Global| Jan 14 2013

Global| Jan 14 2013Encouraging Signs of Economic Growth from Leading Indicators

Summary

Except for "tail risks", those with a low probability, like failure to raise the debt ceiling, the economic fundamentals appear to be on the mend. The OECD calculates composite leading indicators (CLIs) for 39 countries*. Its CLIs [...]

Except for "tail risks", those with a low probability, like failure to raise the debt ceiling, the economic fundamentals appear to be on the mend. The OECD calculates composite leading indicators (CLIs) for 39 countries*. Its CLIs have proved to be reliable predictors of the course of economic activity. The latest data for November, 2012 were released today and can be found in the Haver database, OECDMEI. On balance, the data are encouraging. The CLIs in twenty-one countries are rising. They are falling in 13 countries and are essentially unchanged in five.

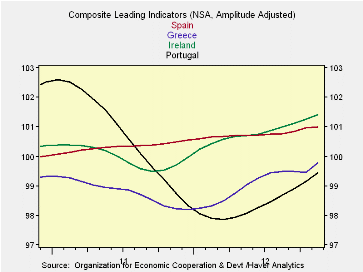

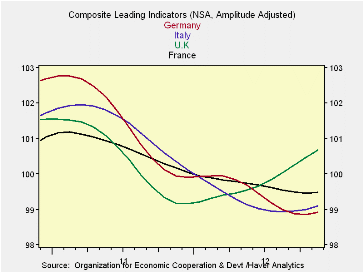

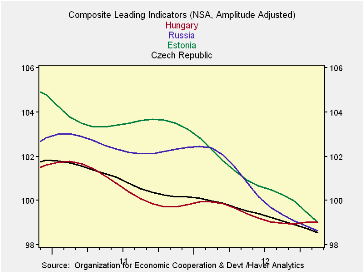

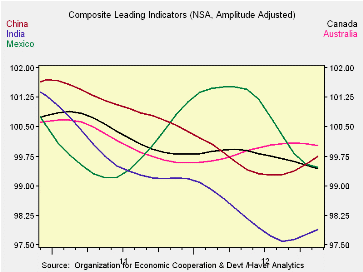

Some of biggest increases in the CLIs are found in the peripheral countries of the Euro Area--Spain, Portugal, Ireland and Greece--as can be seen in the first chart. Even the CLIs of the large countries of the Euro Area--Germany, France and Italy--are remaining steady or rising slightly. In contrast to the big Euro Area countries, the CLI for the U.K. is up sharply, as shown in the second chart. The economies of the Eastern European countries are still depressed and their CLIs continue to fall, as shown in the third chart. Finally, in the fourth chart, we show the CLIs for China, India, Australia, Canada and Mexico. The CLI for Mexico has taken a tumble while those for Australia and Canada have fallen slightly and those for China and India are up sharply.

* There are 40 countries in the OECDMEI data base, but not all the countries have all the component data. Iceland, for example, does not have the composite leading indicators.