Global| Oct 08 2008

Global| Oct 08 2008FOMC at Emergency Meeting Cut Funds Rate to 1.5%; Other Signs of Monetary Ease

by:Tom Moeller

|in:Economy in Brief

Summary

At an emergency meeting, the U.S. Federal Open Market Committee lowered the federal funds rate by 50 basis points to 1.5%. The move was an action coordinated with the Central Banks of Europe and Japan. The Fed indicated that "the move [...]

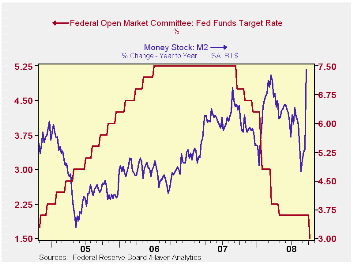

At an emergency meeting, the U.S. Federal Open Market Committee lowered the federal funds rate by 50 basis points to 1.5%. The move was an action coordinated with the Central Banks of Europe and Japan. The Fed indicated that "the move was necessary because of the worsening crisis in global financial markets."

The decision was unanimous amongst FOMC members.

The action by the Fed brought the funds rate to its lowest level since mid-2004. The discount rate was also lowered by 50 basis points to 1.75%.

For the complete text of the Fed's latest press release please follow this link.

In another other sign of monetary easing, the Fed took steps this week that could make trillions of dollars available by lending directly to nonfinancial corporations.

The other tool which the Fed is using to inject liquidity into the market is reflected by the monetary aggregates. Growth in the monetary base has accelerated to 10.9% from 2.0%. M1 growth has risen to 8.3% from 2.3%; M2 growth rose to 7.4% from 5.6%.

Liquidity Crisis from the Federal Reserve Bank of Philadelphia can be found here.

| Current | Last | September '07 | 2007 | 2006 | 2005 | |

|---|---|---|---|---|---|---|

| Federal Funds Rate, % (Target) | 1.50 | 2.00 | 4.94 | 5.02 | 4.96 | 3.19 |

| Discount Rate, % | 1.75 | 2.25 | 5.53 | 5.86 | 5.95 | 4.18 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates