Global| Apr 15 2008

Global| Apr 15 2008For The ECB Inflation Fears Outweigh Investors' Worries

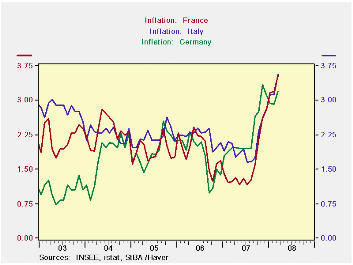

Concern over inflation is being fueled by today's releases of March inflation in Italy and France, both of which exceeded 3.5%. The year to year rate of increase in the Harmonized Index of Consumer Prices in Italy rose 3.57% and, in France, 3.53%. Inflation in March for Germany was released earlier and it was 3.2%. Inflation rates for France, Italy and Germany are shown in the second chart, where the sharp run up in inflation since last September is apparent.

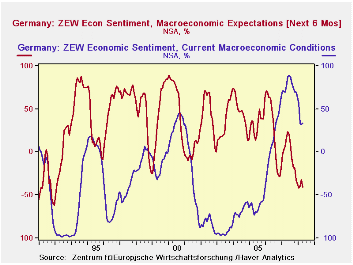

Institutional investors and analysts in the ZEW survey are still relatively comfortable with the present economic conditions--the excess of optimists over pessimists rose slightly in April to 33.2%. They have, however, become much more cautious about the next six months. The excess of pessimists over optimists regarding the next six months rose from 32.0% to 40.7%. This compares with the largest excess of pessimists of 62.2% in December, 1992. The third chart shows percent balances for current and expected conditions since the beginning of the series.

| INFLATION AND CONFIDENCE | Mar 08 | Feb 08 | Mar 07 | M/M Chg | Y/Y | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|---|

| Inflation Y/Y % Chg in HICP | ||||||||

| Italy | 3.57 | 3.13 | 2.07 | 0.44 | 1.50 | 2.04 | 2.22 | 2.21 |

| France | 3.53 | 23.19 | 1.23 | 0.34 | 1.30 | 1.61 | 1.91 | 1.90 |

| Germany | 3.20 | 2.91 | 1.98 | 0.29 | 1.22 | 2.28 | 1.78 | 1.92 |

| ZEW(% Balance) | Apr 08 | Mar 08 | Apr 07 | M/M Chg | Y/Y Chg | 2007 | 2006 | 2005 |

| Current Economic Conditions | 33.2 | 32.1 | 70.6 | 1.1 | -43.7 | 75.9 | 18.3 | -61.8 |

| Expectations Next 6 Months | -40.7 | -32.0 | 16.5 | -8.7 | -57.2 | -3.0 | 22.3 | 34.8 |