Global| May 16 2017

Global| May 16 2017European Car Sales Plunged in April, Barely Holding Year-on-Year Gain; GDP Advances and the ZEW Survey Is Somewhat Mixed

Summary

Today was a big day for European data. I feature the auto sales data which surprised on the low side with a really weak performance. Auto sales and retail sales Sales for Europe as whole fell by 8.7% in April and now only rise by 0.6% [...]

Today was a big day for European data. I feature the auto sales data which surprised on the low side with a really weak performance.

Today was a big day for European data. I feature the auto sales data which surprised on the low side with a really weak performance.

Auto sales and retail sales

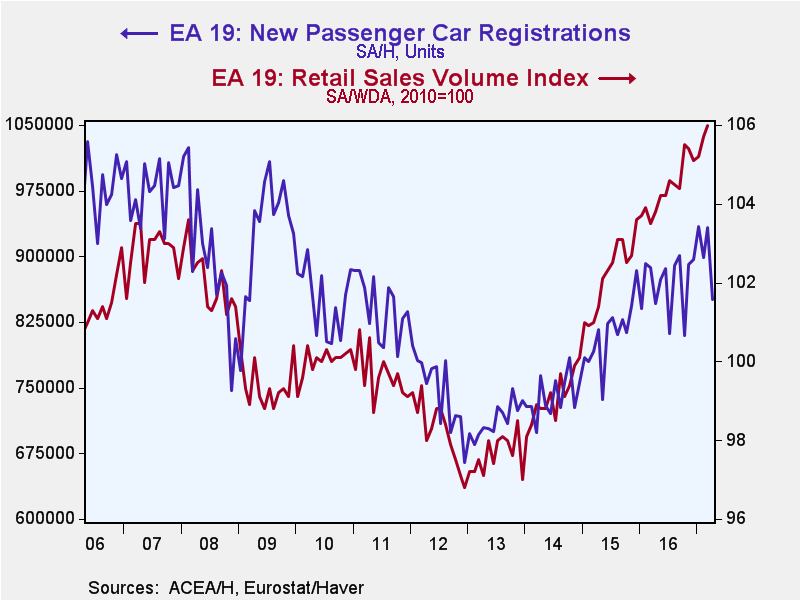

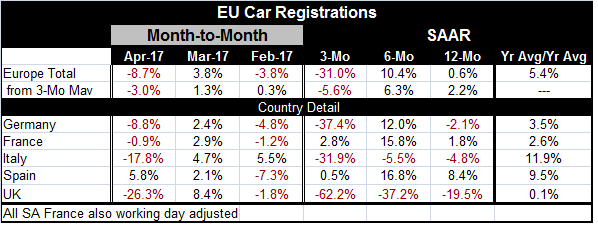

Sales for Europe as whole fell by 8.7% in April and now only rise by 0.6% over 12 months. However, if we smooth the series and calculate everything from three-month averages, the April (plus May plus June) drop is -3% (from March plus February plus January); the change from the three-month average of one year ago is a gain of 2.2%. That is an attempt to not over-weight or over-react to one month's weak report. But we will want to keep an eye on auto sales. Auto sales, as the chart shows, have weakened while retail sales continue to push higher. The chart is executed in terms of levels of real sales (for retail sales) and unit sales (for autos). Retail sales continue to mark new post-recession financial crisis highs. But auto sales are now stalling and the stall is not just this month's large set-back. Sales have started to gyrate more seriously over the past year, losing momentum.

Country by country weakness too

Moreover, in April sales fell in four of five individual country-reporters with Spain being the only one not reporting a sales drop in April. Germany, Italy and the U.K. have sales lower year-over-year while France logs a moderate year-on-year gain of 1.9%. Spain shows sales up by a hefty 8.4% over 12 months.

