Global| Sep 28 2007

Global| Sep 28 2007EU Growth and Inflation Conditions

Summary

Sentiment fell across the EU region in September. The drop was widespread but not severe. Consumer sentiment had the lowest absolute reading but retail sentiment fell the most in September, dropping by five points. Construction [...]

Sentiment fell across the EU region in September. The drop was widespread but not severe. Consumer sentiment had the lowest absolute reading but retail sentiment fell the most in September, dropping by five points. Construction sentiment bucked the trend and rose by one point. In EMU the top four countries saw sharp drops in confidence. The UK, an EU member, bucked that trend and saw sentiment rise by 1%. Across the largest EU member economies, Spain and Germany have the lowest relative sentiment readings in their ranges at 56% and 65% respectively.

Across EU it is clear that it is the consumer that is leading the slippage. The lowest relative rank among the confidence indicators is for services followed by consumer sentiment directly and by retailing. The industrial and construction readings are still above the average sentiment percentile reading for the month.

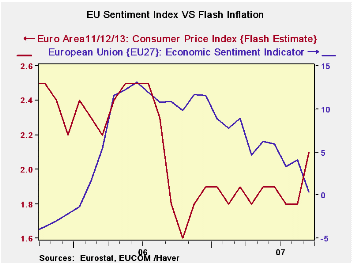

The accompanying chart shows that the slide in overall EU sentiment has been in progress for some time--since about mid-2006. It also shows that inflation has been moving lower steadily until this month when it suddenly shot up above the 2.0% ECB threshold to 2.1%.

Europe is in a dilemma. Not that 2.1% inflation is such a worry; but having inflation spurt while growth slides is a dilemma for a central bank. Since it is the first over-ceiling inflation observation in over a yea, I don’t expect the ECB to overreact to it. But the ECB has been on a bias to hike rates that it put off due to financial markets unrest and this could turn the bias into an actual rate hike. At the same the ECB must be mindful that the euro is high-valued and climbing. There has been squawking from various elements since the euro broke toward and above $1.40.

The ECB will have to puzzle out what risk it fears most. Is the strong euro enough to contain inflation and will it also cool growth obviating the need for a rate hike? Or will the ECB opt for the more direct approach and hike rates risking an even stronger move up by the euro and the risk to growth that such a move could bring?

We shall look for signs of tilting one way or the other on this issue from the various upcoming ECB spokesmen in the weeks ahead.

| EU Sectors and Country level Overall Sentiment | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| EU | Sep 07 |

Aug 07 |

Jul 07 |

Jun 07 |

%tile | Rank | Max | Min | Range | Mean | r-sq w/ Confid |

| Overall | 110.8 | 113.1 | 113.3 | 115 | 85.9 | 41 | 117 | 74 | 43 | 100 | 1.00 |

| Industrial | 3 | 5 | 5 | 7 | 88.2 | 19 | 7 | -27 | 34 | -7 | 0.90 |

| Consumer Confidence | -4 | -3 | -2 | -2 | 79.3 | 34 | 2 | -27 | 29 | -10 | 0.82 |

| Retail | 1 | 6 | 5 | 5 | 81.5 | 23 | 6 | -21 | 27 | -6 | 0.47 |

| Construction | 1 | 0 | 0 | 1 | 95.6 | 5 | 3 | -42 | 45 | -18 | 0.44 |

| Services | 20 | 22 | 20 | 21 | 68.4 | 58 | 32 | -6 | 38 | 17 | 0.80 |

| % m/m | Based on Level | Level | |||||||||

| EMU | -2.5% | -1.0% | -0.6% | -0.4% | 76.5 | 61 | 117 | 74 | 44 | 100 | 0.94 |

| Germany | -3.3% | -0.9% | -0.5% | -0.4% | 65.2 | 57 | 121 | 79 | 42 | 100 | 0.61 |

| France | -1.3% | -1.1% | 0.6% | 0.0% | 81.8 | 27 | 119 | 72 | 47 | 100 | 0.80 |

| Italy | -0.8% | -3.0% | -0.9% | -1.3% | 61.9 | 90 | 121 | 72 | 49 | 100 | 0.79 |

| Spain | -2.9% | 1.1% | -0.9% | 1.2% | 56.5 | 161 | 118 | 67 | 50 | 100 | 0.67 |

| Memo:UK | 1.1% | 4.5% | -5.7% | 1.6% | 92.9 | 6 | 119 | 69 | 50 | 101 | 0.38 |

| Since 1990 except Services(Oct 1996) | 208-Count | Services: | 126-Count | ||||||||

| Sentiment is an index, sector readings are net balance diffusion measures | |||||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates