Global| Nov 01 2005

Global| Nov 01 2005Fed Funds Rate Raised to 4.00% and Going Higher?

by:Tom Moeller

|in:Economy in Brief

Summary

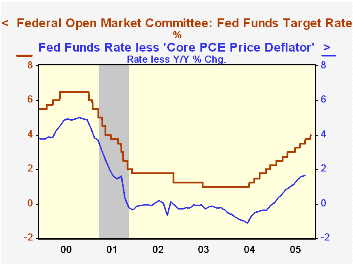

The Federal Open Market Committee's unanimous decision to increase the target rate for federal funds 25 basis points to 4.00% was widely expected by analysts. The discount rate also was raised 25 basis points to 5.00%. This latest [...]

The Federal Open Market Committee's unanimous decision to increase the target rate for federal funds 25 basis points to 4.00% was widely expected by analysts. The discount rate also was raised 25 basis points to 5.00%. This latest increase was the twelfth since June of 2004.

Today's press release from the Fed focused on the effects of higher energy prices. "Elevated energy prices and hurricane-related disruptions in economic activity have temporarily depressed output and employment."

The FOMC statement further indicated, as it did in September, that "The cumulative rise in energy and other costs have the potential to add to inflation pressures ..."

For the complete text of the Fed's latest press release please click here.

Implementing Monetary Policy, a March 2005 speech by then Fed Governor Ben S. Bernanke is available here.

ISM Index Firmer Than Expected, Pricing Upby Tom Moeller November 1, 2005

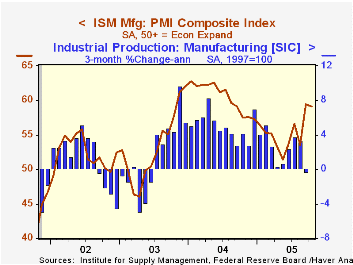

The October Composite Index of activity in the manufacturing sector remained unexpectedly firm at 59.1, reported the Institute of Supply Management (ISM). The modest decline from 59.4 in September contrasted with Consensus expectations for a drop to 57.0. The last two months have been the highest for the index since the Summer of last year.

During the last twenty years there has been a 64% correlation between the level of the Composite Index and the three month growth in factory sector industrial production.

Three of the index's five components fell in October. New orders gave back 2.1 of the 7.4 point September rise but remained at the second highest level of the year. Production gave back just 1.1 of the 7.2 point spike in September, also to remain at the second highest level of 2005 and inventories also fell to the middle of recent months' range.

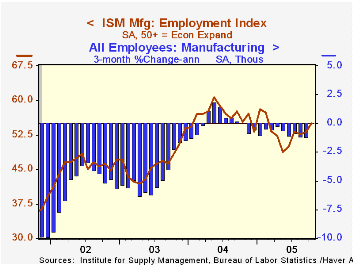

Job creation in the factory sector improved as indicated by a rise in the employment index to the highest level since February. During the last twenty years there has been a 67% correlation between the level of the ISM Employment Index and the three month growth in factory sector employment.

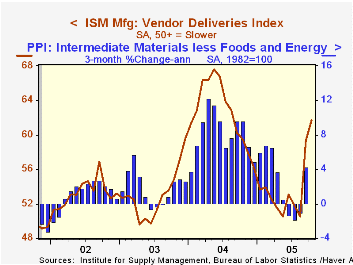

The vendor deliveries index, indicating that the pace of vendor deliveries slowed, rose 2.4 points on top of an 8.8 point September rise to the highest level in over one year. During the last ten years there been an 82% correlation between the index and the three month change in the core PPI for intermediate materials.

Improved pricing power in the factory sector was further indicated by a 6.0 point rise in the prices paid index to the highest level since May of last year. Seventy percent of those surveyed indicated success in raising prices, the highest since May '04, while just two percent reported lower prices. From the ISM's latest Report of Business, respondents indicated "We are seeing an increase in the number of chemical products being placed on allocation and order control." (Chemicals), "Concern over the price of oil and its effect on the future prices of commodities. Existing inventories are being depleted and we are seeing some significant price increases in some commodities." (Electronic Components & Equipment), "Most price increase letters I have ever seen." (Instruments & Photographic Equipment) and "Refrigerated freight a significant issue - unable to find available trucks. Sugar prices are skyrocketing." (Food)

The Global Saving Glut and the U.S. Current Account Deficit, an April 2005 speech by then Fed Governor Ben S. Bernanke is available here.

| ISM Manufacturing Survey | Oct | Sept | Oct '04 | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Composite Index | 59.1 | 59.4 | 57.5 | 60.5 | 53.3 | 52.4 |

| New Orders Index | 61.7 | 63.8 | 59.3 | 63.5 | 57.9 | 56.5 |

| Prices Paid Index (NSA) | 84.0 | 78.0 | 78.5 | 79.8 | 59.6 | 57.6 |

by Tom Moeller November 1, 2005

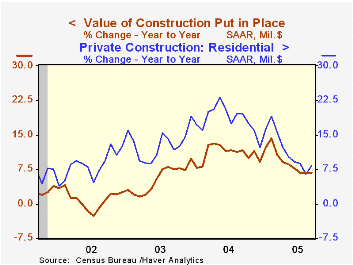

The value of construction put in place matched Consensus expectations for the second month in a row and rose 0.5% in September following an upwardly revised 0.6% gain in August.

Private building activity increased 0.6%. Residential building jumped 1.0% as new single family building surged 1.4% (10.5% y/y) though the value of residential improvements fell 0.2% (-1.0% y/y), the seventh consecutive monthly decline.