GDP trends

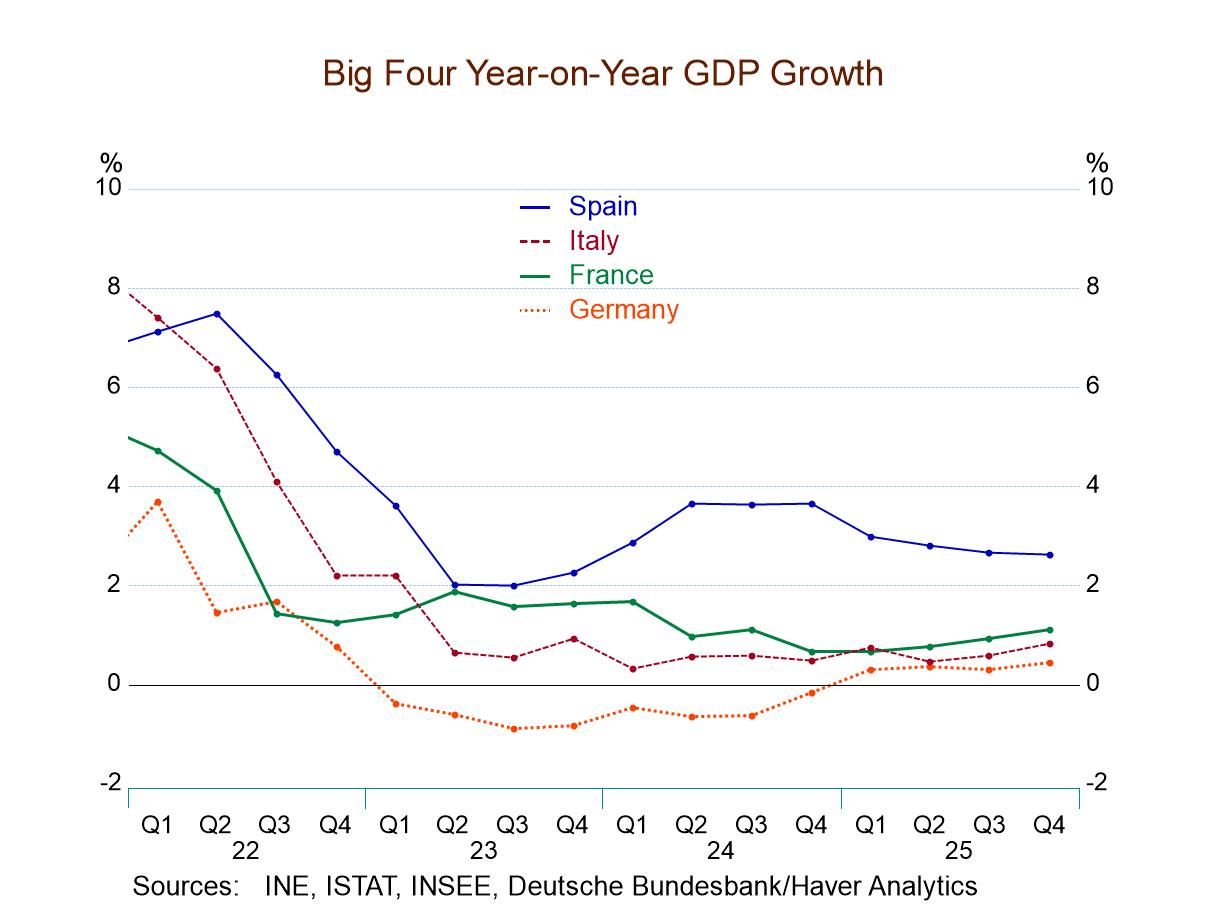

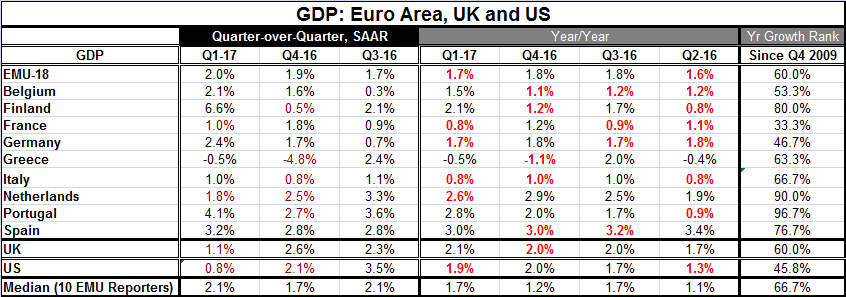

Also released today was a more comprehensive set of GDP growth results for the EMU. The GDP table below shows EMU GDP at a 2% quarterly annualized gain in Q1 2017, a step up from 1.9% in Q4 2016, but with a lower year-on-year rise of 1.7% in Q1 compared to 1.8% in Q4.

Country results and trends

In Q1 2017, GDP slowed in France and in the Netherlands. Year-over-year growth slowed for the EMU as a whole, in France, Germany, Italy, and the Netherlands. Greece logged its second quarter-to-quarter drop in GDP, prompting some to say that it is back in recession. Despite the drop, the GDP loss was smaller than in Q4 2016. Greece also has a year-over-year decline in GDP in Q1 2017 and in Q4 2016. On this basis, the year-over-year drop is also less in Q1. Greece's weakness is lingering, but it is not worsening.

The U.K.

The U.K. produced a slowdown for Q1 2017 as GDP growth decelerated to 1.1%, down from a 2.6% gain in Q4 2016. But U.K. GDP did speed up year-over-year to a 2.1% pace in Q1 from a 2.0% pace in Q4. As with the EMU, the U.K. annual vs. quarterly trend results are mixed.

Ranking by growth rates is reassuring

We rank all the EMU year-on-year growth rates since Q4 2009. On that basis, the Q1 rates are above their medians for this period everywhere except France (33rd percentile) and Germany (46th percentile). Growth in the EMU as whole is in its 60th percentile for the period. The Netherlands and Portugal have rates that have been higher less than 10% of the time while Finland's growth has been higher only 20% of the time. Generally speaking, these are good GDP numbers for the EMU and its members.

