Global| May 11 2006

Global| May 11 2006First Q1 GDP Releases Show Signs of Life in Europe

Summary

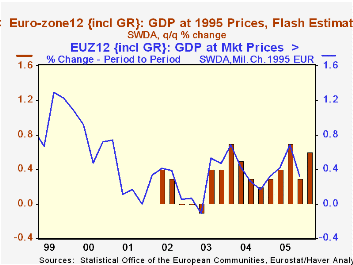

GDP growth picked up in the first quarter for the EuroZone and several individual countries.Eurostat reported this morning that GDP in the EuroZone grew 0.6% over Q4 following 0.3% in that period. The year/year gain was 2.0% from Q1 [...]

GDP growth picked up in the first quarter for the EuroZone and several individual countries.Eurostat reported this morning that GDP in the EuroZone grew 0.6% over Q4 following 0.3% in that period. The year/year gain was 2.0% from Q1 2005. This is the best since Q2 2004.

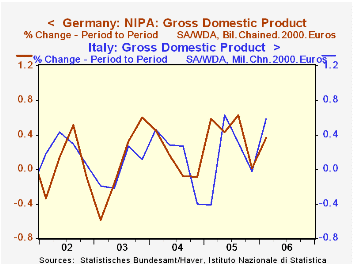

No details are presented in this "flash" estimate, but totals for several constituent countries are available. Germany reported growth of 0.4% in Q1 after no change in Q4. Its yearly growth rate was 1.4%. The German Federal Statistics Office described that a rebound in consumption was the spur to Q1 growth, after its outright decline in Q4. The data for this and other components will be released May 23.

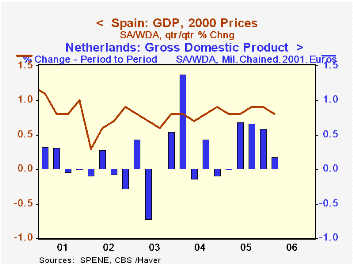

Similarly, Italy's growth bounced by 0.6% after its flat performance in Q4. This produced a 1.5% gain from Q1 2005, the largest increase since Q2 2001. In Spain, growth has been on a much firmer track generally, and it actually ticked down in Q1 to 0.8% from 0.9% in Q4. This still, however, maintained the recent 3.5% year/year pace.

Growth slowed in the Netherlands, to 0.2% from 0.6% in Q4; however, the last three quarters were all at a moderately firm rate, yielding year-on-year growth of 2.1% in Q1, one of the strongest yearly increases since the late 1990s boom period.

The improvements in most of these growth rates seem to confirm the EC Commission's optimism in its latest forecast issued Monday and discussed here by Louise Curley. The Commission raised its outlook for the EuroZone12 by 0.2 percentage points to 2.3% for the year 2006. In the actual Q1 data reported today, perhaps the most important single factor is the gain in Germany; we await the specific figures for private consumption on May 23, but increased spending by the people of Europe's largest nation has to be a help to the entire region. It is all the more significant in light of the accelerating cost of energy.

| GDP | Q1 2006 | Q4 2005 | Q3 2005 | Q1 2005 | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|

| EU - Flash | 0.6 | 0.3 | 0.7 | 2.0 | 1.4 | 1.8 | 0.7 |

| Germany | 0.4 | 0.0 | 0.6 | 1.4 | 1.2 | 1.1 | -0.2 |

| Italy | 0.6 | -0.0 | 0.3 | 1.5 | 0.1 | 0.9 | 0.1 |

| Spain | 0.8 | 0.9 | 0.9 | 3.5 | 3.4 | 3.1 | 3.0 |

| Netherlands | 0.2 | 0.6 | 0.7 | 2.1 | 1.1 | 1.7 | -0.1 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates