europe having slowed, is starting to regain its footing.

However, current US data trends are far from clear. The Philadelphia Fed's regional manufacturing survey showed a very sharply stepped-up pace of activity in September. We are going to be looking to see if other Federal Reserve regional manufacturing indices join in that exuberance. The Markit index suggests that the Philadelphia reading is going to be a lonely one this month.

Also pointing to weaker US data are the continued weak readings on consumer attitudes led by some sharp weakness in the U of M consumer sentiment reading whose preliminary gauge was shockingly weak, and by ongoing weekly weakness registered by the Bloomberg Consumer Comfort gauge. The Conference Board index has been slipping too.

By now everyone knows that the Federal Reserve used US weakness as an excuse to stay the hand of its tapering operation. We are hearing different descriptions of why this happened and what this means from various Fed officials. It's quite clear that those members on the committee who we tend to call `Hawks' are much more disappointed with the Fed's decision not to follow through on this tapering operation. Some think that tying the operation to incoming data is a mistake.

One thing is already very clear about the Fed is that is that having a conditional policy is creating problems for it in terms of actions and communications. With the ECB and Bank of England having adopted policies of forward guidance that essentially depend on the same sorts of unknown future events they would seem to face risks of the same sorts of flaky policy changes from those two central banks in the future.

Central banks never know what the future is going to be. They have knowledge of markets and economics; they have models to help gauge the future, but the real world timing of reactions to real world events sometimes tricks markets, tricks models and tricks policymakers trying to make policy decisions. The Fed apparently wanted to head toward ending quantitative easing when the economy's better-than-expected performance early in the year suggested economic resiliency to tax hikes and policy changes. No sooner had the Fed adopted its rosy view of the future then all that started to change. Now, with a considerably weaker economy and growing concerns about fiscal policy The US is back in the soup. Some Fed officials are still more concerned with this growing size of the Fed balance sheet than with the growing weakness in the economy. Some Fed members have the opposite set of concerns.

For the moment Europe seems to be like a new bright new and shiny penny with everybody seeing the good reflections in the recent data. But given time it will oxidize. Europe will come to realize that the glint we are seeing from the European economy may just be another passing phase. Europe has not fixed what's really wrong with it. The German elections are now behind us and Angela Merkel appears to have gathered a great deal of support. That's not to say that the people of Portugal, Spain and Greece are happy with that outcome. But it is what is. The question is that now, with this German election behind it, can Europe begin to deal with some of the real issues that it has only papered over in the past?

As it does this, how is the central bank going to react? Europe has no overarching fiscal policy and monetary policy in Europe has been working overtime to try to figure out ways to provide different levels of local accommodation. Every time the European central bank takes a step in that direction the Bundesbank takes a step to head it off.

In making policy or thinking about strategies that wrap around what policymakers are doing, we need to make sure that we have perspective in how we deal with incoming data. It's always true that the most recent data are the most important data; it's also true that the most recent data are the least reliable. We have to be aware that economic statistics can at times move in a direction that will be different from their ultimate trend. Therefore we must pay a great deal of attention to incoming data in order to understand why what we are seeing is happening.

US policy officials were fooled early in 2013 because the economy stayed stronger longer that they thought in the face of restrictive fiscal policy. The US economy appeared to be somewhat resilient; instead it was marking it's time to make its nosedive. And of course a revised GDP framework with new data eventually showed us that the economy wasn't doing quite so well although job data from that period still appear to be impressive.

The lesson from economics to be learned from this US experience by Europe is to remain skeptical of economic data that do things that appear to be inconsistent with the way you know the world should work. Maybe that's a lesson that Europe should be paying some attention to right now as its current economic data appear to show an economic revival. That revival is based on what? Will it really last?

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates