Global| Nov 01 2017

Global| Nov 01 2017FOMC Leaves Rate Unchanged but December Hike Likely

by:Sandy Batten

|in:Economy in Brief

Summary

At today's meeting of the Federal Open Market Committee, the target for the federal funds rate was left unchanged at 1.00%-1.25%. This was the third consecutive meeting at which the rate target had been held steady with the last rate [...]

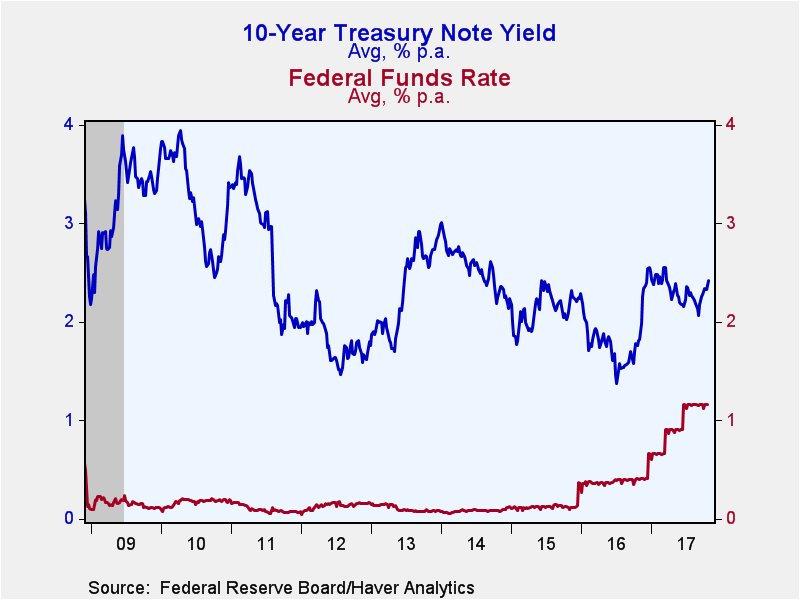

At today's meeting of the Federal Open Market Committee, the target for the federal funds rate was left unchanged at 1.00%-1.25%. This was the third consecutive meeting at which the rate target had been held steady with the last rate change being a 25-bp increase at the June 13-14 meeting. There have been two 25-bp increases so far this year. The financial market had not expected a policy change at today's meeting. Of the 16 market analysts surveyed by Action Economics last week, none expected a rate change today. And the probability of no rate change today calculated by the CME FedWatch tool (from prices of fed funds rate futures) was 98.5%.

There was no press conference scheduled for after this meeting. So, all views on FOMC thinking are derived from the released statement, which was largely the same as the one released after the September 19-20 meeting.

The FOMC continued to state that "The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate." Nevertheless, the Fed reiterated that the "stance of monetary policy remains accommodative" and that the funds rate will "likely remain for some time below levels that are expected to prevail in the longer run."