Nonresidential building activity fell 0.3% after a 2.1% spike in August due to less commercial sector spending where auto industry outlays fell 4.4% (+9.6% y/y). Office construction surged 3.8% (12.2% y/y) after upwardly revised, small gains in the prior three months.

Public construction spending fell slightly due to a 0.9% (+19.7% y/y) decline in construction activity on highways & streets, nearly one third of the value of public construction spending.

These more detailed categories represent the Census Bureau’s reclassification of construction activity into end-use groups. Finer detail is available for many of the categories; for instance, commercial construction is shown for Automotive sales and parking facilities, drugstores, building supply stores, and both commercial warehouses and mini-storage facilities. Note that start dates vary for some seasonally adjusted line items in 2000 and 2002 and that constant-dollar data are no longer computed.

| Construction Put-in-place | Sept | Aug | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Total | 0.5% | 0.6% | 6.8% | 10.9% | 5.4% | 1.0% |

| Private | 0.6% | 0.7% | 6.2% | 13.6% | 6.3% | -0.4% |

| Residential | 1.0% | 0.1% | 8.2% | 18.2% | 12.9% | 8.5% |

| Nonresidential | -0.3% | 2.1% | 1.4% | 3.9% | -5.4% | -13.0% |

| Public | -0.0% | 0.4% | 9.0% | 2.5% | 2.7% | 5.7% |

by Tom Moeller November 1, 2005

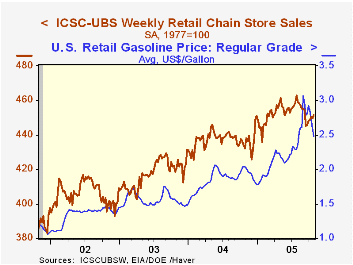

Lower gasoline prices helped raise spending at chain stores. Last week, the retail average price of regular gasoline in the U.S. fell 12 cents for the second consecutive week to $2.48 per gallon (+21.9 y/y). Since the early September peak of $3.07, retail prices are down 19.2% and a 12 cent decline in yesterday's spot market price for gasoline suggests another drop this week.

With a 0.4% rise at the end of October, chain store sales rose for the fifth time in the last six weeks according to the International Council of Shopping Centers (ICSC)-UBS survey. The gains were enough to pull the month's average sales level up 0.1% from September which fell 1.7% from August.

During the last ten years there has been a 56% correlation between the y/y change in chain store sales and the change in non-auto retail sales less gasoline, as published by the US Census Department. Chain store sales correspond directly with roughly 14% of non-auto retail sales less gasoline. The leading indicator of chain store sales from ICSC was unchanged w/w during the latest week (-2.2% y/y) following a 0.9% spurt the prior week.The ICSC-UBS retail chain-store sales index is constructed using the same-store sales (stores open for one year) reported by 78 stores of seven retailers: Dayton Hudson, Federated, Kmart, May, J.C. Penney, Sears and Wal-Mart.

Oil Price Shocks and Inflation from the Federal Reserve Bank of San Francisco is available here.

| ICSC-UBS (SA, 1977=100) | 10/29/05 | 10/22/05 | Y/Y | 2004 | 2003 |

|---|---|---|---|---|---|

| Total Weekly Chain Store Sales | 451.6 | 449.7 | 4.4% | 4.6% | 2.9% |

by Louise Curley November 1, 2005

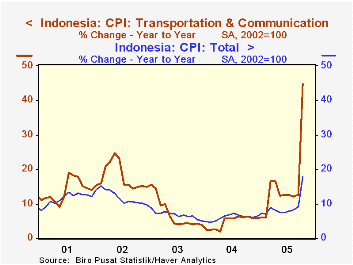

Inflation in Indonesia rose almost 18% in October largely as a result of government action on October 1, reducing subsidies on petroleum related products. Kerosene prices, for example, almost tripled and diesel prices doubled. The hardest hit components of the consumer price index were transportation and communication, showing a year-over-year rise of almost 45% and foodstuffs, 18%. The first chart shows the year-over-year change in the total index and in the transportation and communication component.

A major reason for the government's action in reducing the subsidies was the growing cost and its impact on the budget balance. In the first nine months of this year expenditures were about 20% above those of the corresponding period of last year. This increase follows one of 16.2% for all of 2004 and 14.5% for 2002 and only 1.3% for 2001.

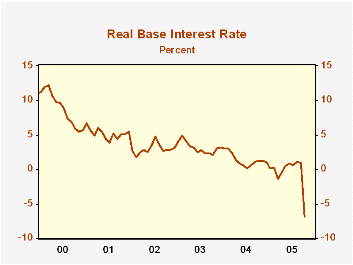

Following the announcement of the spike in inflation, the Central Bank raised the one month bill rate 125 basis points from 11% to 12.25%. The real base interest rate (nominal value less the rate of inflation) is shown in the second chart. The real rate has declined substantially over the past five years, from 12% in 2000 to zero or slightly negative values in several recent months. The October real rate is almost -7% in spite of the hefty rise in the nominal rate.

| Indonesia | Oct 05 | Sep 05 | Oct 04 | M/M % | Y/Y % | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|---|

| Consumer Price Index (2002=100) | 136.16 | 125.23 | 115.20 | 8.73 | 17.90 | 6.06 | 6.79 | 11.91 |

| Foodstuffs | 128.58 | 120.84 | 108.97 | 6.41 | 18.00 | 5.89 | 0.90 | 11.21 |

| Transportation and Communication | 164.61 | 127.40 | 113.73 | 29.21 | 44.74 | 4.78 | 6.95 | 17.61 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates