Global| Jan 04 2008

Global| Jan 04 2008French Consumer Confidence Continues to Slide

Summary

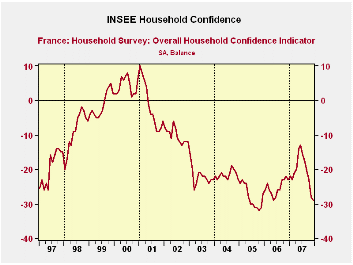

While France’s services sector is holding up pretty well the consumer is not keeping up that sort of pace. Consumer confidence fell by one point in December but the index has lost 16 points from its peak in this cycle and the [...]

While France’s services sector is holding up pretty well the

consumer is not keeping up that sort of pace. Consumer confidence fell

by one point in December but the index has lost 16 points from its peak

in this cycle and the resulting index now stands at a relatively weak

position with respect to its recent range of values. Confidence is now

in the bottom ten percent of its range over the past eighteen years.

Consumers say it’s the worst price environment in the past 18 years.

They expect pricing conditions to ease up in the 12-months ahead.

Households assess their living conditions over the past 12

months as in the bottom seven percentile of the past 18 year’s results.

They see that improving to the bottom 19 percentile in the year ahead.

Households place unemployment prospects in the bottom 38th

percentile for the 12 months ahead. Their spending plans are in the

bottom third of their range, a similar reading Households assess their

current financial situation as middling: in the 52nd percentile of its

range. But over the past 12months they place it in the bottom fifth of

its range and over the next 12 months they expect a bottom quarter of

the range result. Consumer responses are certainly more downbeat than

the performance of the French services sector would let us infer.

France is clearly one to watch to see which way its various and

disparate readings eventually coalesce or if they do.

| INSEE Household Monthly Survey | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Since Jan 1990 | Since Jan 1990 | |||||||||

| Dec 07 |

Nov 07 |

Oct 07 |

Sep 07 |

%tile | Rank | Max | Min | Range | Mean | |

| Household Confidence | -29 | -28 | -23 | -21 | 9.3 | 196 | 10 | -33 | 43 | -17 |

| Living Standards | ||||||||||

| past 12 Mos | -61 | -59 | -54 | -51 | 7.1 | 207 | 18 | -67 | 85 | -37 |

| Next 12-Mos | -31 | -36 | -25 | -26 | 19.3 | 165 | 15 | -42 | 57 | -18 |

| Unemployment: Next 12 | 5 | 11 | 11 | 10 | 38.2 | 172 | 73 | -37 | 110 | 30 |

| Price Developments | ||||||||||

| Past 12Mo | 39 | 30 | 17 | 12 | 100.0 | 1 | 39 | -57 | 96 | -19 |

| Next 12-Mos | -23 | -8 | -19 | -16 | 40.7 | 33 | 31 | -60 | 91 | -34 |

| Savings | ||||||||||

| Favorable to save | 30 | 27 | 31 | 36 | 72.2 | 32 | 40 | 4 | 36 | 23 |

| Ability to save Next 12 | -12 | -13 | -7 | -6 | 37.9 | 147 | 6 | -23 | 29 | -8 |

| Spending | ||||||||||

| Favorable for major purchase | -23 | -18 | -11 | -10 | 32.8 | 173 | 16 | -42 | 58 | -12 |

| Financial Situation | ||||||||||

| Current | 14 | 15 | 16 | 16 | 52.4 | 66 | 24 | 3 | 21 | 12 |

| Past 12 Mos | -23 | -19 | -17 | -15 | 18.2 | 190 | -5 | -27 | 22 | -16 |

| Next 12-Mos | -9 | -8 | -6 | -5 | 25.9 | 206 | 11 | -16 | 27 | 0 |

| Number of observations in the period | 215 | |||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates