Global| Aug 28 2009

Global| Aug 28 2009EU Commission Indices Surprise: Show a Real Turn Is in Progress

Summary

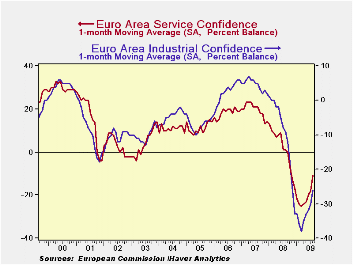

The EU Commission indices kicked out the jams this month with increases that left the economic forecasts standing in the dust wondering what happened. The overall commission sentiment index made its largest jump since at least 1988l [...]

The EU Commission indices kicked out the jams this month with

increases that left the economic forecasts standing in the dust

wondering what happened. The overall commission sentiment index made

its largest jump since at least 1988l lead by the industrial index’s

largest jump since 1988 and the service sector’s largest jump since it

began in 1996. While consumer confidence and retailing improved

month-to-month their respective rises were milder ranking as the 31st

best rise (out of 251 that is still not bad). The EMU overall index

made its second largest jump, The German sentiment index made its

largest jump along with the UK. The monthly rises for Italy and Spain

ranked about 20th in their respective histories. France did not report.

In terms of levels all sectors have a ways to go as sector

readings are negative in absolute terms.

In terms of the various indices standing in their respective

ranges compared to historic vales the EU index stands in the 36th

percentile of its range just above the boundary for the lower third of

its range. The EMU index Germany and Spain all stand around the 30th

percentiles of their respective ranges. The UK is better off in the

40th percentile of its range.

In terms of sectors, the relatively strongest sector is

retailing in the 41st percentile of its range followed by the consumer

confidence reading (35th percentile) and services (31st percentile).

The industrial sector stands in the 28th percentile of its range and

construction hovers in the bottom 13th percentile of its range.

For the most part these distinctions are not so important. All

the various indices stand well below the 50 percentile mark that

denotes the middle of their respective ranges. All are well below par.

All are well away from their respective range midpoints. If this were a

game of football none would have an insurmountable lead but the

construction sector (team) might consider resting its best players to

use another day…The good news this month is in how much the various

indices have risen and improved not about what strikingly high values

they have reached. These readings are still quite weak across sectors

and across EU and EMU reporting countries. The momentum, however, is

excellent.

| EU Sectors and Country level Overall Sentiment | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EU | Aug 09 |

Jul 09 |

Jun 09 |

May 09 |

%tile | Rank | Max | Min | Range | Mean | By

Queue Rank% |

R-SQ w/Overall |

Rank

of Change |

| Overall Index | 80.9 | 75 | 71.1 | 67.9 | 36.9 | 229 | 116 | 60 | 56 | 100 | -48.7% | 1.00 | 1 |

| Industrial | -26 | -30 | -33 | -34 | 28.3 | 236 | 7 | -39 | 46 | -7 | -53.2% | 0.90 | 1 |

| Consumer Confidence | -20 | -21 | -23 | -26 | 35.3 | 220 | 2 | -32 | 34 | -11 | -42.9% | 0.86 | 31 |

| Retail | -12 | -14 | -17 | -17 | 41.9 | 216 | 6 | -25 | 31 | -6 | -40.3% | 0.66 | 31 |

| Construction | -36 | -37 | -37 | -39 | 13.0 | 227 | 4 | -42 | 46 | -16 | -47.4% | 0.47 | 44 |

| Services | -11 | -19 | -23 | -26 | 31.7 | 145 | 32 | -31 | 63 | 14 | 5.8% | 0.89 | 1 |

| % m/m | Aug 09 |

Based on Level | Level | ||||||||||

| EMU | 6.1% | 3.8% | 4.3% | 80.6 | 30.5 | 230 | 117 | 65 | 53 | 100 | -49.4% | 0.95 | 2 |

| Germany | 6.3% | 4.1% | 4.3% | 85.9 | 28.0 | 218 | 121 | 72 | 49 | 100 | -41.6% | 0.70 | 1 |

| France | #N/A | 0.5% | 4.4% | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A |

| Italy | 4.5% | 4.4% | 1.4% | 87.5 | 37.0 | 222 | 122 | 67 | 55 | 100 | -44.2% | 0.83 | 20 |

| Spain | 3.7% | 5.2% | 2.0% | 81.9 | 30.5 | 223 | 117 | 67 | 50 | 100 | -44.8% | 0.74 | 19 |

| Memo: UK | 13.1% | 7.3% | 4.1% | 83.5 | 40.3 | 226 | 124 | 56 | 68 | 100 | -46.8% | 0.59 | 1 |

| Since Oct 1988 | 251 | -Count | Services: | 154 | -Count | ||||||||

| Sentiment is an index, sector readings are net balance diffusion measures | |||||||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates