Global| Jun 29 2010

Global| Jun 29 2010EU Sentiment Falls; EMU Sentiment Edges Higher

Summary

Sentiment among the Big Five EU countries saw improvements in three of those five. Set backs in June were experienced in the UK and in France. For France its the second drop in a row. After seeing drops in four of six of the largest [...]

Sentiment among the Big Five EU countries saw improvements in three of those five. Set backs in June were experienced in the UK and in France. For France its the second drop in a row. After seeing drops in four of six of the largest economies in May in the wake of the Greek crisis June reflects a strong and largely unexpected bounce back.

Sentiment among the Big Five EU countries saw improvements in three of those five. Set backs in June were experienced in the UK and in France. For France its the second drop in a row. After seeing drops in four of six of the largest economies in May in the wake of the Greek crisis June reflects a strong and largely unexpected bounce back.

Still German has the best sentiment among EU/EMU members with its sentiment gauge in the 69th percentile of its queue of values since Mid 1989. The UK ranks second best with a standing in the 39th percentile of its queue. Spains reading stands in the 17th percentile of its historic queue.

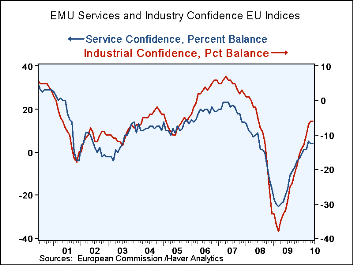

By economic measures the EU readings are weak across the board. The retailing and industrial measures are relatively the best with each standing in the 57th percentile of their respective queues.

The percentile of range readings are all higher than the percentile of queue measures. But the queue ranking percentiles are the better measure at this point because they place the current readings among all reading not just as a percentile between the highs and lows.

On balance the rebound in the EMU measure of sentiment surprised the market but the broader EU measure did slip. Europe is still on unsteady footing.

| EU Sectors and Country level Overall Sentiment | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| EU | Jun 10 |

May 10 |

Apr 10 |

Mar 10 |

%tile | Rank | Max | Min | Range | Mean | By Queue rank% |

| Overall Index | 100.1 | 100.2 | 101.9 | 99.8 | 68.2 | 142 | 115 | 68 | 47 | 100 | 43.4% |

| Industrial | -6 | -5 | -7 | -10 | 71.7 | 108 | 7 | -39 | 46 | -8 | 57.0% |

| Consumer Confid(e) | -17 | -15 | -12 | -14 | 44.1 | 207 | 2 | -32 | 34 | -11 | 17.5% |

| Retail | -5 | -4 | 0 | -4 | 64.5 | 107 | 6 | -25 | 31 | -6 | 57.4% |

| Construction | -32 | -30 | -28 | -29 | 21.7 | 202 | 4 | -42 | 46 | -18 | 19.5% |

| Services | 4 | 3 | 4 | 1 | 55.6 | 114 | 32 | -31 | 63 | 12 | 28.8% |

| %M/M | Jun 10 |

Based on Level | Level | ||||||||

| EMU | 0.3% | -2.2% | 2.8% | 98.7 | 61.5 | 149 | 116 | 71 | 46 | 100 | 40.6% |

| Germany | 0.4% | 1.1% | 4.3% | 106.2 | 68.0 | 77 | 121 | 75 | 46 | 100 | 69.3% |

| France | -2.3% | -3.5% | 2.0% | 96.6 | 50.3 | 169 | 119 | 74 | 44 | 100 | 32.7% |

| Italy | 1.5% | -3.9% | 1.5% | 97.2 | 53.5 | 162 | 120 | 71 | 50 | 100 | 35.5% |

| Spain | 2.6% | -4.3% | 1.2% | 90.9 | 43.0 | 208 | 116 | 72 | 44 | 100 | 17.1% |

| Memo:UK | -2.9% | 0.7% | 0.8% | 99.4 | 68.3 | 151 | 115 | 65 | 50 | 100 | 39.8% |

| All since Feb 1989 | 251 | -Count | Services: | 160 | -Count | ||||||

| Sentiment is an index, sector readings are net balance diffusion measures; Confid estimated | |||||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.