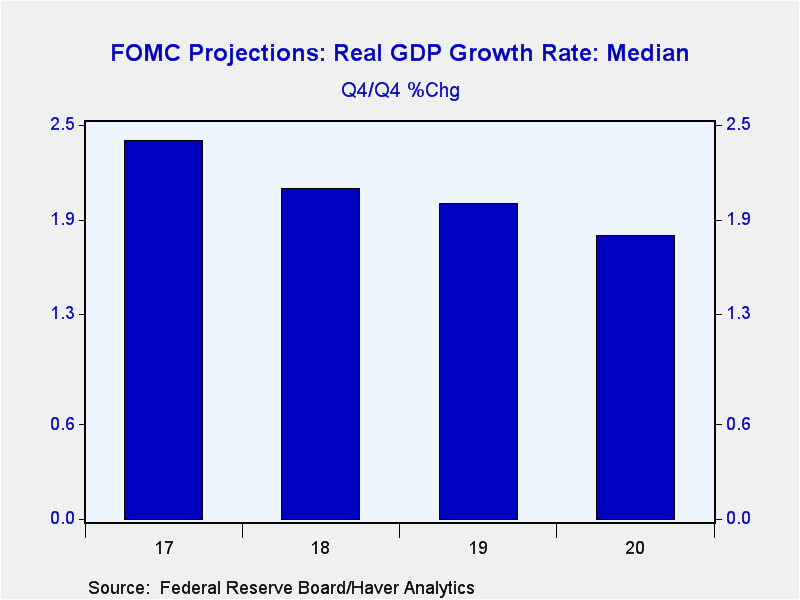

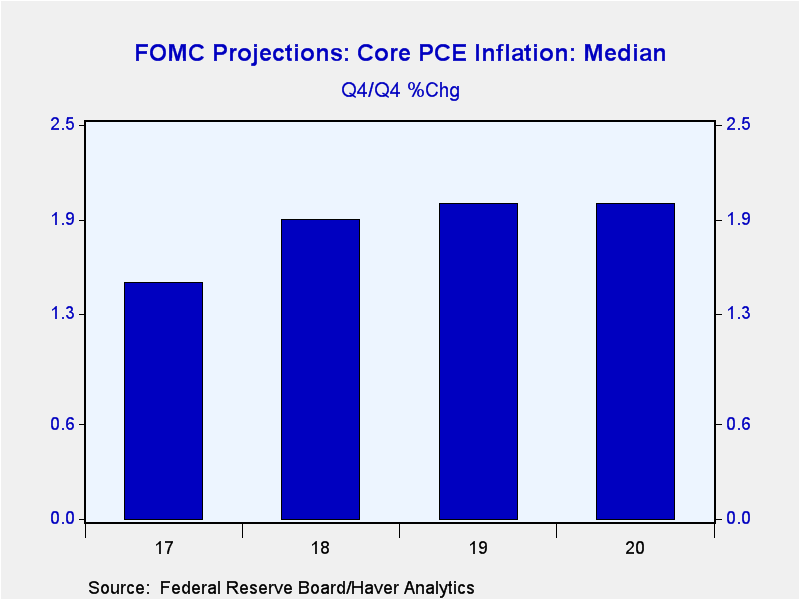

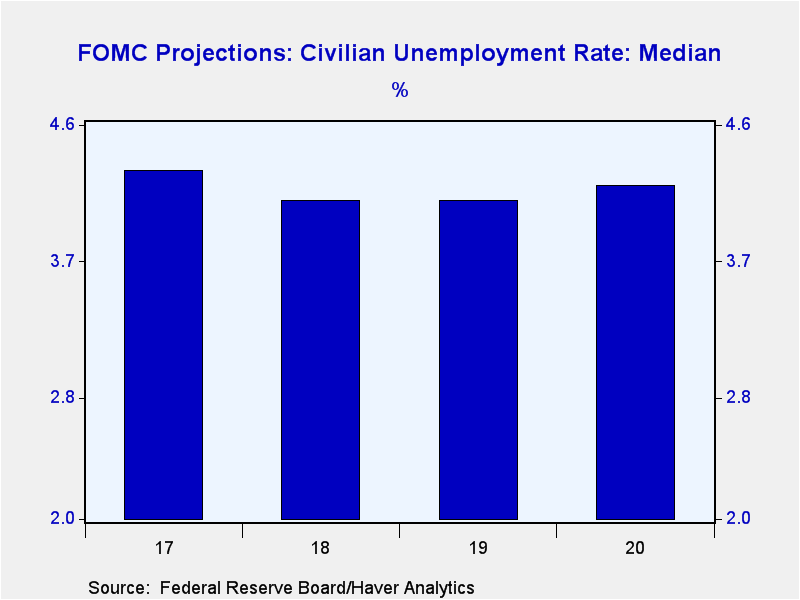

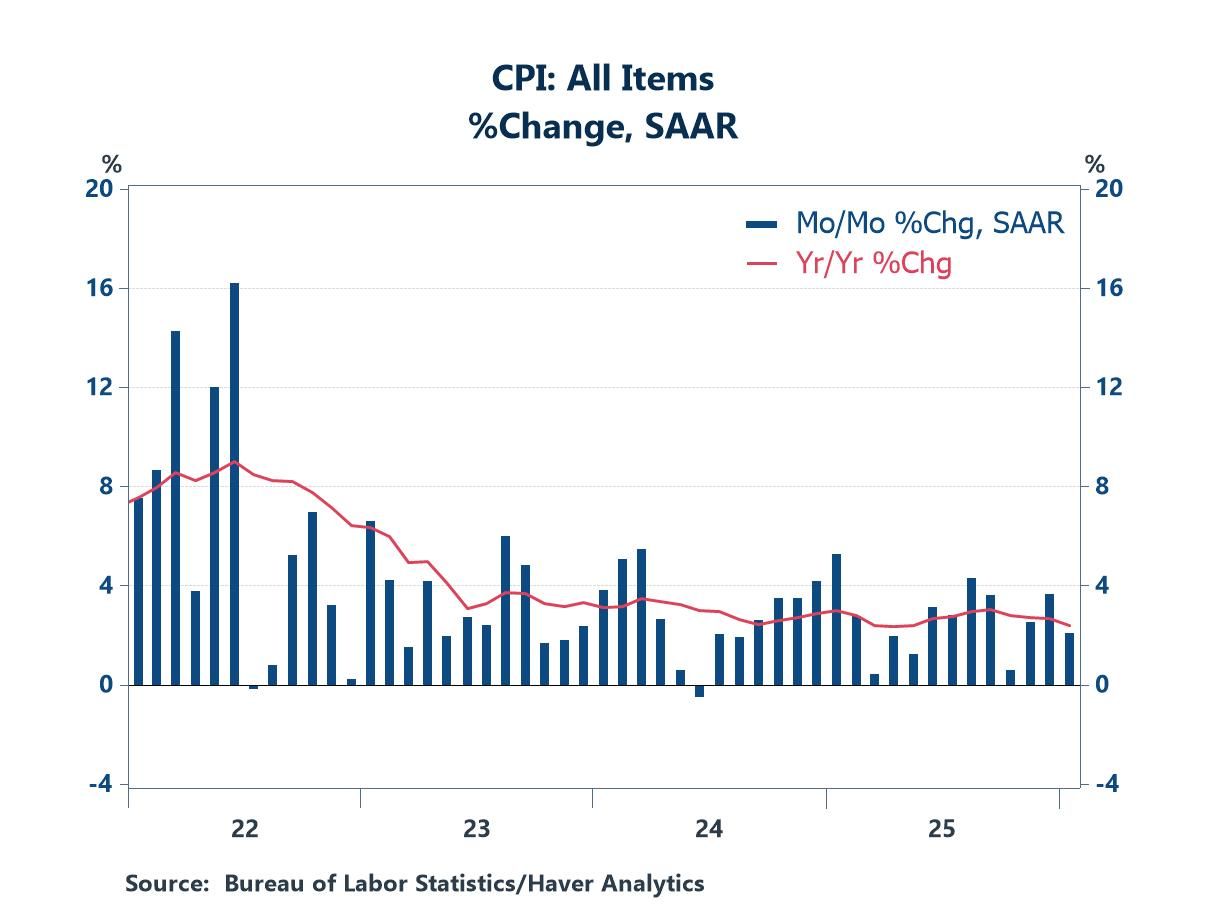

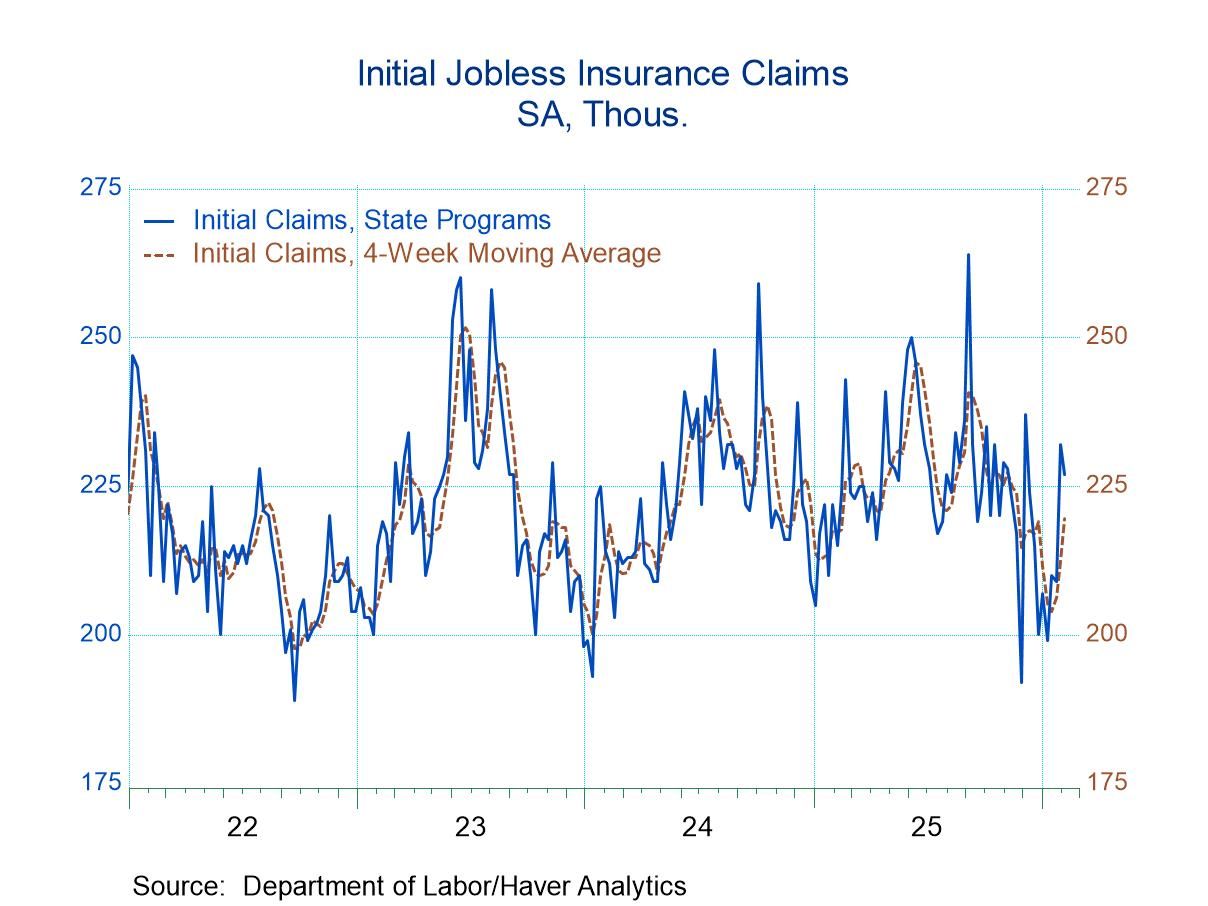

Despite temporary hurricane-related disruptions, the economy has been rising at a "solid" rate (this is the first time in more than two years that the Fed has used "solid " to characterize growth and represents an upgrade) and the labor market has continued to strengthen. Moreover, as in several previous statements, the FOMC expects economic growth to continue at a moderate pace and labor markets to strengthen further. Price inflation has risen in the wake of the hurricanes, though inflation for items other than food and energy has remained "soft." In general, inflation on a 12-month basis is "expected to remain somewhat below 2% in the near term but to stabilize around the Committee's 2% objective over the medium term."

The Fed indicated that its balance sheet normalization program was proceeding.

Though the FOMC made no explicit mention of possible monetary policy action at its next meeting (December 12-13), it clearly expects to continue to normalize policy. In the economic projections released after the September 19-20 meeting, the median outlook by the FOMC for the fed funds rate target at the end of 2017 was 25 bp higher than the current target. So, given an essentially unchanged outlook for the economy since that meeting, it would seem that the Committee anticipates another 25-bp increase in the funds rate target in December. Indeed, all 16 of the analysts survey by Action Economics on October 27 look for a 25-bp increase. And the CME FedWatch tool calculates a 97.7% probability of a 25-bp hike.

The press release for today's FOMC meeting can be found here.

Haver's SURVEYS database contains the economic projections from the FOMC.

| Current | Last | 2016 | 2015 | 2014 | 2013 | |

|---|---|---|---|---|---|---|

| Federal Funds Rate Target | 1.00%-1.25% | 1.00%-1.25% | 0.40% | 0.13% | 0.09% | 0.11% |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.