The view from ZEW

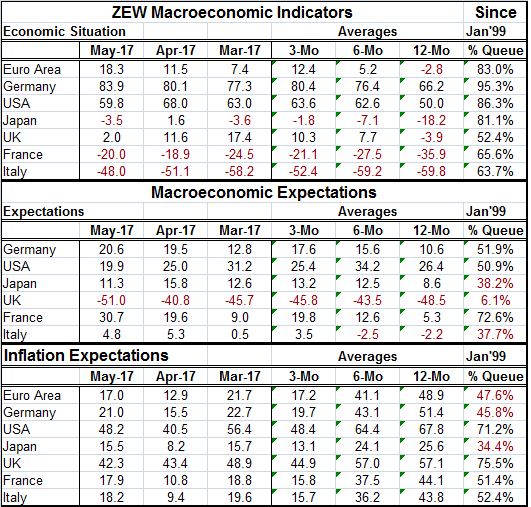

Germany's ZEW indexes were also released today and the ZEW table below summarizes their results. You can think of these as a sort of update to the GDP data as GDP data are up-to-date for Q1 and the ZEW data which are the results of the impressions of German financial experts are up-to-date through May, two-thirds of the way through the next quarter.

ZEW: The economic situation

The ZEW experts find that the economic situation in the EMU has improved in May to a net reading of 18.3 compared to 11.5 in April and 7.4 in March at the end of Q1. The German index has continued to move up, but more modestly. The French index has a net negative reading and back tracked in May but is still improved in May relative to its March reading. Italy's reading is negative as well but has been slowly improving and also stands above its March level. The U.K. continues to see its current situation erode as it stands at a 2.0 reading in May, compared to 17.4 at the end of March.

The economy in relative terms

We also provide percentile standings for the gauges; they find Germany with highest relative standing at its 95th percentile since January 1999. The euro area as a whole has an 83rd percentile standing. France and Italy have middle 60th percentile standings. Despite its erosion, the U.K. still has an above median 52nd percentile reading. More globally, Japan's index has improved slightly since end-March while the U.S. index is lower. Japan and the U.S. both have mid-to-low 80th percentile standings.

ZEW expectations

Looking farther ahead, there are lower macroeconomic expectations. Some changes are positive for several countries, but the levels for expectations are generally below those for the current situation. These results find a strong improvement for Germany, a large gain for France and some bump up for Italy. On this timeline from March onward, the U.S. index erodes significantly while the U.K. undergoes some moderate erosion and Japan has some small slippage. Expectations are far less up-beat than the current assessments in relative terms. France has the highest queue standing in its expectations since January 1999 with a 72nd percentile standing. Germany comes in with a near 52nd percentile standing and the U.S. is near a 51st percentile standing. Italy and Japan have weak standings in their high 30th percentile ranges while the U.K. standing has been worse only about 6% of the time. Brexit fears continue to weigh on the U.K.

Inflation and expectations

The U.K., in fact, has just reported out a 2.7% inflation rate. But the U.K. economy is weakening and expectations are quite weak. About 9,000 banking jobs are set to leave London. The U.K. is going to have an exogenous negative shock and may not have to make any policy changes to bring inflation back into line. While inflation in the U.S. has flared, it has settled down quickly as oil prices abated. Still, ZEW experts have U.S. and U.K. inflation expectations in about the top quarter of their queue for this period. Conversely, a U.K. wage survey just showed very tempered wage expectations in the U.K. And in the U.S., the University of Michigan inflation expectations index is within a stone's throw of its all-time lows in a number of its key metrics. Europeans (ZEW Financial experts) seem to be skeptical of the ability of those outside of Europe to take care of their own business. Meanwhile, euro area inflation is expected at its 47th percentile just below the median for expectations since 1999. Expectations for Germany are in the 45th queue percentile and French expectations are in their 51st percentile. The ZEW experts do not see Japan getting out of its rut and Japanese inflation expectations are rated as lower only about one-third of the time since 1999.

Summing up

It was day of a lot of European and global data. In addition, not all the reports for the day are summarized above. One added report found that the euro area declared a wider trade surplus in March, something certain not to make the Trump administration very happy. There are a lot of dislocations and disequilibrium situations in the global economy. A lot of them could be solved by export-led growth, but not all once unless we have learned how to export to Mars. Trade has been the lynchpin for growth in many areas, but with the Trump administration now watching like a hawk and demanding fair trade after the U.S. has absorbed such huge and unrelenting deficits in the wake of Bretton Woods, that vigilance will make it harder on everyone to generate growth. But that doesn't make the U.S. the bad guy. What it means is that all this unfair trading will have to come to a stop and countries are going to have to generate their own domestic demand.

Yesterday's IMF mission report on Germany is good example. In that report, the IMF urged Germany to engage in more public spending and lift wages and spur domestic demand. With such a low unemployment rate, the advice seems peculiar and is likely to be ignored and distained by the Germans. Faced with the same situation, the Fed in the U.S. is trying to do just the opposite to oppose fiscal expansion and raise rates. It would seem the state of economics and of economic advice-giving has never been more confused than it is today. There are a lot of problems to be fixed globally and a lot of old ways of operating that must be changed. And these demands would seem set to keep us all on the road for weak growth for some time to come. Optimists repent.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.