Global| Sep 24 2003

Global| Sep 24 2003Falling Exports Reduce Euro-zone Current Account

Summary

The current account in the Euro-Zone is eroding this year. Monthly surpluses are mostly smaller than in 2002 and two months of 2003, April and July, have not had surpluses at all. This recent pattern reverses an up-trend in the [...]

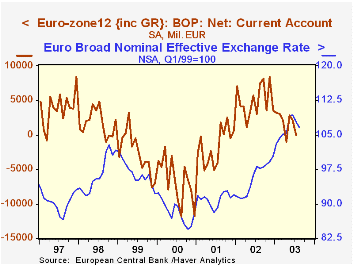

The current account in the Euro-Zone is eroding this year. Monthly surpluses are mostly smaller than in 2002 and two months of 2003, April and July, have not had surpluses at all. This recent pattern reverses an up-trend in the balance that had been in place from early 2001 to late last year.

Exports of goods are a main source of the downturn in the balance. They flattened almost immediately with an upturn in the euro currency in 2001, and began to fall last November. The decline has been moderate, but persistent. It is visible in nearly every country's individual trade and GDP data. In more recent months, exports of services have crept lower as well. In this current account compilation, the balance on income has also been ratcheting lower, and the most recent data show a large volume of external transfers, worsening the overall current account position in July.

The offsetting financial flows have individually shown little distinct trend, making it hard to identify the factors generating overall capital movements. Portfolio investment has perhaps drifted a bit lower on balance, but direct investment, "other" investment (i.e., bank loans, repo transactions, etc.), and derivative flows have each been very erratic on a monthly basis. There is some hint of a rising capital account trend that is tending to counter the decline in the current account; the "capital account" covers transactions in fixed assets and intangible assets, such as patents. Thus, while a strong euro seems to have had an identifiable impact on current account activity, it has not particularly reflected the sustained inflows of capital funds that might be expected to accompany a steeply rising currency.

| Euro-Zone Balance of Payments (Billions of Euros) | July 2003 | June 2003 | May 2003 | Annual Average

|---|---|---|---|

| 2002 | 2001 | 2000 |

| Balance on Current Account | 0.0 | 2.1 | 2.8 | 5.0 | -1.6 | -6.7 | |

|---|---|---|---|---|---|---|---|

| Balance on Capital Account | 0.8 | 2.3 | 0.4 | 1.0 | 0.8 | 1.0 | |

| Net Direct Investment | -3.6 | 24.0 | -0.2 | 1.7 | 3.2 | 1.3 | |

| Net Portfolio Investment | -35.3 | 12.9 | 8.0 | 4.8 | 6.8 | 10.1 | |

| Net "Other" Investment | 34.1 | -39.6 | -39.6 | -15.9 | -0.1 | 15.4 | |

| Errors & Omissions | 4.1 | 16.0 | 29.1 | 5.1 | 2.9 | -0.6 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates