Global| Jan 14 2008

Global| Jan 14 2008Euro Area IP Slows on Broad Front

Summary

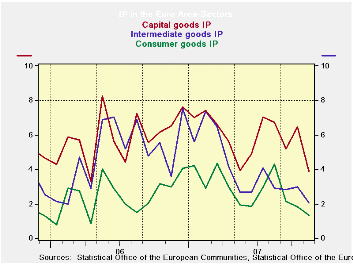

Industrial output is dropping in November and more than offsetting the rise in October that followed another drop in September. The chart shows that while industrial output trends are ragged across sectors they are also losing [...]

Industrial output is dropping in November and more than

offsetting the rise in October that followed another drop in September.

The chart shows that while industrial output trends are ragged across

sectors they are also losing momentum. Main EMU sectors are lower in

November and in the quarter-to-date (see table, final column). Still

for two of the three largest Euro Area countries, France and Germany,

IP was still advancing in Q2 even though it did fall in both those

countries in November. Spain’s sharp rise is no surprise since the

Spanish data are extremely volatile. The UK, an European Union member,

shows a slight drop in output in November and small decline two months

into the fourth quarter as well.

On Balance, the talk for Euro Area suggests that growth is not

the main worry there, while inflation is becoming more of a worry,

unlike the US cycle. Recent reports show that the 3-Month LIBOR premium

over the US discount rate has been evaporating as the successive TAF

auctions have been completed. So Europe may have less of a sense of

risk form the financial crisis that welled up related to sub-prime

loans and more at the end of last year. Still that is different from

saying that growth prospects there have improved. This morning the Euro

was strong and headed toward a new high vs dollar. It made a new high

vs sterling. Surely with the impact for such shifts in the pipeline

growth in the E-zone will not be enhanced. Nonetheless more of the ECB

members seem to be leaning toward agreeing that it is time to hike

rates.

| E-zone and UK IP and MFG | |||||||

|---|---|---|---|---|---|---|---|

| Saar except m/m | Mo/Mo | Nov-07 | Nov-07 | Nov-07 | |||

| Ezone Detail | Nov-07 | Oct-07 | Sep-07 | 3-Mo | 6-mo | 12-mo | Q-2-Date |

| Manufacturing | -0.6% | 0.5% | -1.3% | -5.4% | 1.0% | 2.2% | -1.3% |

| Consumer Goods | -0.2% | 0.2% | -1.4% | -5.6% | 0.1% | 1.3% | -1.8% |

| Consumer Durables | -1.9% | 0.0% | -3.7% | -20.5% | -4.5% | -3.1% | -- |

| Consumer Nondurables | 0.1% | 0.1% | -1.2% | -4.1% | 0.8% | 2.2% | -- |

| Intermediate Goods | -0.6% | 0.6% | -1.4% | -5.8% | 0.6% | 2.1% | -1.5% |

| Capital Goods | -0.7% | 0.9% | -1.3% | -4.1% | 4.0% | 3.9% | 0.7% |

| Main E-zone Countries and UK IP in MFG | |||||||

| Mo/Mo | 104.8 | 104.8 | 104.8 | ||||

| Memo: Manufacturing | 1-Mo% | 1-Mo% | 1-Mo% | 3-Mo | 6-mo | 12-mo | Q-2-Date |

| Germany | -0.9% | 0.2% | -0.1% | -2.9% | 2.7% | 4.5% | 2.0% |

| France: IP excl Construction | -1.5% | 2.1% | -1.3% | -3.0% | 0.8% | 2.5% | 2.5% |

| Italy | -1.4% | -0.6% | -1.7% | -13.9% | -5.3% | -3.9% | -9.3% |

| Spain | -6.2% | 10.2% | -6.8% | -13.6% | -7.7% | -0.7% | 13.2% |

| UK | -0.1% | 0.3% | -0.7% | -1.9% | -0.2% | 0.1% | -0.2% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.