Global| Mar 30 2007

Global| Mar 30 2007Euro-Zone Confidence Gains to Best Levels in 6 Years; Unemployment Reaches Record Low

Summary

We've been talking about the improving economic conditions in Europe, and today the EC reported still more evidence. On a day when US consumer sentiment was reported to be down again, that in Europe improved, and the overall [...]

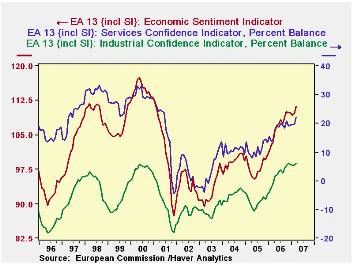

We've been talking about the improving economic conditions in Europe, and today the EC reported still more evidence. On a day when US consumer sentiment was reported to be down again, that in Europe improved, and the overall "sentiment indicator", which includes separate readings for various business sectors, gained 1.5 points to 111.2, the highest reading since January 2001. This index is based on a long-term average set at 100, so this reading is 11.2% "higher than average".

All the sectors contributed to the increase, although construction barely moved, going to 0.2 from 0.0 (these are "percent balance" measures, the percent of respondents with better conditions less that with worsening conditions). More distinctive changes came in industry, which increased from +5.4 in February to +6.1 in March. This reading ties with last November as the highest in the history of the survey, which runs back to 1985. Service businesses' confidence increased to 22.3 for March from 19.6 in February. Sentiment here has run much stronger than in other areas, with readings up in the 30's during the pre-2000 tech boom, so high as 22.3 sounds, it is not relatively as strong as other sectors. Retail trade moved to 0.0 from -1.1, but it had been above zero during much of 2006.

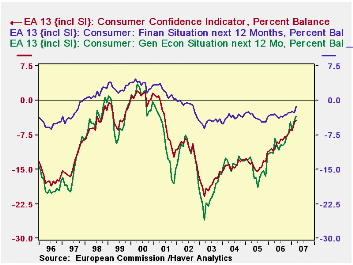

Consumer confidence remains negative at -4.4, but this is still the best level since the spring of 2001. People see the general economic situation as improving, unemployment declining and their own financial prospects also getting better. The only component of consumer confidence not moving favorably is planned savings, which dipped 0.2 to -7.8.

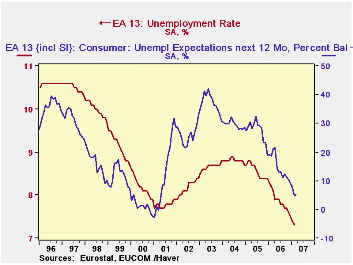

The unemployment situation as perceived by consumers runs close to the actual unemployment experience. That figure was reported today as well, for February. The harmonized rate for the Euro-zone EA13 edged down from 7.4% to 7.3%, the lowest in the 11-year history of these data. In fact, last November, the rate reached 7.6%, the first time it had been below 7.7%. And it's still improving.

| EA13 Business & Consumer Sentiment, SA | Mar 2007 | Feb 2007 | Jan 2007 | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Economic Sentiment Indicator (LT Avg = 100) |

111.2 | 109.7 | 109.2 | 103.5 | 106.9 | 97.9 | 99.2 |

| Industry (% Balance) | 6.1* | 5.4 | 5.4 | -0.7 | 2.3 | -7.3 | -4.7 |

| Services (% Balance) | 22.3 | 19.6 | 19.6 | 14.5 | 18.1 | 11.1 | 10.6 |

| Consumers (% Balance) | -4.4 | -4.8 | -6.5 | -11.0 | -9.0 | -13.8 | -13.9 |

| Unemployment Rate (%) | -- | 7.3* | 7.4 | 8.2 | 7.9 | 8.6 | 8.8 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.