Global| Jun 13 2014

Global| Jun 13 2014EMU Trade Trends Give Us Pause

Summary

The current account surplus in the European Monetary Union increased slightly in April as imports fell more sharply than exports, which also fell. The recent report on EMU industrial production showed that the European Union is making [...]

The current account surplus in the European Monetary Union increased slightly in April as imports fell more sharply than exports, which also fell.

The current account surplus in the European Monetary Union increased slightly in April as imports fell more sharply than exports, which also fell.

The recent report on EMU industrial production showed that the European Union is making progress and seems to be in good shape. But now, another report, on this month's trade situation, sends the opposite signal. The trade report for the euro area in April raises many more questions than providing any reassurance.

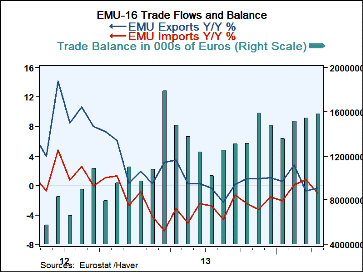

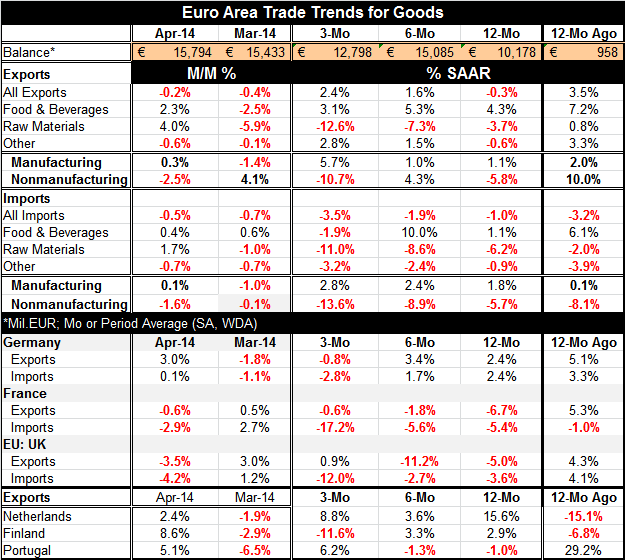

Exports are now falling for two months in a row. Imports are also down for two months in a row and imports have fallen more sharply. Export and import trends show that exports are gradually accelerating from a 12-month growth rate of -0.3% to a six-month growth rate of 1.6% to three-month growth rate of 2.4%. Export growth at 2.4% is weak but showing steady progress.

That's more than you can say for imports. Imports are falling at a 3.5% annual rate over three months. That's worse than its 1.9% annual rate drop over six months and worse than its 1% drop over 12 months. Imports are dropping at progressively faster rates. Imports do not decline like this when an economy is growing unless its growth is exceptionally weak. However, for a short time, exports and imports can react somewhat differently from underlying fundamental economic activity - but not for long. And sharp drops in imports are not likely except in exceptional circumstances. Imports can have separate cycles form domestic activity because of special trade interruptions or because of changes in inventory behavior. Exports, of course, are totally different from the domestic economy since exports are a product of a country/region's competitiveness and of the growth in the overseas markets to which the exports are being sent. Exports are more closely linked to foreign growth.

The biggest persistent declines in imports are from raw materials. That could reflect lesser domestic demand, because of weaker output or because stockpiles are satisfactory. On the export side, raw materials are also week. And so apart from demand issues when both exports and imports show the same weakness in raw materials, it could be prices that are creating this weakness in these flows.

Turning to manufacturing exports and imports, we see a slightly more reassuring pattern. For exports year-over-year growth rate is 1.1% and it is nearly the same at 1% over six months, then exports jump to a 5.7% annual rate over the most recent three months. Manufacturing imports show the biggest change from overall trends. The 12-month growth rate of 1.8% goes up to 2.4% over six months and a 2.8% over three months. It appears that manufacturing imports are behaving as you'd expect if the euro area were still growing and healthy.

There is weakness, however, in the nonmanufacturing sector for both exports and imports. Nonmanufacturing exports are lower by 5.8% over 12 months, up at a 4.3% annualized rate over six months and down at a 10.7% pace over three months. For imports is just grim weakness for nonmanufacturing goods: the growth rate starts at -5.7% over 12 months, drops to -8.9% over six months and plunges to a 13.6% rate of decline over three months.

Even though there is what appears to be solid growth in manufacturing imports, the pronounced weakness and nonmanufacturing goods is off-putting.

In the bottom half the table, we look at exports and imports for Germany, France and the UK and we look at export and import trends. For the Netherlands, Finland, and Portugal, we look at exports alone. These figures again are mostly reassuring, at least on exports. German exports are higher in April as are exports from the Netherlands, Finland and Portugal. However, over three months, German exports are declining as our French exports and Finnish exports with only the Netherlands and Portugal showing increases. The imports of Germany and France show weakness over three months with German imports falling at a 2.8% annual rate and French imports falling at an outsized 17.2% annual rate. The UK, a member of the EU but not of the EMU, shows declines in exports and imports in May, but over three months it shows a small 0.9% gain in exports as imports are falling at a 12% annual rate.

These trade results for Europe are somewhat of a mystery as we see that manufacturing trade seems to progressing in just fine, but overall trade shows a lot of weakness stemming from the nonmanufacturing portion of the economy. That weakness seems to be too abrupt to be explained by issues with commodity prices, or specifically oil prices. Nonetheless, that weakness is there. Other measures of the EMU's health, such as the recent industrial production report and the PMI gauges issued by Markit, continue to show relatively good growth for the Union as a whole. However, this trade report makes us want to look at European data with renewed scrutiny. Something isn't right.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates